—— Netflix Handily Beats Expectation; Oyo Hotels Seeks $450M Refinance; Israel Launches Retaliatory Strikes; Amex Revenue Exceeds Forecast; P&G Raises 2024 Profit Outlook; Apollo and Sony Team Up to Bid For Paramount; Tesla Recalls Near 3,900 Cybertrucks

1. Netflix Handily Beats Expectation

In the initial quarter of 2024, the company acquired 9.33 million new customers, nearly doubling the analysts’ estimated average of 4.84 million. Netflix experienced a surge in new subscribers globally, with particularly robust performance in the US and Canada. This influx of new subscribers exceeded sales and earnings forecasts.

However, despite this growth, Netflix shares fell by up to 6.6% in premarket trading on Friday, following a New York closing price of $610.56. This decline marks the stock’s most significant intraday drop since July, despite a 25% increase in value year-to-date until the close of regular trading on Thursday.

Netflix’s first-quarter expectations had risen sharply in the days leading up to it, fueled by optimistic forecasts from analysts. However, in its investor letter on Thursday, the company indicated that subscriber growth for this period would be lower, despite anticipating a 16% increase in revenue.

______

2. Oyo Hotels Seeks $450M Refinance

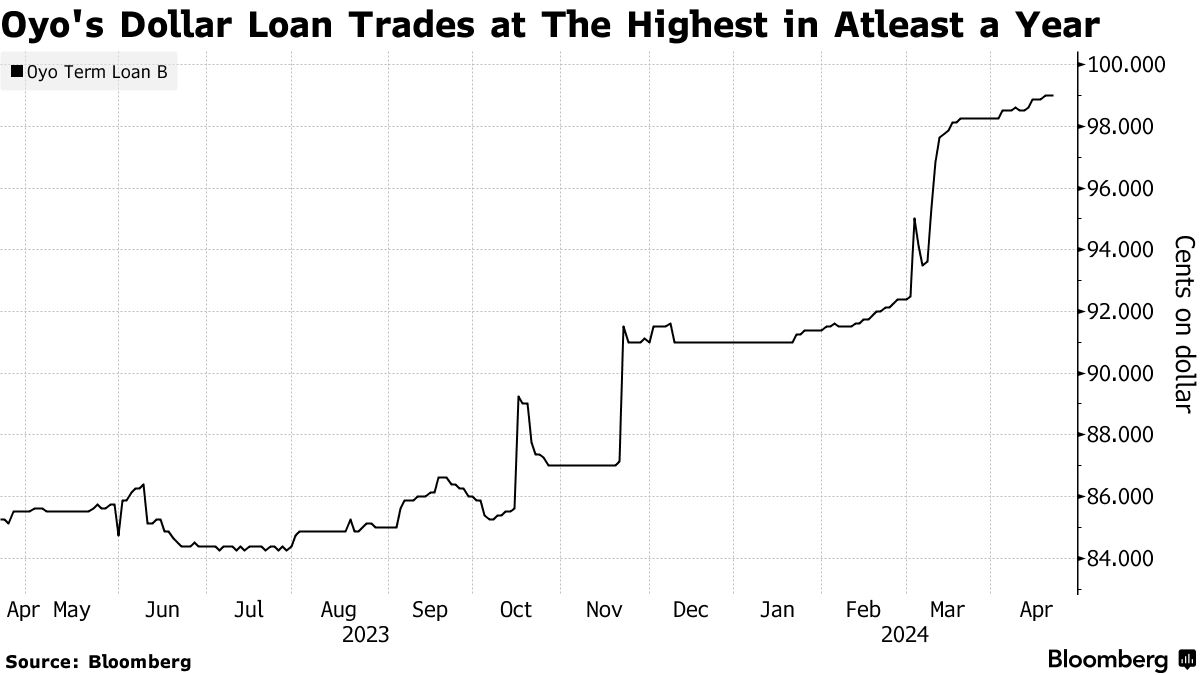

Oyo Hotels is currently in discussions to secure up to $450 million through dollar bonds, according to a source familiar with the matter. This move comes as the once-prominent Indian startup aims to replace an existing high-cost loan amid delays in its anticipated stock-market debut.

Oravel Stays Ltd., Oyo’s parent company, is reportedly in talks with bankers to raise between $350 million and $450 million to repay its term loan B, which is set to mature in 2026. The source, who preferred not to be identified due to the private nature of the information, revealed that the refinancing would extend the repayment timeline to five years. The company intends to finalize this process during the September quarter.

In 2021, Oyo borrowed $660 million, with approximately $465 million still outstanding after the hotel-booking firm, backed by Softbank Group Corp., prepaid a portion of it last year. A representative from Oyo declined to comment on the planned transaction.

Following setbacks in its initial public offering plan, Oyo is aiming to decrease its interest payments and pivot its focus towards achieving profitability.

______

3. Israel Launches Retaliatory Strikes

Israel launched strikes against Iran early on Friday morning, Israeli and western officials said, in what appeared to be limited retaliatory action for last week’s drone and missile attack by Tehran.

Iran’s air defenses shot at incoming targets and explosions were reported near the cities of Isfahan, in central Iran, and Tabriz in the north-west, local authorities and media said.

Iranian state media played down the damage from the attacks and Iran lifted flight restrictions imposed overnight.

According to Israeli and western officials, Israel initiated strikes against Iran on Friday, seemingly in response to Tehran’s recent drone and missile attack. Reports indicate that Iran’s air defenses engaged incoming targets, resulting in explosions near Isfahan and Tabriz. Despite this, Iranian state media downplayed the damage, and flight restrictions were lifted.

An Israeli official stated that the country informed the US of its plans to conduct strikes in Iran on Thursday evening, providing its closest ally with a few hours of official notice.

______

4. Amex Revenue Exceeds Forecast

American Express Co. announced revenue figures for the first quarter of the year that surpassed expectations, fueled by ongoing consumer interest in the company’s premium credit-card offerings.

In a statement released on Friday, the New York-based credit-card giant revealed that revenue surged by 11% to $15.8 billion during the first quarter, exceeding the average analyst estimate of $15.77 billion compiled by Bloomberg.

Consequently, Amex reaffirmed its expectation for full-year revenue to increase by as much as 11% compared to 2023.

“We continue to attract high-spending, high credit-quality customers to the franchise,” stated Chief Executive Officer Steve Squeri in the announcement.

Continuing claims, which serve as an indicator of the number of individuals receiving unemployment benefits, also saw minimal change, standing at 1.81 million for the week ending April 6.

______

5. P&G Raises 2024 Profit Outlook

Procter & Gamble Co. has revised its profit outlook upwards, attributing the improvement to a combination of steady price hikes, declining commodity costs, and increased productivity, particularly in its Pampers diapers and Dawn dish soap lines.

The company now anticipates earnings, excluding certain items, to fall within the range of $6.49 to $6.55 per share for the current fiscal year. This marks an increase of 12 cents from the previous forecast and surpasses analysts’ average estimates. Additionally, the company’s gross margin, a key indicator of profitability, exceeded expectations for the quarter ending March 31. Procter & Gamble cited reduced costs, partly due to reduced overtime at production facilities and the adoption of lower-cost ingredients, as contributing factors.

Despite surpassing earnings expectations, the company fell short of sales projections. Organic sales, which exclude the impact of acquisitions, divestitures, and currency fluctuations, grew slightly less than analysts had predicted. Shipment volumes remained relatively unchanged compared to the previous year.

In North America, which accounts for half of P&G’s revenue, third-quarter volume increased by 3%, slightly lower than the previous quarter’s growth of 4%. However, overall volume remained flat during the period.

______

6. Apollo and Sony Team Up to Bid For Paramount

Apollo Global, a US private equity group, is in discussions with Sony Pictures Entertainment regarding a potential joint bid for Paramount Global. This bid would compete with existing talks between Paramount’s controlling shareholder, Shari Redstone, and Skydance, known for films like “Top Gun: Maverick.”

Sources familiar with the matter mentioned that discussions between Apollo and Sony are in the early stages. However, any successful deal would likely face various challenges, including addressing Paramount’s cable business. As of now, no formal offer from Apollo and Sony Pictures has been presented to Paramount’s board.

Earlier in the month, Paramount entered exclusive negotiations with Skydance. Skydance proposed to acquire Redstone’s National Amusements, which holds 77% of Paramount’s voting stock, and subsequently merge the two companies.

Apollo had previously made a takeover offer exceeding $26 billion, which would have provided shareholders with a significant cash premium compared to Paramount’s trading price. However, this bid was rejected by Paramount.

______

7. Tesla Recalls Near 3,900 Cybertrucks

Tesla Inc. has issued a recall for 3,878 Cybertruck pickups due to concerns over accelerator pedals that may dislodge, potentially leading to unintended acceleration and an increased risk of accidents.

According to a recall report submitted to the US National Highway Traffic Safety Administration, Tesla received two customer claims related to this issue. The company explained that under high force, the Cybertruck’s accelerator pedal could become dislodged and become trapped by interior trim.

Tesla will address this issue by reworking or replacing the accelerator pedals at no cost to customers. Following this announcement, Tesla’s shares experienced a decline of up to 2.3% before the commencement of regular trading on Friday. Overall, the company’s shares have dropped by 40% this year.

Musk has provided an estimate that it will require 12 to 18 months for Tesla to ramp up production of stainless steel-clad Cybertrucks to high volume levels.

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, and Bloomberg.