—— AI Startup Raises $100mn at $1.15bn Valuation; Temu Founder Becomes Richest Person in China; Stellantis to Cut 2,450 Staff in Michigan; Intel Cancels Innovation Event to Save Money; TikTok Has Less Anti-China Content Than Rivals; Investors Bearish on Commodities as Sentiment Shifts; Ares Could Take Over Industrial Manufacturer

1. AI Startup Raises $100mn at $1.15bn Valuation

DevRev Inc., a startup that leverages artificial intelligence for customer support and other tasks, has raised $100 million in funding from Khosla Ventures and other investors, bringing the company’s valuation to $1.15 billion.

The company was co-founded in 2020 by CEO Dheeraj Pandey, who also co-founded Nutanix Inc. DevRev’s AI-driven solutions aim to enhance the efficiency of employees in support, product, and engineering teams. In an interview with Bloomberg, Pandey emphasized that the technology will enable workers to reclaim their personal time, saying, “Humans can get their nights and weekends back.”

Alongside Khosla Ventures, the Mayfield Fund also participated in the funding round. Navin Chaddha, managing partner at Mayfield, cited Pandey’s successful track record with Nutanix as a major factor in his decision to invest in DevRev, noting that he regrets not having invested in Nutanix. Chaddha was so confident in DevRev’s potential that he “wired the money in two days.”

He praised the company’s progress, calling it “picture-perfect execution,” and expressed confidence that DevRev will eventually pursue an initial public offering (IPO).

______

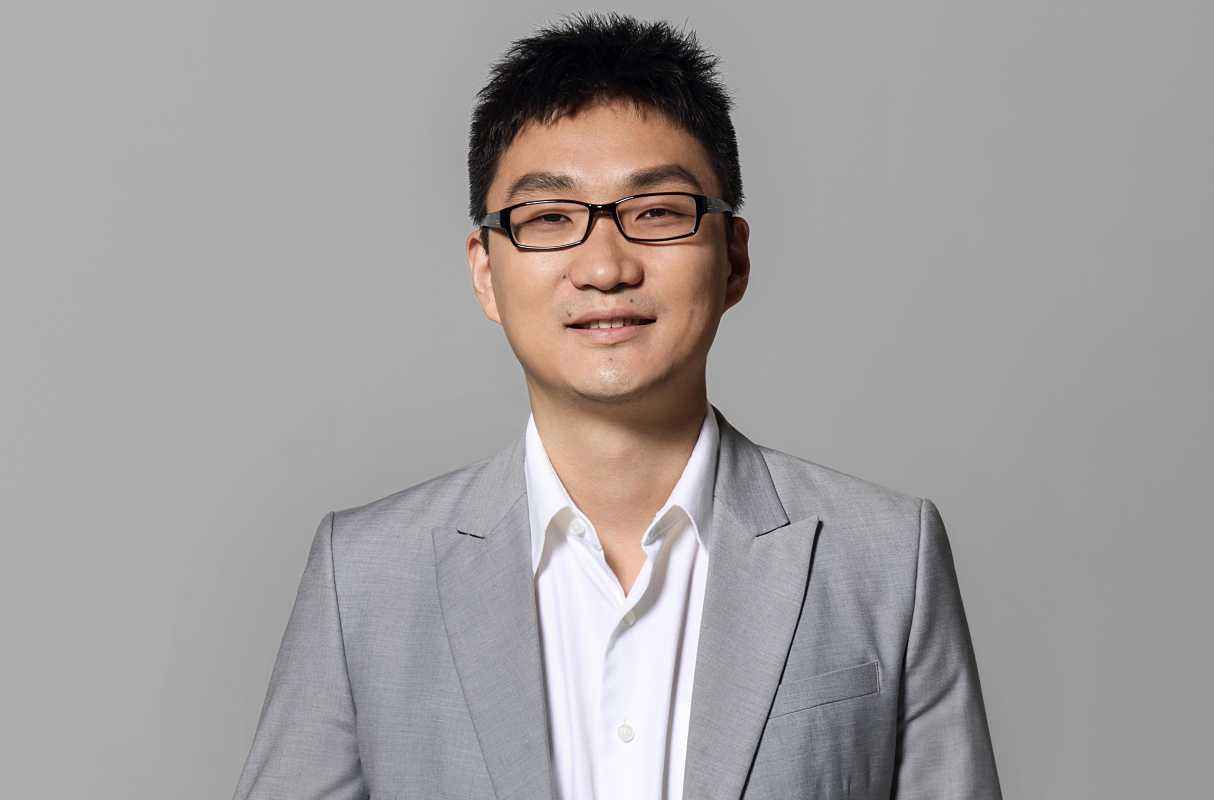

2. Temu Founder Becomes Richest Person in China

After achieving moderate success in ventures related to gaming and e-commerce, Colin Huang, a former Google engineer, took a break from his entrepreneurial pursuits, staying home for a year to contemplate his next move.

In 2015, Huang founded Pinduoduo, an e-commerce platform renowned for offering extremely low-priced products through massive promotions. The platform’s rapid growth catapulted Huang into the ranks of the world’s wealthiest individuals, with his net worth reaching a peak of $71.5 billion in early 2021.

However, like many “Covid billionaires,” Huang’s fortune quickly declined, plummeting by 87% within about a year. His dramatic fall was largely due to the combination of the global pandemic’s slowdown and China’s abrupt crackdown on its private sector.

Despite this downturn, Huang’s company, PDD Holdings Inc., made a surprising comeback. Although not as large as before, the recovery has been steady, driven in part by PDD’s international expansion under the Temu brand, which has helped to offset the challenges of a persistently weak domestic economy in China.

______

3. Stellantis to Cut 2,450 Staff in Michigan

Stellantis NV, the parent company of Jeep and Ram brands, announced plans to cut up to 2,450 hourly positions at its pickup truck factory near Detroit.

The automaker stated on Friday that these job cuts are linked to its decision to cease production of the Ram 1500 Classic truck model at the Warren, Michigan plant later this year. Consequently, the facility will reduce its operations from two shifts to one.

The Warren plant, which also manufactures the Jeep Wagoneer and Grand Wagoneer, currently employs a total of 3,700 United Auto Workers (UAW) union members.

Stellantis indicated that the layoffs could begin as early as October 8, but union members will have the option to transfer to other plants.

______

4. Intel Cancels Innovation Event to Save Money

Intel Corp., which is currently implementing job cuts and cost reductions to conserve its shrinking cash reserves, has postponed its Innovation event that was scheduled for next month in San Jose, California.

Instead of the Innovation conference, Intel announced on Friday that it will concentrate on other gatherings, such as webinars, hackathons, and the Intel AI Summit, according to a statement emailed by the company.

This decision comes after Intel’s rocky earnings report last week, where the company issued a disappointing sales forecast and announced a dividend cut. Additionally, Intel plans to eliminate 15% of its workforce, signaling that a significant recovery under Chief Executive Officer Pat Gelsinger remains distant.

The annual Innovation event was part of Gelsinger’s strategy to reclaim Intel’s technological leadership and industry influence. The event was modeled after the Intel Developer Forum, a long-standing conference that historically helped set the direction for the computer industry.

______

5. TikTok Has Less Anti-China Content Than Rivals

A new study has found that videos condemning or critically depicting China’s human rights abuses are more difficult to find on TikTok compared to other social media platforms like Instagram and YouTube, potentially giving US users an incomplete picture of China’s history when searching for key terms.

The study, conducted by the Network Contagion Research Institute at Rutgers University, revealed that US TikTok users who search for terms such as “Tiananmen,” “Tibet,” and “Uyghur” — terms often associated with Chinese Communist Party propaganda — are less likely to encounter “anti-China” content than users who conduct the same searches on Instagram and YouTube.

To replicate the experience of American teenagers signing up for social media, analysts created 24 new accounts across TikTok, Instagram, and YouTube. The study found that TikTok’s algorithm displayed a higher percentage of positive, neutral, or irrelevant content when users searched for keywords related to China’s human rights abuses, in contrast to Instagram and YouTube, which showed more critical content.

“What sets TikTok apart is that the accurate information about China’s human rights abuses is most successfully crowded out on the platform,” said Joel Finkelstein, director and chief science officer of NCRI. Additionally, a survey conducted alongside the study showed that people who used TikTok for three hours or more daily had a significantly more positive view of China’s human rights record than non-users.

______

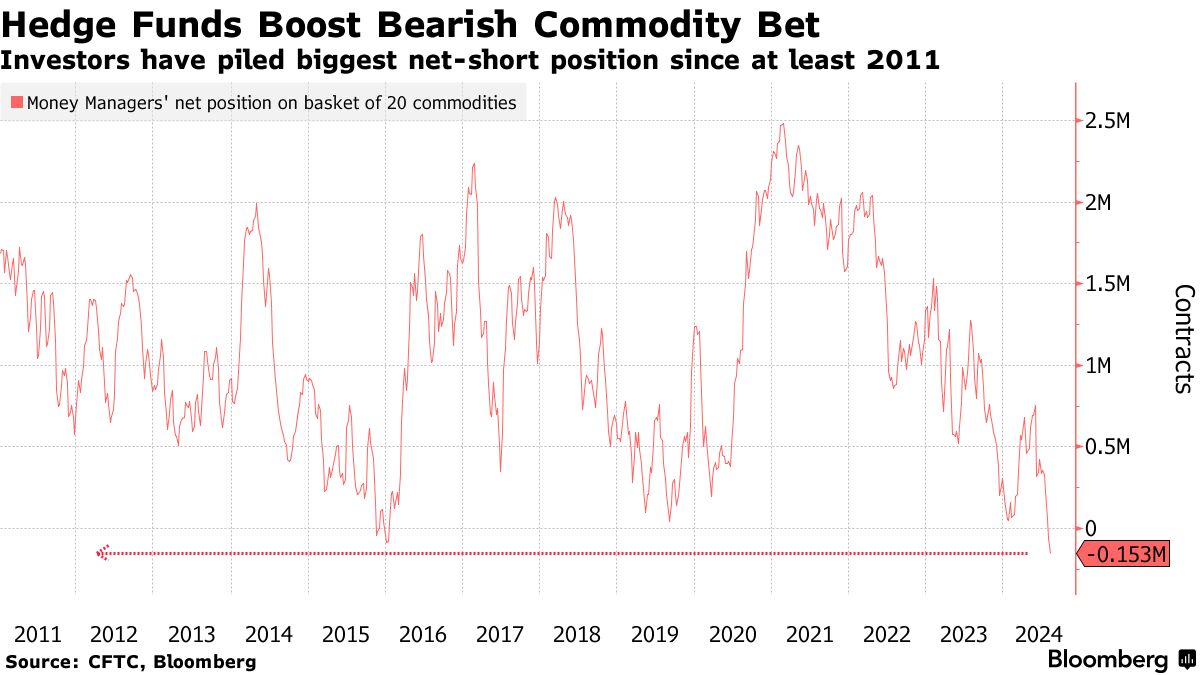

6. Investors Bearish on Commodities as Sentiment Shifts

Hedge funds are currently holding their most bearish stance on commodities prices in at least 13 years, driven by growing fears of a deeper economic slowdown that could reduce demand for a wide range of raw materials, including crude oil, metals, and grains.

Money managers accumulated a combined net-short position of nearly 153,000 futures and options contracts across 20 different raw-material markets during the week ending Tuesday, according to data from the US Commodity Futures Trading Commission compiled by Bloomberg. This marks the most bearish position on record, based on data going back to 2011.

This significant shift in sentiment highlights a dramatic change from the early pandemic period, when supply disruptions and speculation about a commodity super-cycle led to record bullish bets in 2021. However, factors such as a slowdown in China—traditionally the largest driver of demand growth for commodities over the past two decades—and a rebound in production have since dampened investor enthusiasm for raw materials.

Additionally, recent market turbulence caused by fears of a US recession has further exacerbated this trend, leading investors to turn bearish on commodities for the first time since 2016.

______

7. Ares Could Take Over Industrial Manufacturer

Ares Management Corp. is exploring a potential acquisition of industrial manufacturer Form Technologies, according to people familiar with the matter.

The investment firm is considering financing the deal through a combination of preferred equity and common shares and is seeking a co-investor to participate in the equity portion, these sources said.

Jefferies Financial Group Inc. has been reaching out to investors about a debt package to help fund the buyout of Form Technologies, which is currently backed by Partners Group Holding AG. The debt package includes a $650 million term loan, which is being pitched with an interest rate of approximately 450 to 500 basis points over the Secured Overnight Financing Rate (SOFR), according to the sources.

Deliberations are ongoing, and the pricing terms on the loan could still change. Additionally, Ares may ultimately decide not to pursue the deal, the sources added, asking to remain anonymous due to the confidential nature of the information.

Form Technologies has been exploring strategic options, including a potential sale, as it faces around $900 million of debt maturing next year, as reported by Bloomberg News in April.

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。