1. Hindenburg Shorts Roblox

2. Jamie Dimon Advocates for Lower IPO Barriers

3. BlackRock Invests in Back-Office Services Firm

4. Weight-Loss Drugs Could Cost Medicare $35 Billion

5. Wells Fargo Downgrades Amazon

6. Home Depot Mandates In-Store Experience for White-Collar Staff

7. China A-Shares Open Strong, End Lower

1. Hindenburg Shorts Roblox

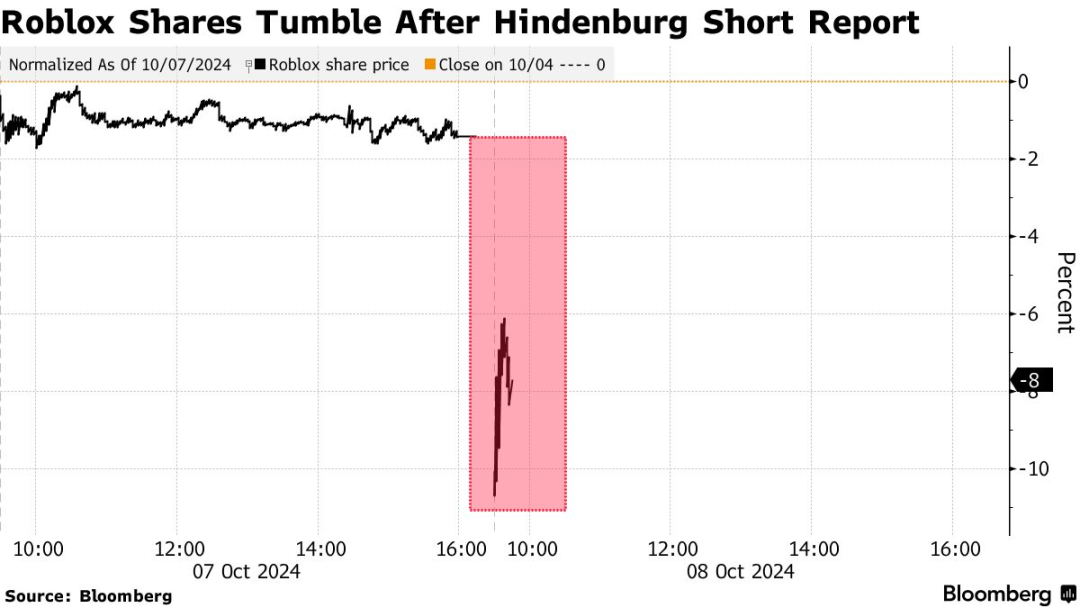

Today, short-selling firm Hindenburg has once again set its sights on Roblox. Before market open, the company’s stock price plunged by 13%, hitting a new low not seen since early August.

Year-to-date, Roblox shares have declined by 9.5%.

In its report, Hindenburg claimed that Roblox has exaggerated several key metrics and lacks adequate safety measures to prevent misuse of its platform by bad actors.

Roblox has been a short target for a while. A company spokesperson said they completely reject the allegations in the report.

Source:Bloomberg – Roblox Tumbles as Hindenburg Bets Against Gaming Platform

______

2. Jamie Dimon Advocates for Lower IPO Barriers

In an interview with Bloomberg in London, JPMorgan CEO Jamie Dimon said he hopes lawmakers realize that the current requirements for going public in the U.S. are too high, and that the cost of regulatory compliance is rising.

Jamie expressed confusion over the fact that listed companies now have very high market caps, yet the number of IPOs hasn’t increased proportionally. While many companies are preparing for IPOs, the final outcomes remain uncertain.

He suggested reducing the difficulty and cost of going public and allowing more mergers among mid-sized banks.

At 65, Dimon believes the Fed’s 50-basis-point rate cut last month was the right move, but warned that inflation still persists.

Source:Bloomberg – Dimon Says Regulators Should Reduce Hurdles to Going Public

______

3. BlackRock Invests in Back-Office Services Firm

Dynasty Financial Partners, a company providing back-office services to independent financial advisors, has sold a minority stake to BlackRock and JPMorgan Asset Management, valuing the company at $800 million. Sources did not disclose the transaction’s exact value.

Dynasty offers trading software, financing, investment banking services, and record-keeping. With increased M&A and IPO activity recently, the company aims to expand its investment banking business and upgrade its tech infrastructure.

Existing shareholder Charles Schwab also participated in this latest funding round.

Source:Bloomberg – BlackRock, JPMorgan Asset Back Dynasty Financial at $800 Million Valuation

______

4. Weight-Loss Drugs Could Cost Medicare $35 Billion

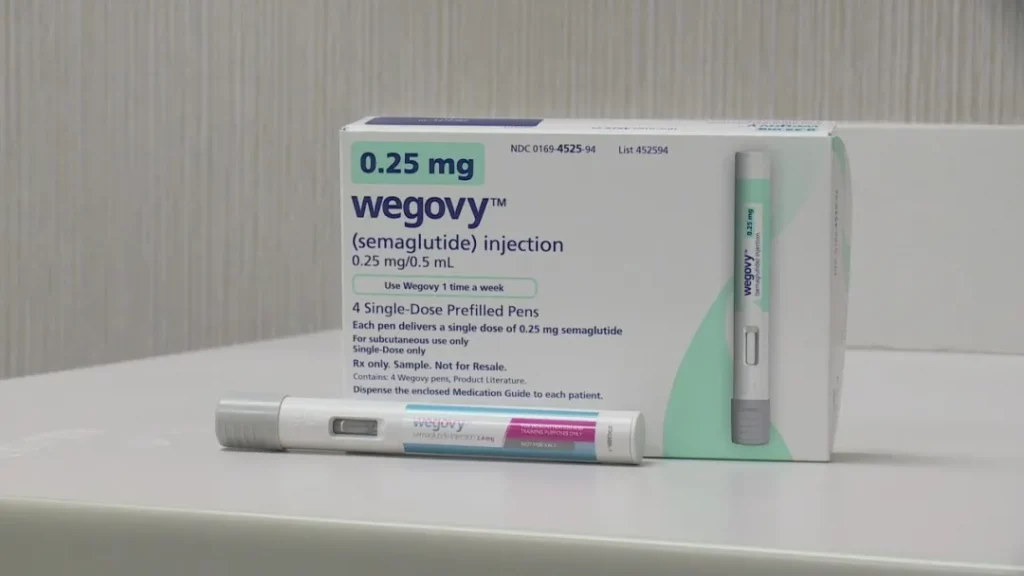

U.S. congressional budget data shows that if Medicare begins covering popular weight-loss drugs, federal spending could increase by $35 billion over the next nine years.

The Congressional Budget Office said today that the health benefits for users do not outweigh the high drug costs.

Pharmaceutical companies are lobbying Congress to allow Medicare reimbursement for weight-loss drugs, aiming to help those in need but unable to afford treatment.

Drugs from Eli Lilly and Novo Nordisk now serve more than 12.5 million users.

Source:Bloomberg – Obesity Drugs Seen Costing Medicare $35 Billion Through 2034

______

5. Wells Fargo Downgrades Amazon

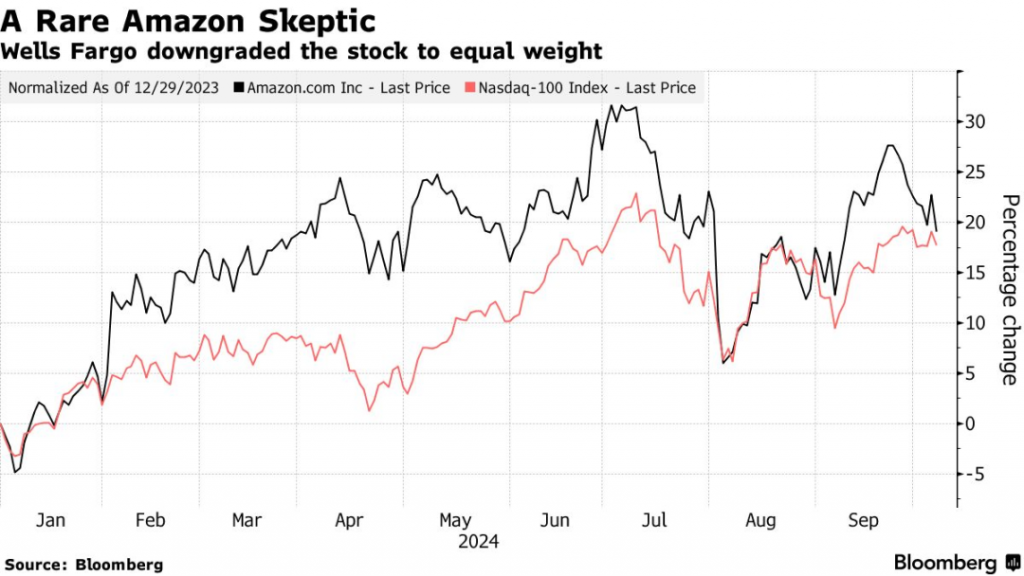

Amazon shares dropped on Monday after Wells Fargo issued a rare downgrade.

Wells Fargo believes Amazon’s cloud arm AWS cannot offset declining e-commerce margins. The firm lowered its price target from $225 to $183, one of the lowest on Wall Street.

Despite this, Amazon shares are still up 19% year-to-date, slightly beating the Nasdaq’s nearly 18% gain.

Notably, 94% of Wall Street analysts rate Amazon a “buy,” with none rating it a “sell.”

______

6. Home Depot Mandates In-Store Experience for White-Collar Staff

Home Depot announced today that starting in Q4, all corporate employees will be required to spend at least one day each quarter working in a retail role, to better understand the challenges faced by store associates.

CEO Ted Decker emphasized that retail is the company’s core and that this policy aims to build empathy for frontline workers.

Home Depot is one of the largest U.S. retailers, with over $150 billion in annual revenue and 450,000+ employees.

During the pandemic, Americans spent heavily on home improvement, but their spending has since shifted elsewhere.

Source:Bloomberg – Home Depot Orders Corporate Staff to Take 8-Hour Retail Shifts

______

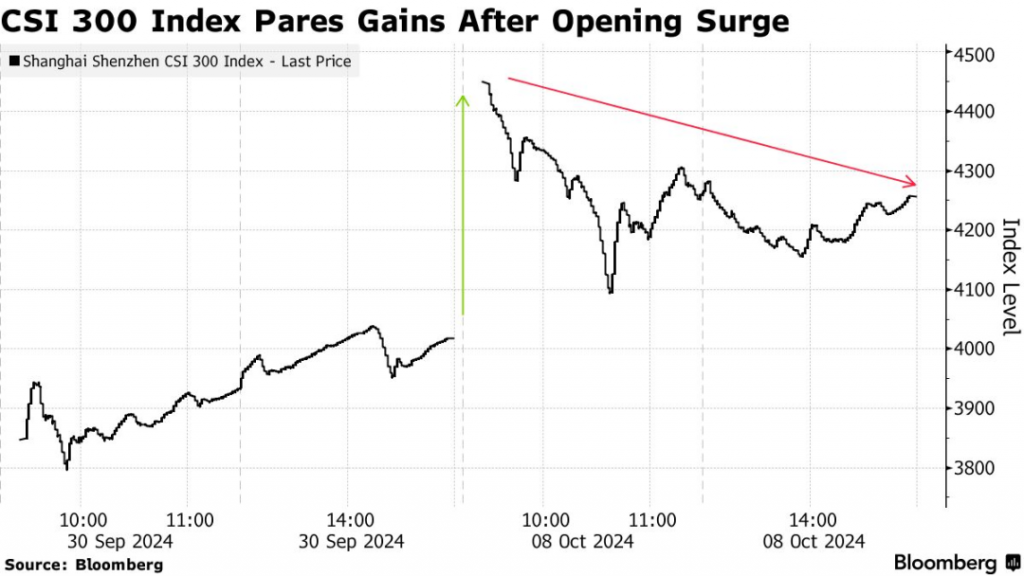

7. China A-Shares Open Strong, End Lower

Following the end of the Golden Week holiday, Chinese stocks reopened with an 11% surge at market open. However, investor enthusiasm faded after a key policy meeting failed to impress.

The CSI 300 Index closed with a 5.9% gain, while the Hong Kong-listed China Enterprises Index plunged more than 10%, nearly wiping out gains made during the A-share market closure.

Morgan Stanley noted that the longevity of this bull run depends on whether the government introduces more concrete stimulus or real financial support.

New account openings at China’s major brokerages surged today.

Source:Bloomberg – China’s Stock Euphoria Cools as Traders Reassess Stimulus Bets

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.