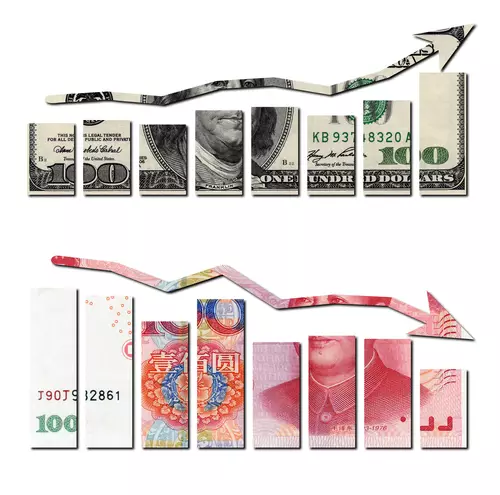

—— Britain’s historic Brexit aftershock is not over, and global financial markets continue to fall into chaos. With the pound slumping and the dollar strengthening, Renminbi dropped by nearly 600 points on June 27th, the largest one-day drop since the devaluation of the renminbi triggered the global financial turmoil in August last year. It also hit a 5-year low onshore exchange rate.

After the sudden Brexit this year, China-European trade is bound to be affected.

China’s investment in Europe has lost its springboard; at the same time, the risk of the RMB exchange rate will increase and capital outflows will further intensify, which is expected to have an impact on the already weak Chinese economy.

RMB breaks 6.64

On June 27, the Central Bank of China took the initiative to lower the central parity rate of RMB against the U.S. dollar to 6.6375, the largest percentage drop since August 13th last year and the lowest in five years.

The onshore RMB exchange rate against the U.S. dollar once fell to 6.6459, and closed at 6.6393, down 245 points, a five-year low as well.

“Today’s central price is undoubtedly a reminder that the market will face greater volatility.” Zhou Hao, an economist at Deutsche Bank in Singapore, commented that the current situation might give traders who want the central bank to maintain stability some disappointments.

Aftershocks exist, be cautious in “buy low sell high”

Facing Brexit, global financial market volatility, and external expectations will have major impacts on the Chinese economy.

In the past few years, Chinese companies have invested heavily in the U.K., becoming a springboard for entering Europe. For example, Wang Jianlin, the richest real estate developer in China, invested 1 billion pounds in the U.K. Before the referendum, he warned that his Wanke’s European headquarters might be moved away from the U.K. After the Brexit, there will be at least two more years of negotiations with the EU, which will inevitably have an impact on these companies going out of China.

However, when there is a depression in value, the decline in the pound may be a good opportunity for China companies to enter the European market. But, some analysts bluntly disagree with this view and do not recommend that investors go to the U.K. to buy low too early, because there will be more aftershocks, and there may be a series of new earthquakes.

What’s next for RMB?

The Chinese economy is showing a weak state, and the RMB has already suffered a serious negative impact. Since the devaluation of the Renminbi, overseas investment has become a value-preserving method, and investing in real estate in the United States can help the Chinese rich or small and medium-sized enterprises to escape the currency dilemma.

Currently, the U.S. tax law can help Chinese funds enter the United States. In 1980, the U.S. government made some amendments to real estate-related regulations to increase the transparency of tax exemptions for overseas investments. This measure makes it easier for the U.S. government to track and review assets inflows from abroad. It also provides a tax haven for foreign institutional investors and high-net-worth individual investors.

Associate Professor Zhuang Tailiang of the Department of Economics at Sun Yat-Sen University believes that Europe is a huge export market for Hong Kong and China. If the European economy declines and the currency plummets, it is expected that purchasing power will decrease, which will put pressure on Hong Kong and China’s exports.

Therefore, in order to avoid the damage caused by another substantial depreciation of the Renminbi, the continued sharp rise of the U.S. dollar can help Chinese investors protect their assets, which will not only help continue to boost the US real estate industry but help preserve the value of assets.

After experiencing multiple global economic turbulences such as Brexit and the continuous devaluation of the Renminbi, many Chinese investors have also suffered economic losses to varying degrees.

So how to mitigate the impact of the devaluation of the renminbi?

Investing in the overseas real estate industry is undoubtedly one of the solutions.

The data in this article comes from The Wall Street Journal, Financial Times, and Bloomberg, etc.