— US Housing Market Hits $47 Trillion Record; Bezos Buys Man-Made Island Mansion; US PPI Rises, Stock Market Falls; Amazon Tightens Office Attendance Rules; Wildfires Ravage Hawaii, Thousands Missing; Fed Nears $1 Trillion in QT; California Housing Affordability Worsens

1. US Housing Market Hits $4 Trillion Rebound

According to Redfin Corp., the total value of U.S. housing has reached a new record of $47 trillion, regaining the $3 trillion lost during last year’s market downturn. The rebound has been driven by tight inventory pushing up home prices.

Redfin’s Head of Economic Research, Chen Zhao, noted that many homeowners are reluctant to sell, as moving would double their mortgage rate—making existing homes scarce and competitive.

Atlanta saw the largest gain in housing value, rising by $33.4 billion since June 2022. Miami followed with a $30.3 billion increase.

Housing values in 32 major U.S. cities declined, with Los Angeles leading the drop by $153 billion.

______

2. Bezos Buys Man-Made Island Mansion

Sources revealed that Amazon founder Jeff Bezos purchased a mansion on Miami’s man-made Indian Creek Island for $68 million.

The three-bedroom estate sits on 2.8 acres and was built in 1965. The previous owner was MTM Star International. The property last changed hands in 1982 for $1.4 million.

Known as the “Billionaire Bunker,” Indian Creek has housed celebrities like Carl Icahn, Tom Brady, and Ivanka Trump.

In recent years, Bezos has bought several high-end properties across the U.S., including a $165 million mansion in Beverly Hills.

______

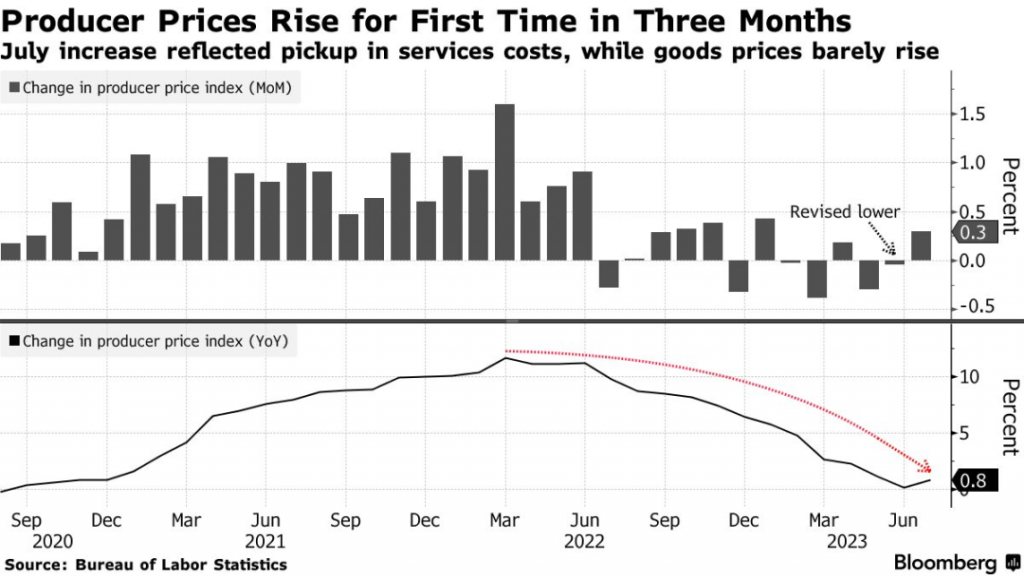

3. US PPI Rises, Stock Market Falls

The latest data from the Bureau of Labor Statistics shows U.S. producer prices (PPI) rose 0.3% year-over-year in July, slightly above expectations.

While global supply chains and demand for goods have normalized, more consumer spending has shifted to services, helping to ease goods inflation. However, rising oil prices are again complicating inflation control.

Service costs saw their largest jump in nearly a year, with notable increases in portfolio management, outpatient services, and passenger transportation.

Food prices also spiked, marking the biggest jump since last November.

______

4. Amazon Tightens Office Attendance Rules

Bloomberg reports that some Amazon employees in the U.S. received warning emails this week for failing to meet the company’s in-office requirement of three days per week.

Amazon joins other companies like Chipotle and BlackRock in cracking down on remote work policy violations and requiring more in-office presence.

According to a recent McKinsey report, office usage remains 30% below pre-pandemic levels.

______

5. Wildfires Ravage Hawaii, Thousands Missing

In recent days, Lahaina, Hawaii has suffered its worst disaster in history. Fast-moving wildfires have claimed 55 lives, with over 1,000 people still unaccounted for.

Hawaii Governor Josh Green warned that the death toll may rise further, describing the scene as resembling a war zone.

As of Thursday, 80% of the fires were contained, but aerial patrols showed at least 270 buildings still burning.

Accuweather estimates that total property damage could reach $8 billion to $10 billion.

______

6. Fed Nears $1 Trillion in Quantitative Tightening

To stimulate the economy during the pandemic, the Federal Reserve purchased trillions in government bonds and mortgage-backed securities.

As of August 9, the Fed’s balance sheet has shrunk by $980 billion from its May 2022 peak and is on pace to surpass $1 trillion by the end of this month.

Quantitative tightening (QT) increases the supply of bonds available for private investors.

However, JPMorgan’s head of U.S. rate strategy, Jay Barry, warns that injecting the next $1 trillion into markets could have significantly negative effects.

This QT effort also conflicts with the U.S. government’s urgent borrowing needs.

______

7. California Housing Affordability Worsens

According to the California Association of Realtors (CAR), only 16% of residents could afford to buy a median-priced single-family home in Q2, down from 19% in Q1.

California’s affordability crisis is hindering both economic and population growth, with more residents and businesses leaving the state.

Nationally, over one-third of U.S. households can afford a home priced at the median $402,600.

In California, the median home price is $830,000, requiring an annual income of $208,000 to qualify for a 30-year mortgage.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.