—— Amazon is raising base salary cap to $350,000 From $160,000; JPMorgan says buy stocks as rate Hikes; Frontier to buy discounter Spirit Airlines; Americans who say it’s a good time to buy a home hits all-time low; Bitcoin notches longest rally Since September; Peter Thiel to step down from Meta’s Board; Flexport raises $935 million in new funding round.

1. Amazon raises base salary

Today, e-commerce giant Amazon.com said in a statement to employees that due to the recent fierce competition in the talent market and the company’s improved revenue performance, the company will increase the maximum base salary from $160,000 to $350,000 this year.

Amazon also said that the scope of salary increases covers most of the positions over the world, and the timing of equity incentives will more closely match the promotion cycle.

Like many other big tech companies, Amazon has recently had a much harder time retaining talent. In the past, the company has relied heavily on equity incentives to retain employees. However, during 2021, the company’s stock price has only risen by 2.4%, far below the overall market increase, so it has gradually lost its attraction.

As of December 31, 2021, Amazon had 1.6 million employees worldwide, and the company also increased the pay of hourly workers from $15 to $18 an hour.

Amazon’s stock only rises 2.4% in 2021

2. JPMorgan strategists long stock

In January this year, global stock markets suffered a sharp correction due to the Omicron virus and potential fiscal changes, as investors worried that overly aggressive monetary tightening would seriously affect economic growth.

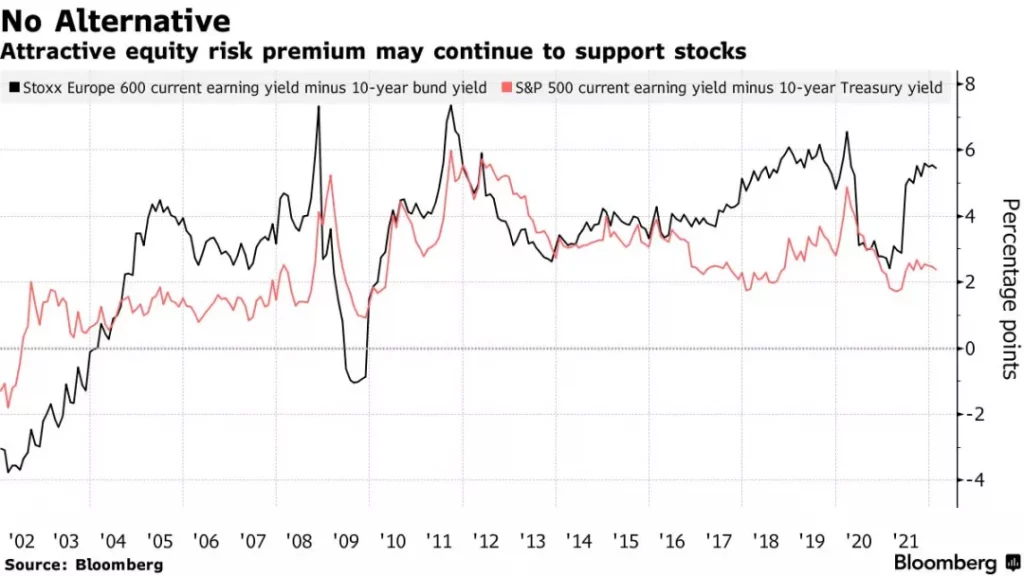

However, Mislav Matejka, investment strategy officer at JPMorgan, believes that neither the Federal Reserve nor the European Central Bank is likely to issue a more hawkish policy, and the potential risks to global stock markets have already been reflected in the price.

In addition, inflation may be close to its peak, and the new financial results of many companies may also be better than industry expectations, so there is still room for the stock market to rise.

Mislav believes that the job market and corporate earnings are very optimistic today, and the probability of a recession is low.

The risk premium of equities is still higher than that of other investment products

3. Spirit merges with Frontier

Today, the airline company Spirit Airlines Inc. announced in a statement that it has been acquired by another low-cost airline, Frontier Group Holdings Inc., in a merger.

Spirit shareholders will receive $2.13 in cash and 1.9126 Frontier shares for each company stock they own. In the merger transaction, Spirit was valued at $25.83 per share, 19% higher than its closing price on February 4.

Spirit’s chairman, Mac Gardner, said in a statement that Spirit’s and Frontier’s corporate cultures, aircraft types, and major routes complement each other very well. This merger can bring win-win opportunities for both companies and create more value for consumers.

Shares of Spirit jumped 16% this morning to $24.74 a share on the news, recoded the biggest one-day gain since Nov. 9, 2020.

Low-cost airlines are very focused on cost savings

4. U.S. Housing market worries young homebuyers

According to the latest survey released by Fannie Mae, only 25% of Americans surveyed believe that now is a good time to buy a home, the result is a record low.

Today, home prices and mortgage rates have both risen, but Americans’ job security has declined, resulting in a large number of homebuyers being turned off.

Doug Duncan, the chief economist at Fannie Mae, said younger consumers are worried about their financial future and the state of the U.S. macro economy and believe home prices will continue to rise.

In January, 69% of survey respondents thought it was a good time to sell their home, and it was also the highest rate since 2010.

Home prices rose fastest in more family-friendly suburbs, according to real estate firm Zillow Group. For many young people who are about to start a family, the problem of buying a house is very distressing.

The proportion of people who do not think it is a good time to buy a home has reached a record high

5. Bitcoin price returns to $44,000

Today, Bitcoin’s price entered a five-day gain and posted its longest gain since September. The price of Bitcoin rose as much as 5.8% to $44,110; the Shiba Inu coin also rose 50%.

In the past few weeks, central banks have tightened monetary policy, causing huge volatility in capital markets around the world. At one point, the price fell more than 50% from Bitcoin’s November high of $69,000.

However, Lindsey Bell, the market strategist at Ally Financial Inc., believes that the crisis in the market has not been fully resolved, and the true speed of the Fed’s rate hike is still unknown.

Since the beginning of last year, the price of Bitcoin has seen many ups and downs

6. Peter Thiel to step down from Meta’s Board

Meta Platforms Inc., Facebook’s parent company, announced in a statement today that the company’s earliest investor and outside board member, Peter Thiel, will officially step down from the board.

Peter hopes to use all his energy to help Republican candidates in the 2022 midterm elections and support the approach of former U.S. President Donald Trump, according to people familiar with the matter.

In August 2004, Peter invested $500,000 and became the company’s first outside investor. In 2005, Peter joined the company’s board of directors. His early investments in Silicon Valley helped him earn big returns.

Peter is a successful venture capitalist and Trump supporter

7. Flexport raises $935 million

Flexport, a supply chain technology company, announced in a statement today that it has raised $935 million in Series E funding from investors including prominent venture capital firm Andreessen Horowitz, Michael Dell’s MSD Partners, and Canadian e-commerce platform Shopify Wait.

Former Intel Corp. CEO Bob Swan, who joined Andreessen Horowitz last year, will join Flexport’s board. Flexport’s post-money valuation reached $8 billion in this round of financing.

Flexport uses technology to help retailers better arrange air and ocean freight, with a subscription system much like an online platform for buying airline tickets.

According to PitchBook statistics, logistics technology companies had received a total of $24.3 billion in venture capital in the first three quarters of 2021, which is 58% higher than the same period in 2020.

In the period of supply chain chaos, an efficient and easy-to-use logistics management platform is very much needed by enterprises

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, Bloomberg, etc.