—— U.S. CPI rose 8.8% in June; inflation forced young people to return to their parents homes; Peloton changed its production model; Lego terminated 81 Russian dealers; US Dollar is close to the Euro equivalent level; vertical farming may become an important trend in agriculture; BYD Hong Kong stock prices fell 12%.

1. U.S. CPI rose 8.8% in June

The U.S. Consumer Price Index (CPI) rose 8.8% in June from a year earlier and 1.1% higher than in May. Inflation continues to heat up, hitting new records, and the Fed is bracing itself for another big rate hike.

The main driver of the rapid rise in the CPI has been a rise in gasoline and food prices. U.S. gasoline prices hit more than $5 a gallon in mid-June, adding at least 0.5% to the CPI for the month.

Gasoline prices had been on the rise long before the start of the Russian-Ukrainian war, which is one of the reasons why U.S. President Joe Biden’s support rates look “ugly”.

The good news is that fuel prices have fallen this month, which means July’s inflation reading is likely to head in a better direction.

Inflation could improve if oil and food supply problems ease

______

2. inflation forced young people to return to parents homes

As rent, electricity, food, and even natural gas prices in the United States have soared recently, more and more young and middle-aged people are choosing to move back to their parents.

According to a recent Pew Research survey, between 1971 and 2021, the number of U.S. households where multiple generations lived together more than doubled to 18% of the population.

It’s not just the US, where 3.6 million people aged 20 to 34 lived with their parents in the UK last year, 1.1 million more than 20 years ago, according to the Office for National Statistics. Other European countries, including Sweden, Belgium and Portugal, are showing similar trends.

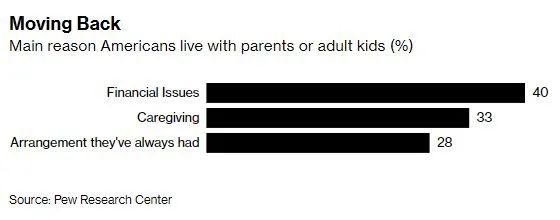

Survey finds that financial burden is the main reason many Americans move back to their parents’ homes

______

3. Peloton switches production model

Smart exercise bike company Peloton Interactive Inc. announced that it will no longer manufacture bicycles and treadmills in-house and will begin relying entirely on its partners for production. The purpose of this is to simplify operations and reduce costs.

Shares in the company rose 2.7% when U.S. markets opened on Tuesday.

“Companies will try the original production model, which is not relying on their own production, but a business model that relies on partner producers,” Andrew Rendich, chief supply chain officer, told Bloomberg. This allows the company to flexibly adjust production according to capacity and demand.”

Peloton recently laid off nearly 3,000 employees, including some executives

______

4. LEGO terminates contracts with 81 Russian dealers

Lego, the world’s largest toy maker, said it would stop sales in Russia and had terminated contracts with the operator of 81 local Lego retail stores in Russia.

After the start of the Russian-Ukrainian war, LEGO company stopped shipping products in March. The Russian government has also responded to these sanctions by removing tariffs on numerous products and legalizing gray market sales.

Like many western multinationals, LEGO has also chosen to terminate contracts with local Russian retailers

______

5. US dollar close to euro equivalent

Capital markets have been overshadowed by fears of a global recession this year, with a U.S. economic slowdown looming. Inflation has become more stubborn, and it is difficult for the Fed to effectively regulate the economy and markets.

Fears of a recession are stronger among Europeans, though, with governments worried that Moscow will cut off gas supplies, exacerbating an energy shock and a cost of living crisis.

This year, many European investors believe that the U.S. economy is relatively likely to perform better, so a large amount of capital has flowed into the United States from Europe and the rest of the world, which has also caused the dollar to continue to appreciate, and is now close to the euro’s exchange rate level.

Investors, worried about a possible economic crisis in Europe, bought large amounts of relatively safe U.S. Treasuries

______

6. Vertical farming has been a new trend

Recently, agricultural technology company Bowery Farming is trying to revolutionize the world’s food supply through vertical farming.

The company’s CEO, Irving Fain, said vertical farming is the use of automation, cutting-edge plant science, and massive data processing to grow fruits and vegetables in tightly controlled indoor environments.

Vertical farms have many advantages, such as the fact that growers do not have to worry about external hazards such as pests, floods or droughts. Scientists can also choose from a wider and more delicious variety.

Indoor environments can help growers grow crops without pesticides or herbicides and use 90 percent less water than conventional farming. This is a huge market that may form in the future.

If the vertical farming model can be applied on a large scale, then global food farming will experience a revolution

______

7. BYD Hong Kong shares down 12%

Shares in Chinese company BYD fell more than 12% today as investors worried that Buffett’s Berkshire Hathaway had dumped its stake in Chinese tram company BYD.

The number of available BYD shares circulating in the market increased by 225 million, according to a disclosure document of the Hong Kong Stock Exchange, and this number is close to Berkshire’s holdings, which is also a reason for investors’ concern.

Shares in BYD hit an all-time high of $42 in late June on the back of rapid growth in electric vehicle sales and support for the industry by the Chinese government, which hopes to stimulate the economy and help the country reduce emissions.

Berkshire bought a $232 million stake in BYD in 2008, and the current return is as high as 33 times

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, and Bloomberg.