1. Citadel to Return $7 Billion to Investors;

2. Carlyle Considers $4.6 Billion Acrotec Sale;

3. US Core CPI Rises in November;

4. KKR to Buy Medical Tech Company;

5. Billionaire Brazenly Trades Amid Insider Charges;

6. Goldman Sachs Top Trader Steps Down;

7. WeWork Reaches NYC Office Lease Deal.

1. Citadel to Return $7 Billion to Investors

Sources revealed that Ken Griffin’s Citadel will return $7 billion in capital to investors in its multi-strategy hedge fund Wellington. Year-to-date in 2023, the fund is up 15%, following a 38% gain in 2022.

Hedge funds like Citadel often return a portion of capital to investors to prevent the fund from growing too large, which can hinder investment agility and strategic flexibility.

In recent years, multi-strategy hedge funds have attracted massive capital inflows due to their relative stability, as they feature multiple managers trading across various markets and asset classes.

This year, Citadel posted double-digit returns—well ahead of its peers.

______

2. Carlyle Considers $4.6 Billion Acrotec Sale

According to insiders, Carlyle Group is considering selling Swiss luxury watch parts maker Acrotec in a deal that could value the company at $4.6 billion.

Carlyle is currently in talks with several banks about a sale or IPO and has chosen Rothschild & Co. to lead the IPO process.

Acrotec produces precision components for watches, medical devices, automotive, electronics, and aerospace industries. Carlyle acquired Acrotec from Castik Capital in December 2020.

With central banks wrapping up rate hikes, investors are pressuring private equity firms to return capital.

______

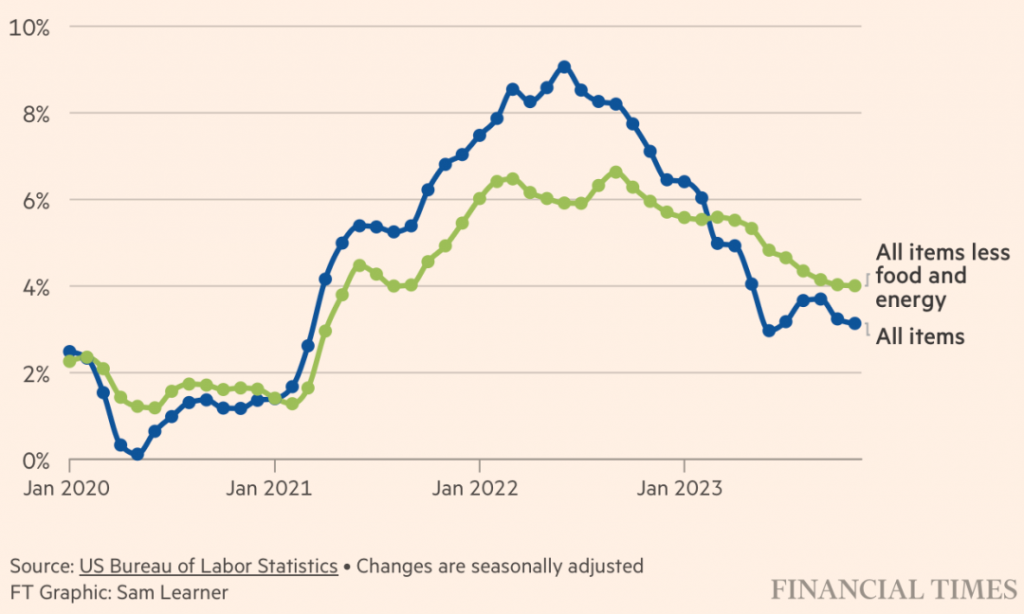

3. US Core CPI Rises in November

Newly released data shows that US core CPI rose 0.3% month-over-month in November, with the year-over-year figure holding at 4%.

Overall CPI rose 3.1% year-over-year, in line with expectations and down from October’s 3.2%. The data prompted investors to lower expectations of imminent Fed rate cuts.

Omair Sharif, President of Inflation Insights, noted that the Fed has repeatedly warned investors not to assume inflation will quickly fall to 2%, and the new data is likely to shake market confidence.

The Fed will vote on monetary policy this Wednesday, with markets expecting the benchmark rate to remain at 5.25%–5.5%.

______

4. KKR to Buy Medical Tech Company

Three sources revealed that Veritas Capital is considering selling a 50% stake in medical tech firm Cotiviti to private equity giant KKR, valuing the company at up to $11 billion.

Carlyle was previously in talks to acquire Cotiviti in April, but the deal fell through. If KKR finalizes the deal within two weeks, Cotiviti’s shareholders could receive billions in returns.

Reportedly, Veritas will first sell 100% of the company to distribute gains to early investors, then repurchase a 50% stake via its new $10.7 billion fund.

Cotiviti is one of Veritas’s most successful investments.

______

5. Billionaire Brazenly Trades Amid Insider Charges

In July, US federal prosecutors charged UK billionaire Joe Lewis with insider trading. Yet, he continues to openly trade shares in Mirati Therapeutics Inc., Australian Agricultural Co., and Tango Therapeutics Inc.

Court documents allege that the 86-year-old used board-level access to share insider information with friends, family, and his private pilot. Lewis has pleaded not guilty.

Former SEC lawyer Brad Bondi said that the government’s unilateral charges won’t impact Lewis’s daily life or investment decisions.

Lewis’s lawyer, David Zornow, stated the charges are baseless and vowed to defend Lewis vigorously in court.

Lewis has a net worth of $7.5 billion, ranking 315th globally.

______

6. Goldman Sachs Top Trader Steps Down

Goldman Sachs’ head of commodities trading, Ed Emerson, is stepping down from his role and will serve as an advisor during the transition, sources say.

Thanks to the division’s stellar performance, Emerson reportedly earned around $100 million in bonuses over the past three years—exceeding CEO David Solomon’s $77.5 million.

Internally, Emerson was considered one of Solomon’s most vocal critics. Still, he maintains good relationships with President John Waldron and trading chief Ashok Varadhan.

Last year, Goldman’s trading division generated over $3 billion in revenue—matching levels not seen since 15 years ago.

______

7. WeWork Reaches NYC Office Lease Deal

Co-working firm WeWork, which filed for bankruptcy in November, has struck a new lease deal with the landlord of 1440 Broadway in Manhattan—agreeing to lower rents and shorter terms while retaining 10 floors totaling 300,000 sq ft.

Since declaring bankruptcy, WeWork has canceled over 70 lease agreements and plans to cancel more in the coming weeks. The 1440 Broadway location is in the heart of Times Square.

Amazon is currently the building’s largest tenant.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.