——Goldman Posts Surprise Profit Jump; US Retail Sales Rise More Than Forecast; US Homebuilder Sentiment Remains High; Bain Sells Payroll Software Company; Fed Could Raise Rate to 6.5%; Yen Falls to 30 Year Low; Tesla to Cut 10% Global Staff

1. Goldman Posts Surprise Profit Jump

Goldman Sachs Group Inc. is reaping the rewards of its return to fundamental strategies, surpassing expectations with its latest profit report and driving its stock to its highest increase of the year. Despite analysts’ predictions of a decline compared to last year, the Wall Street powerhouse recorded a remarkable 28% increase in net income for the first quarter.

This unexpected surge was primarily fueled by its traders, who outperformed those at its main competitor, JPMorgan Chase & Co., and its bankers who capitalized on a resurgence in deal-making activities. Seeking to regain investor confidence, Goldman Sachs has refocused on its core Wall Street operations and adopted a more predictable approach in its money-management division.

This strategic shift follows criticism directed at the firm’s management for its faltering retail-banking expansion efforts. Much of 2023 was spent dismantling these efforts amid a broader slowdown, which resulted in disappointing outcomes.

Dimon emphasized the need to prepare the firm for a range of potential scenarios, stating, “Although the outcomes of these factors are uncertain, it’s essential to ensure our readiness to consistently support our clients through various environments.”

______

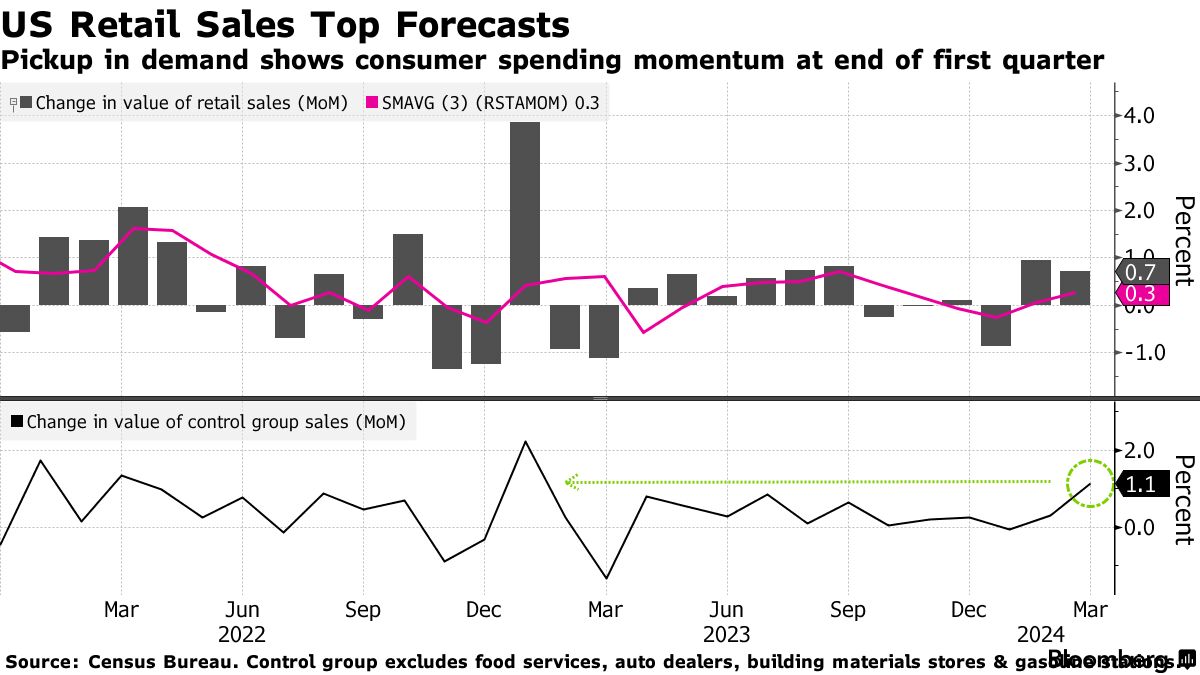

2. US Retail Sales Rise More Than Forecast

Retail sales in the US outpaced expectations in March, with the previous month’s figures also revised upwards, underscoring the enduring strength of consumer demand that continues to drive a remarkably robust economy.

According to data from the Commerce Department released on Monday, the value of retail transactions, not adjusted for inflation, surged by 0.7% from February, aligning with the highest projection among economists surveyed by Bloomberg. When excluding sales of automobiles and gasoline, the increase was even more pronounced at 1%.

The report indicates strong momentum in consumer spending as the second quarter begins. As long as the labor market remains robust and supports household demand, there is a concern that inflation could become firmly established in the economy. This may prolong the delay in interest rate cuts by the Federal Reserve.

Stock futures maintained their upward trajectory, and Treasury yields experienced an increase following the release of the report. Traders remain convinced that the Federal Reserve’s initial interest rate cut will likely occur well into the latter half of this year.

______

3. US Homebuilder Sentiment Remains High

The dollar is poised for its most robust weekly showing since 2022 following substantial US inflation data that sent shockwaves across global markets.

Since Monday, the US currency has appreciated by 1.6% against a basket of six currencies, marking its strongest weekly surge since September 2022. This surge comes as traders reversed their expectations for early interest rate cuts by the Federal Reserve.

On Friday, both the euro and sterling dipped to their lowest levels against the dollar since November, reaching $1.0642 and $1.2447, respectively, while the yen plummeted to its weakest point in 34 years before rebounding to ¥153.13.

The recent uptick in US consumer price inflation, reaching a higher-than-expected 3.5% for March, has led traders to ramp up speculation that the Federal Reserve may only implement one interest rate cut this year.

______

4. Bain Sells Payroll Software Company

Bain Capital has reached an agreement to sell the UK-based payroll software company Zellis Group, whose clientele includes renowned names such as department store Harrods and carmaker Jaguar, to Apax Partners, as per a statement released. The deal places Zellis’s valuation at approximately £1.25 billion ($1.56 billion), as reported by individuals familiar with the situation. Apax is financing a portion of the transaction through a unitranche loan of £450 million from private credit funds, these sources added, requesting anonymity due to the sensitivity of the information.

“In the wake of the significant changes spurred by the Covid pandemic, companies across various sectors are intensifying efforts to reduce employee turnover and enhance employee engagement and transactions,” stated Christophe Jacobs van Merlen, a partner at Bain Capital, during an interview. “We believe that payroll technology will remain an appealing sector.”

The company serves approximately one third of the companies listed in the FTSE 100, and its payroll software is utilized to remunerate or incentivize roughly 5 million individuals on a monthly basis.

______

5. Fed Could Raise Rate to 6.5%

The combination of robust growth in the US economy and persistent inflation is increasing the likelihood that the Federal Reserve will raise interest rates rather than lower them, potentially pushing borrowing costs up to 6.5% by next year, according to strategists at UBS Group AG.

Although UBS’s initial forecast for this year includes two rate cuts, the firm now sees a growing chance that inflation will not retreat to the Fed’s desired level. This scenario could prompt a shift back to rate hikes, triggering a significant sell-off in both bond and stock markets. Recent data indicating unexpected strength in the US economy has led markets to scale back expectations of monetary easing.

The UBS strategists, including Jonathan Pingle and Bhanu Baweja, stated in a note, “If economic expansion remains robust and inflation remains at or above 2.5%, there is a substantial risk that the Federal Open Market Committee (FOMC) will resume raising rates by early next year, potentially reaching a Fed Funds rate of 6.5% by the middle of next year.”

The scenario dubbed as the “no landing scenario,” involving further rate hikes, would likely result in a significant flattening of the US Treasury curve, with benchmark yields experiencing a notable increase. Additionally, equities could potentially face a decline of 10% to 15%, as projected by the strategists.

______

6. Yen Falls to 30 Year Low

The Japanese yen has dropped below the ¥154 mark against the dollar for the first time since 1990, surpassing levels that some analysts have cautioned could prompt direct intervention from Japan.

The currency has depreciated by 0.7%, reaching ¥154.28, as traders adjusted their expectations regarding swift interest rate cuts by the US Federal Reserve, thereby bolstering the strength of the greenback.

Japanese officials have issued warnings multiple times in recent weeks, expressing readiness to intervene to prevent excessive movements in the country’s currency, which has depreciated by more than 9% since the beginning of 2024.

These developments followed the release of stronger-than-expected US retail sales data for March, indicating ongoing economic resilience despite elevated interest rates.

______

7. Tesla to Cut 10% Global Staff

Tesla is slashing over 10% of its workforce, amounting to at least 14,000 jobs, as the global slowdown in electric vehicle (EV) sales and intense price competition take a toll on the American automaker.

In an internal memo seen by the Financial Times, Tesla CEO Elon Musk stated, “We have… made the difficult decision to reduce our headcount by more than 10% globally… this will enable us to be lean, innovative and hungry for the next growth phase cycle.”

These job cuts coincide with a broader downturn in EV sales, impacting the global automotive industry. Companies throughout the supply chain, from South Korea to Germany, are trimming jobs and expenses in response to these challenges.

Unlike traditional automakers, Tesla is uniquely vulnerable to the slowdown in demand for battery-powered vehicles because it focuses solely on producing electric vehicles (EVs). The company’s shares, which dropped by 3% on Monday, have plummeted by over a third since the beginning of the year.

Source: Financial Times – Tesla to cut 10% of global workforce

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, and Bloomberg.