1. China Injects $112 Billion in Loans;

2. Citi Unexpectedly Shuts Down Muni Bond Unit;

3. Three Giants Dominate $8 Trillion ETF Market;

4. US Gas Prices Hit Two-and-a-Half-Year Low;

5. NY Fed President Downplays Rate Cut Expectations;

6. Morgan Stanley Eyes Real Estate Investments;

7. GM to Cut 1,300 Jobs After Ending Two Vehicle Lines.

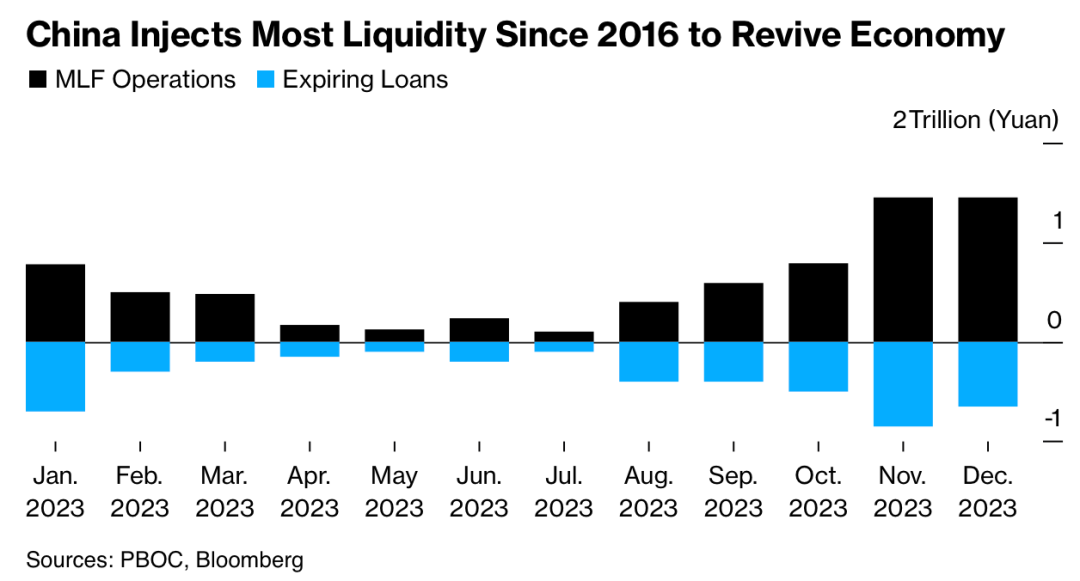

1. China Injects $112 Billion in Loans

Today, China’s central bank issued $112 billion in one-year loans to commercial banks in an effort to ease funding shortages. This follows recent easing of home purchase restrictions in Beijing and Shanghai.

Investors believe this mix of supportive policies could provide significant relief to the real estate market. However, the Chinese government must balance fiscal spending and lending while avoiding excessive currency depreciation.

Serena Zhou, an economist at Mizuho Securities, said lack of confidence is the primary drag on economic growth. She expects the central bank to cut rates by 20 basis points and reduce the capital reserve ratio by 5%.

Real estate and related industrial sectors account for about 20% of China’s GDP.

______

2. Citi Unexpectedly Shuts Down Muni Bond Unit

According to internal documents reviewed by Bloomberg, Citigroup will shut down its municipal bond division by the end of Q1 next year—a division once the envy of its Wall Street peers.

Over 100 employees in muni bond sales and trading will leave the company in the coming months.

Citi stated in a memo that the muni bond business no longer plays a sufficiently strategic role in its efforts to raise overall returns, calling the closure a “difficult decision.”

For decades, Citi held a major presence in the $4 trillion muni bond market, even participating in high-profile projects like the World Trade Center rebuild. The decision shocked Wall Street.

The division no longer fits CEO Jane Fraser’s strategy and recently lost a major client: the state of Texas.

______

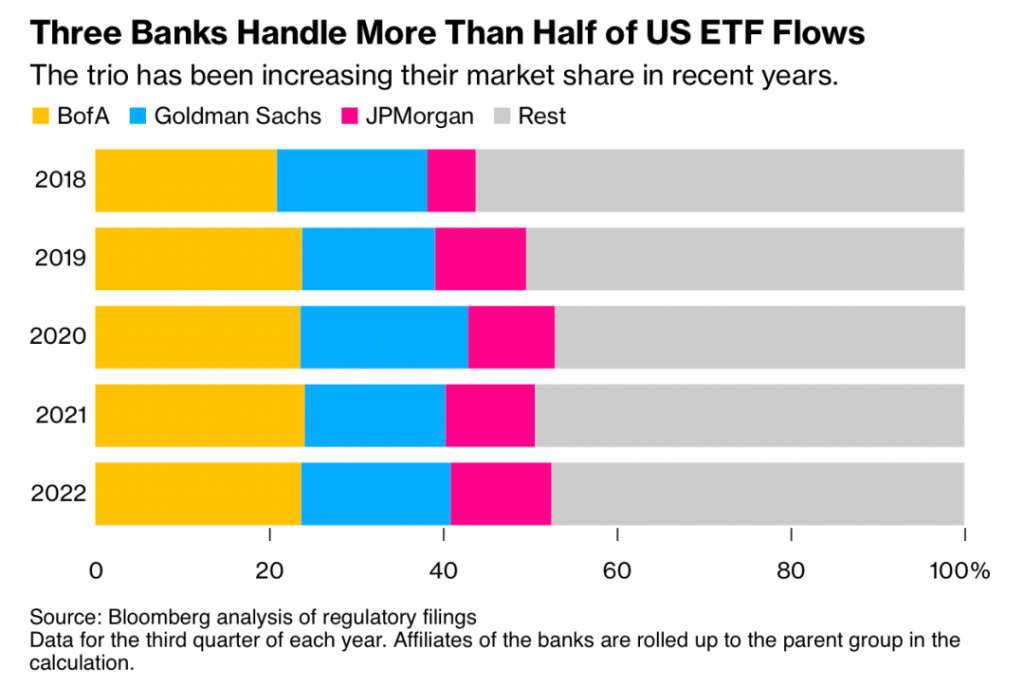

3. Three Giants Dominate $8 Trillion ETF Market

In the past five years, over 1,000 new ETFs have launched, doubling the size of the US ETF market. Annual trading volumes now reach $11 trillion.

Yet only a few authorized broker-dealers manage the liquidity of this $8 trillion market. More than half of ETF trades are handled by just three firms—Bank of America, Goldman Sachs, and JPMorgan. Despite explosive growth, the number of broker-dealers has barely changed.

This concentration means a small number of firms must manage over 3,400 ETFs, with each firm potentially overseeing trades for hundreds. This raises the risk of pricing errors and could increase transaction costs for investors.

ETFs are popular for their low fees and efficiency, but pricing risks can undercut those benefits.

______

4. US Gas Prices Hit Two-and-a-Half-Year Low

According to the latest data from AAA, average US gas prices have dropped to $3.087 per gallon—the lowest since late June 2021. Prices have steadily declined since summer, driven by seasonal demand drop-offs and a supply surplus.

In November, lower gas prices gave consumers more spending power, leading to stronger-than-expected retail sales.

This is also a political win for President Biden, as avoiding a recession is key to his re-election bid in 2024.

With oil inventories still rising, gas prices may continue falling until spring.

______

5. NY Fed President Downplays Rate Cut Expectations

New York Fed President John Williams told CNBC today that the Fed’s focus is not on rate cuts, and the public should not assume a March cut is likely.

Williams said the Fed is still evaluating whether rates are high enough. It’s too soon to discuss cuts, especially since data could fluctuate unexpectedly. If inflation stalls or rises again, the Fed might even resume hikes.

While he didn’t confirm that the 5.25%–5.5% range is sufficient, Williams said the Fed is likely near or at a turning point.

Markets are currently pricing in a March rate cut, but Williams warned against jumping to conclusions.

______

6. Morgan Stanley Eyes Real Estate Investments

Lauren Hochfelder, Co-CEO of Morgan Stanley’s real estate investment unit, said the firm is actively looking for good property deals. Strategies include traditional debt or preferred equity investments in apartments and industrial assets.

In a Bloomberg interview, Hochfelder said now is the time to invest—not to wait for conditions to stabilize.

Last year’s interest rate hikes severely impacted commercial real estate values. Disagreements between sellers and lenders on asset valuations remain common. However, many properties are facing refinancing challenges, making now a rare window for lending opportunities.

Hochfelder expects more buyers and sellers to enter the market once conditions become clearer.

______

7. GM to Cut 1,300 Jobs After Ending Two Vehicle Lines

Today, General Motors announced it will lay off 1,300 workers at its Michigan plants early next year. This includes 945 employees at the Orion Assembly plant producing the Chevrolet Bolt, which will be discontinued before year-end.

GM plans to retool Orion Assembly for electric truck production, with operations resuming in late 2025.

Another 369 workers building the Chevrolet Camaro at the Lansing Grand River Assembly plant will also be laid off. That plant will continue producing Cadillac sedans.

GM said it will help affected workers find new roles, in accordance with its agreement with the UAW union.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.