—— Pfizer Weight-loss Pill Shows Progress; US Overall CPI Finally Drops in June; Tesla Gains 44% in 11 Trading Days; Price of Luxury Watches Continues to Drop; US Deficit Hit $1.27tn in 2024 Fiscal Year; Aritzia Shares Gain 51% This Year; Wealth and Career Advise Startup Raises $200mn

1. Pfizer Weight-loss Pill Shows Progress

Pfizer Inc. is progressing with a weight-loss pill as it attempts to recover from its post-pandemic downturn, but the company provided limited insight into the rationale behind this move.

On Thursday, Pfizer unveiled results from a long-anticipated study involving 20 participants for an anti-obesity pill that had previously encountered issues due to side effects. In the new study, Pfizer evaluated four versions of the treatment, administering it once daily instead of twice daily, to identify a formulation that induces adequate weight loss without the side effects that previously led to discontinuation.

Pfizer did not disclose which formulation was most effective, making it difficult for analysts to assess the results. Mikael Dolsten, the outgoing Chief Scientific Officer, mentioned that several versions of the drug showed “encouraging” results and expressed confidence that a once-daily formulation could be competitive in the obesity pill market.

The company did not immediately respond to inquiries about whether additional data on the drug, known as danuglipron, would be released from this study.

______

2. US Overall CPI Finally Drops in June

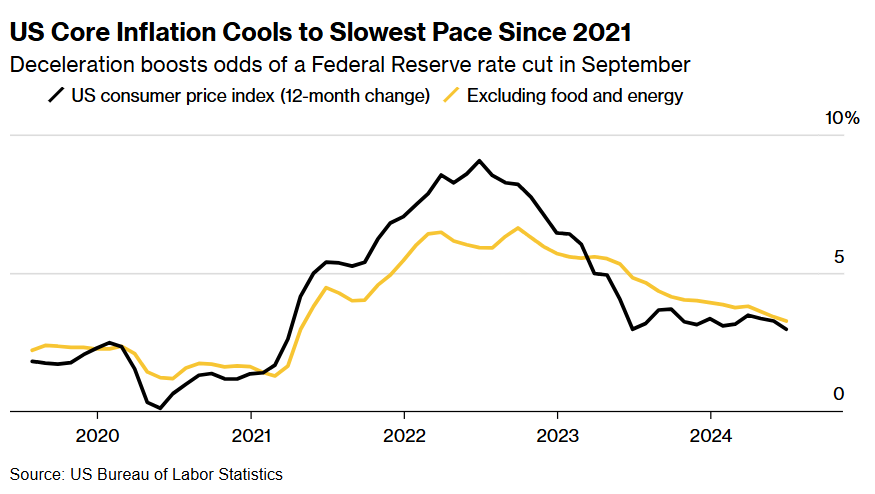

US inflation slowed significantly in June, reaching its lowest rate since 2021, largely due to a long-anticipated decrease in housing costs. This development provides a strong indication that the Federal Reserve may soon be able to reduce interest rates.

The core consumer price index (CPI), which excludes food and energy costs, rose by just 0.1% from May, marking the smallest increase in three years, according to the Bureau of Labor Statistics on Thursday. The overall CPI dropped for the first time since the pandemic began, primarily due to lower gasoline prices.

Similar to the May CPI report, which Fed Chair Jerome Powell recently described as “really good” following an unexpected increase in the first quarter, the June figures are expected to bolster confidence among Powell and his colleagues to consider cutting rates, possibly starting in September.

Policymakers may hint at this potential move during their meeting later in July, particularly given that unemployment has increased for three consecutive months.

______

3. Tesla Gains 44% in 11 Trading Days

Tesla Inc. shares are skyrocketing at an impressive rate, yet the bullish argument is becoming increasingly difficult to sustain.

During the last comparable surge, the rally was driven by double-digit revenue growth. Currently, the situation appears less optimistic: the overall sentiment around electric vehicles is muted, Tesla’s sales are declining, and its profits are diminishing.

Tesla’s stock has jumped 44% as of Wednesday, marking an 11-day winning streak, the longest since June 2023. The stock is now trading at 90 times forward earnings, a level not seen since early 2022, according to Bloomberg data. Investors attribute the surge to traders focusing beyond Tesla’s electric vehicle credentials and betting on Elon Musk’s potential to transform the company into an artificial intelligence powerhouse.

The anticipation is that Musk will unveil Tesla’s much-awaited self-driving technology, the so-called robotaxi, on August 8, solidifying the company’s position as a leading AI player.

______

4. Price of Luxury Watches Continues to Drop

Prices for the most sought-after luxury watches continued to decline on the secondary market last month, extending a two-year downward trend as investors shift their focus after the pandemic-era surge subsided.

The Bloomberg Subdial Watch Index, which monitors the 50 most-traded watches by transaction value, dropped by less than 1% in June. Over the past year, it has decreased by 8% and has fallen by 23% over the last two years, according to data from Subdial, a UK-based watch trading platform. In contrast, the S&P 500 Index, the benchmark for the US stock market, has surged 27% in the past year.

Top Swiss brands such as Rolex, Patek Philippe, and Audemars Piguet have experienced a reversal after reaching unprecedented heights on the secondary market in early 2022.

This surge was driven by homebound shoppers investing their pandemic savings into luxury timepieces. From June 2021 to June 2022, the Bloomberg Subdial Watch Index rose by 40%, while the S&P 500 fell by about 1%.

______

5. US Deficit Hit $1.27tn in 2024 Fiscal Year

Interest payments on outstanding US debt continued to drive the federal government’s budget deficit, which reached $1.27 trillion for the fiscal year through June.

In June, the deficit stood at $66 billion, despite receipts hitting a record for that month at $466 billion, according to Treasury data released Thursday. Adjusted for calendar differences, the month’s shortfall was $5 billion smaller than in June 2023. The year-to-date deficit also fell slightly short of the same period last year.

Interest on public debt in June reached $140 billion, totaling $868 billion in the first nine months of the current fiscal year, which is 33% higher than in the same period last year.

The Federal Reserve’s aggressive interest-rate hikes, aimed at curbing high inflation, have increased the cost of debt. The weighted average interest rate on US total marketable government debt was 3.3% at the end of June, the highest since 2008 and roughly 60 basis points higher than a year earlier.

Tax receipts remained strong compared to last year, both on a monthly and year-to-date basis. However, Treasury officials noted that much of the year-over-year gains could be attributed to the deferral of tax deadlines from fiscal 2023 into this year in states affected by natural disasters, including most of California.

______

6. Aritzia Shares Gain 51% This Year

Aritzia Inc. reported higher-than-expected sales growth as the clothing retailer introduced new clothing styles and opened additional store locations.

The Vancouver-based company reported revenue of C$498.6 million ($365.7 million) for its fiscal first quarter, which ended June 2, surpassing the average analyst estimate. Sales increased by 7.8% from a year earlier.

Aritzia, which markets itself as “everyday luxury” and specializes in women’s apparel, has focused on expanding its US presence, which the company expects will help drive sales. Aritzia plans to add at least 10 new stores in the US during the fiscal year. While the majority of its locations are still in Canada, the US market generates more revenue.

“We’re encouraged by the positive response to both our new styles and client favorites,” Aritzia Chief Executive Officer Jennifer Wong said in a press release.

E-commerce expansion is another focus area. Although Aritzia’s online sales growth has slowed post-pandemic, the company has been working to improve its website, expand in-store pick-up options, and pilot a mobile application. E-commerce sales grew 4.2% in the first quarter.

Aritzia shares have gained 51% so far this year through Thursday’s close.

______

7. Wealth and Career Advise Startup Raises $200mn

Earned Wealth, a startup that provides financial advisory services to doctors, has raised $200 million in new funding with plans to pursue acquisitions.

The financing was led by Summit Partners and Silversmith Capital Partners, along with existing investors Juxtapose, Hudson Structured Capital Management, and Breyer Capital, according to a statement reviewed by Bloomberg News. The company did not disclose its valuation in this funding round.

Founded in 2021, Earned Wealth offers medical professionals advice on financial planning, tax planning, wealth management, and investing through a single integrated platform. In 2023, the company raised approximately $18 million in a funding round that valued it at close to $40 million, according to data from PitchBook.

Chief Executive Officer John Clendening stated that Earned Wealth aims to simplify financial management for physicians by providing a unified service, eliminating the need to find and communicate with multiple financial advisers.

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。