—— US Retail Sales Stay Strong; Morgan Stanley Profit Missed Forecast; JPMorgan Buys Another Office Building; Insurance Companies Buy Mortgage to Boost Yield; Bidding War for Manhattan Apartments Heats Up; Ken Griffin Donates $10mn to Republican Funds

1. US Retail Sales Stay Strong

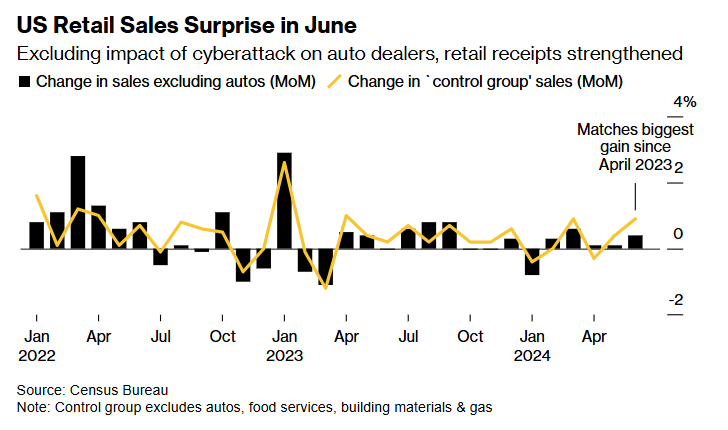

US retail sales, excluding the impact of a cyberattack on auto dealerships, increased in June by the most in three months, indicating that consumers regained their momentum at the end of the second quarter.

Retail purchases, excluding motor vehicles, rose by 0.4% last month following an upwardly revised 0.1% increase in May. Total retail sales remained unchanged due to a 2% decline in receipts at auto dealers. These figures are not adjusted for inflation.

“Consumption and economic activity have slowed significantly so far in 2024. However, conditions have not weakened to a recessionary level,” said Rubeela Farooqi, chief US economist at High Frequency Economics, in a note. “We believe that the data on spending and growth, along with improving inflation readings, support an easing in monetary policy.”

This data contrasts with recent months’ trend of gradual consumption growth slowdown, as Americans face high interest rates and a cooling labor market. It suggests that the economy is still resilient as the Federal Reserve approaches the start of rate cuts.

______

2. Morgan Stanley Profit Missed Forecast

BlackRock Inc. attracted $51 billion in client cash to its long-term investment funds in the second quarter, pushing its total assets to a record $10.6 trillion, making it the world’s largest money manager.

Investors contributed $83 billion to ETFs and $35 billion to fixed-income assets overall, the New York-based firm announced in a statement on Monday.

“Organic growth was driven by private markets, retail active fixed income, and surging flows into our ETFs, which had their best start to a year on record,” said Chief Executive Officer Larry Fink in the statement.

Additionally, BlackRock saw $30 billion in net flows to cash-management and money-market funds during the period, bringing total net flows to $82 billion. However, net flows to long-term investment funds fell short of the $86 billion average estimate by analysts surveyed by Bloomberg.

BlackRock’s flows were impacted by a roughly $20 billion active fixed-income redemption from a large insurance client, Chief Financial Officer Martin Small mentioned during the firm’s call with analysts. The firm also reported $35 billions of institutional outflows from its index funds.

______

3. JPMorgan Buys Another Office Building

JPMorgan Chase & Co. is set to purchase a Manhattan building near its new headquarters for over $300 million.

The bank, in partnership with Hines, has agreed to buy the office tower at 250 Park Ave. from seller AEW, according to a source familiar with the matter who requested anonymity due to the private nature of the information. Bloomberg News reported in June that the bank was nearing a deal for the property.

The transaction has not yet been finalized. Newmark Group Inc. brokers, led by Adam Spies and Doug Harmon, are managing the sale process. Representatives for JPMorgan and Hines declined to comment, while AEW and Newmark did not respond to requests for comment.

This acquisition will further expand JPMorgan’s presence on Park Avenue, where the bank is constructing a 1,388-foot (423-meter) tower for its new headquarters, having demolished its previous building.

______

4. Insurance Companies Buy Mortgage to Boost Yield

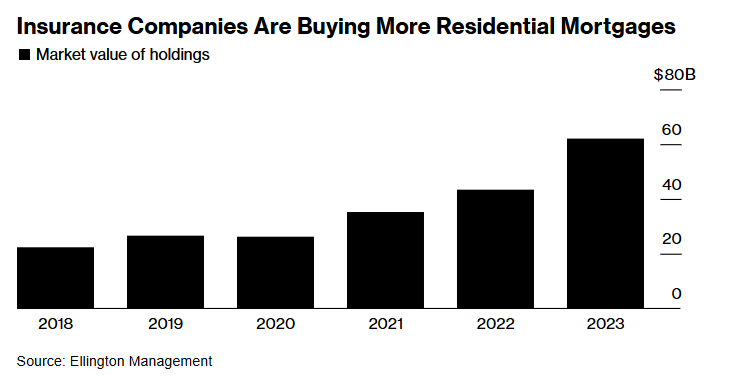

Yield-hungry insurance firms are adopting an unconventional strategy: bypassing mortgage-backed bonds to purchase the underlying whole loans directly.

This trend has gained momentum over the past few years. In the previous year alone, insurers increased their holdings of residential mortgage loans by 45%, or approximately $20 billion, as analyzed by Ellington Management Group.

These loans typically do not qualify for inclusion in bonds guaranteed by Fannie Mae or Freddie Mac—government-backed entities that support most US mortgages for investors. The borrowers are generally riskier, and owning mortgages directly, rather than in the form of mortgage-backed bonds, requires firms to handle complex tasks usually managed by specialists.

So, why endure the hassle of owning these loans directly instead of in a securitized form? The answer lies in better yields. Although difficult to quantify precisely, insurers capable of owning mortgages directly can save around 35-45 basis points on the cost of securitization. Additionally, this approach frees up a significant amount of capital on insurance company balance sheets due to more favorable risk treatment, according to Ryan Singer, head of global residential investments at Balbec Capital.

Not every firm has the size or expertise to manage this, which is why large alternative asset managers like Apollo Global Management Inc. and KKR & Co. are leading this shift.

______

5. Bidding War for Manhattan Apartments Heats Up

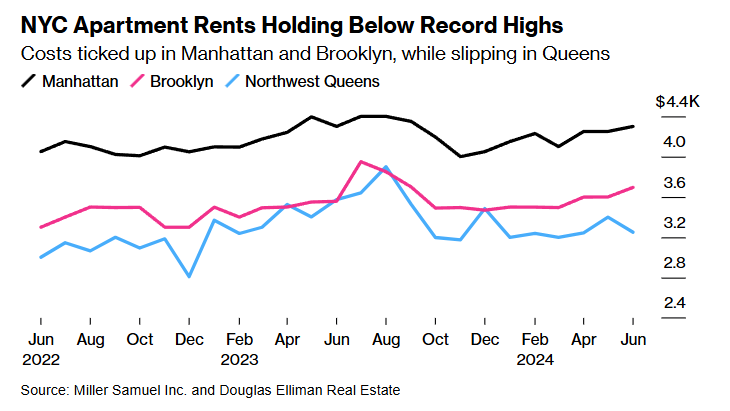

Manhattan’s apartment market reached unprecedented levels of competitiveness in June.

A record-high 24% of leases were signed after bidding wars last month, according to brokerage Douglas Elliman Real Estate and appraiser Miller Samuel Inc. The firms began tracking this metric in 2021 when the rental market started to heat up after the pandemic lockdown was lifted.

Other indicators showed that apartment hunters were under intense pressure in June. Units were listed for an average of just 24 days before being leased, an all-time low. Additionally, renters paid an average premium of 1.4% above listing prices, a figure that often reflects a discount.

Some listing agents across the city have adopted the practice of underpricing apartments and asking potential tenants to make their best offers. Renters, determined to avoid lengthy searches, sometimes bid above the asking price unprompted.

“It’s a very competitive market,” said Jonathan Miller, president of Miller Samuel.

______

6. Adidas Raises Guidance Amid Strong Sales

Adidas AG raised its annual profit target for the second time in three months, driven by strong demand for classic sneakers like the Samba and increased sales from the dwindling stockpile of Yeezy footwear.

The German sportswear company now expects to generate an operating profit of around €1 billion ($1.09 billion), up from the previous forecast of €700 million and aligning with analyst estimates, according to a statement.

Second-quarter sales also exceeded expectations, rising 11% year-over-year to €5.82 billion. Excluding Yeezy products, sales would have increased by 16%, indicating that Adidas’ core business is recovering and becoming less dependent on Yeezy footwear compared to last spring and summer. Following this update, Adidas’ American depositary receipts rose by 2.7% on Tuesday.

Chief Executive Officer Bjorn Gulden is working to initiate another period of rapid growth for Adidas and narrow the gap with industry leader Nike, which has faced challenges recently. Adidas’ net sales declined last year due to the terminated partnership with rapper and designer Ye.

______

7. Ken Griffin Donates $10mn to Republican Funds

Ken Griffin has reinforced his position as a major donor to the Republican campaign to gain control of the US Congress by contributing $10 million to one of the party’s key fundraising groups in the second quarter of the year, according to sources familiar with the matter.

The billionaire founder of hedge fund Citadel donated the sum to the Congressional Leadership Fund (CLF), adding to the $5 million he had already given earlier in the current election cycle and another $10 million to the Senate Leadership Fund. This brings his total contributions to the two super PACs since January 2023 to $25 million.

“I have long been dedicated to supporting problem-solving candidates who drive real results for the country. CLF has done a tremendous job in recruiting qualified individuals to serve our nation,” Griffin said on Monday.

Griffin has been increasing his contributions over past election cycles, donating $1 million to CLF in 2015-16, $4.5 million in 2017-18, $10 million in 2019-20, and $27 million in 2021-22.

However, it remains uncertain whether Griffin will donate to Donald Trump. In 2022, he urged the former president to step aside in favor of Ron DeSantis. A year later, as DeSantis’ campaign faltered, he contributed $5 million to support Nikki Haley’s campaign.

Griffin’s donations to the CLF are designated for the super PAC’s “next generation” fund, which supports “emerging leaders” of the Republican party, including vulnerable first-term House members like Juan Ciscomani, Lori Chavez-DeRemer, and John James.

“For cycles now, Ken Griffin has taken a long view on his political giving,” CLF president Dan Conston told the Financial Times. “These are deliberate investments to elevate the kind of solutions-oriented candidates that exemplify the best of what America can be.”

Source: Financial Times – Ken Griffin gives over $20mn to US Republican fundraising committees

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。