—— Brookfield may split the asset management department; Twitter’s rising revenue in the fourth quarter pushed up the stock price; the number of registered electric cars in California exceeded 1 million; the U.S. inflation rate set a new record in January; Canada Goose lowered its revenue forecast and the stock price plummeted; Beverage prices; Credit Suisse loses more than $2 billion in Q4.

1. Brookfield may split its asset management

Brookfield Asset Management, the world’s leading alternative asset investment firm, announced that it plans to split its asset management division from its parent company and become a separate public company.

Brookfield’s asset management division, which collectively manages $364 billion in assets, spans real estate, infrastructure, renewable energy, credit, and private equity. Brookfield directly holds only $50 billion in net assets, which is an asset-light operating model that has been favored in recent years.

Brookfield CEO Bruce Flatt said in a letter to shareholders this morning that the company is still considering whether to actually separate the asset management division and that any substantial action will be announced several quarters in advance.

Analysts at the investment bank estimate that a standalone valuation of Brookfield’s asset management unit could be worth more than $75 billion.

Brookfield’s asset management division could go public independently at $75 billion

______

2. 4th quarter revenue rise pushes Twitter shares higher

Twitter Inc.’s revenue rose 22 percent to $1.57 billion in its fourth-quarter report on Thursday, unaffected by too many changes to Apple Inc.’s privacy rules.

In a statement released today, Twitter said revenue for the quarter would be $1.17 billion to $1.27 billion, compared with the industry average of $1.26 billion.

During the fourth quarter, Twitter added 6 million new users, and the average monthly active users reached 217 million, more than 13% year-on-year, and within the expected range.

Twitter CFO Ned Segal (Ned Segal) said the company lowered its revenue forecast this quarter because the company sold the advertising platform MoPub to AppLovin Corp. In total, MoPub generated $281 million in ad revenue for Twitter last year.

Shares in Twitter were up about 5% during the morning trade. Shares of Twitter have fallen 12% so far this year.

Twitter adjusts to Apple’s new privacy rules, revenue rises in Q4

______

3. California registered electric cars over 1 million

A total of 663,000 pure electric vehicles and 379,000 hybrid vehicles were registered in California by the end of 2021, according to the latest figures released by the California Energy Commission.

Consumers purchased or leased 184,000 electric vehicles and 63,000 hybrids in 2021, representing 12 percent of all light-duty vehicle sales in California.

California has officially become the first state to register more than 1 million electric or electric-hybrid vehicles, almost a quarter of which will be registered in 2021.

At present, sales in many key electric vehicle markets around the world are rising rapidly, manufacturers have launched more models, and consumers are more accepting of electric vehicles.

California citizens love technology and pay more attention to environmental protection, one of the best markets for trams

______

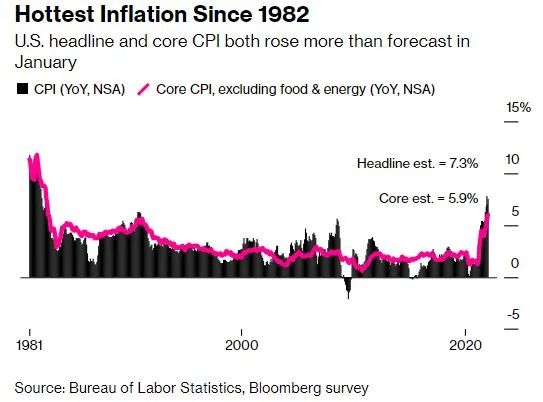

4. U.S. inflation hits record in January

According to the latest data released today by the U.S. Department of Labor, the U.S. CPI rose 7.5% in January from a year ago, up from 7% in December, and set a new record in 40 years.

Excluding high-volatility commodity categories such as energy and food, the core CPI rose 6% year-on-year in January, also the highest since 1982.

On March 15-16, the Federal Reserve will hold a meeting, when the CPI and employment data for February will also be released. However, the latest data in January may encourage the Fed to make more aggressive moves to suppress inflation.

Investors had expected the Fed to raise interest rates at a rate of 0.25% each time, but the January data came out, making a rate increase of 0.5% more likely.

The U.S. CPI and core CPI both set new records in January, and the data in February will be very critical

5. Canada Goose shares plummet

Down jacket brand Canada Goose Holdings Inc. announced today that it will cut its fiscal 2022 revenue forecast to $860 million from $890 million, citing the coronavirus and declining sales in Asia and Europe.

Before the Omicron virus emerged, the Chinese market, where the epidemic was better controlled, recovered faster than the United States and other regions, and consumers also bought a lot of high-end brand clothing. After Omicron appeared, sales began to decline, and the weather gradually passed the down jacket season.

Shares in Canada Goose were down as much as 21% today, their biggest drop since May 2019.

Winter is the best season for Canada Goose sales but also the worst time for the coronavirus

6. PepsiCo may raise beverage prices

Down jacket brand Canada Goose Holdings Inc. announced today that it will cut its fiscal 2022 revenue forecast to $860 million from $890 million, citing the coronavirus and declining sales in Asia and Europe.

Before the Omicron virus emerged, the Chinese market, where the epidemic was better controlled, recovered faster than the United States and other regions, and consumers also bought a lot of high-end brand clothing. After Omicron appeared, sales began to decline, and the weather gradually passed the down jacket season.

Shares in Canada Goose were down as much as 21% today, their biggest drop since May 2019.

Daily necessities and food products with small profits but quick turnover are very vulnerable to inflation

______

7. Credit Suisse loses more than $2 billion

Today, PepsiCo Inc. announced that organic revenue is expected to rise 6% this year, beating analysts average estimate of 5.4%. However, PepsiCo’s North American beverage operating profit fell due to higher costs.

Sales of beverages such as Pepsi in restaurants and sports venues rose in the fourth quarter, but inflation pushed up the company’s raw material, transportation, and labor costs. Affected by this, PepsiCo announced that it would have to raise the price of its products to allow consumers to help share certain costs.

PepsiCo CEO Ramon Laguarta said in an investor conference call that the production of Gatorade, the beverage that had previously been the most affected in the supply chain, had increased.

Credit Suisse’s investment banking division’s revenue fell 33%, total employee bonuses fell 32% compared to 2020

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, Bloomberg