—— Yen Depreciates to Lowest Level Since 1986; US New Single-family Homes Sales Slump; High US Earners Start Worrying about Finances; Amazon Market Cap Hits $2tn; Interactive Brokers Lost $48mn from NYSE Glitch; Millions of Retirement Accounts Earn Big on Stocks; KKR Buys $2.1bn Multifamily Portfolio

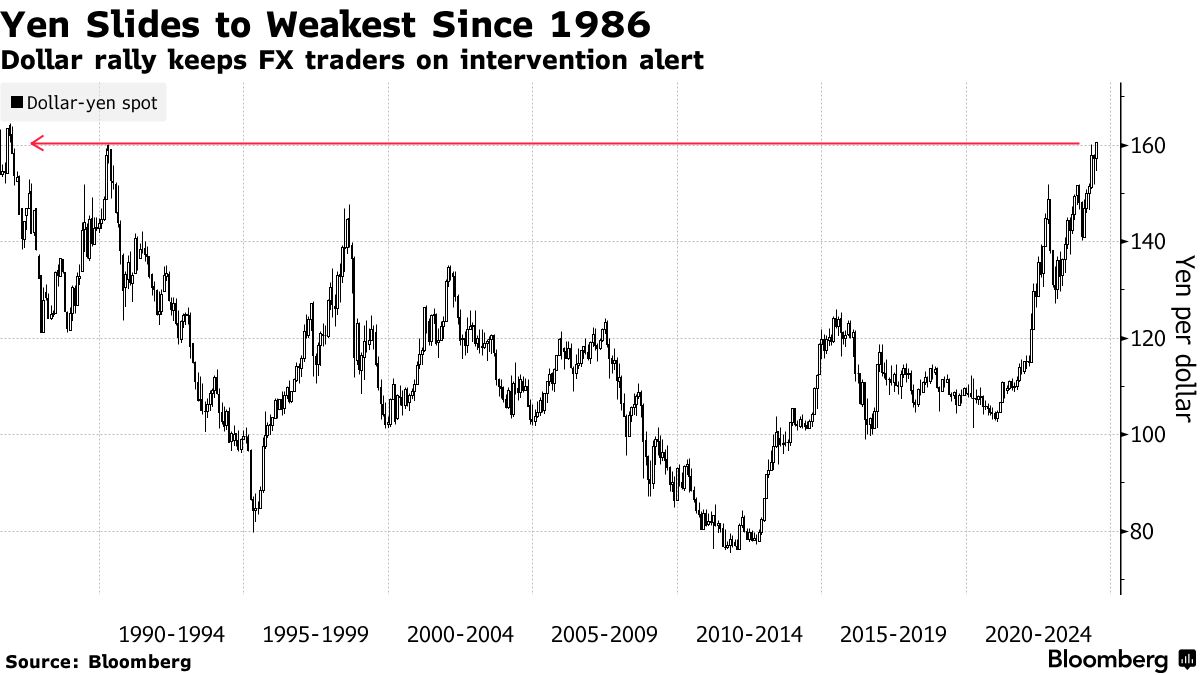

1. Yen Depreciates to Lowest Level Since 1986

The yen fell to its weakest level since 1986, fueling speculation that authorities may soon be compelled to support the currency to stem the worst selloff in the developed world.

The Japanese currency slumped as much as 0.6% to 160.62 per dollar, surpassing the level at which officials intervened in April, and taking losses this year to more than 12%. Against the euro, it dropped to its weakest on record. This depreciation is raising the price of imports, adversely affecting Japanese consumers, and causing growing unease among businesses.

Masato Kanda, Japan’s vice minister of finance and currency chief, stated on Wednesday that officials are monitoring the foreign-exchange markets with a high degree of urgency and would take appropriate steps as needed. He described the currency’s latest move as “rapid” and “one-sided” but refrained from commenting on whether it is excessive. The yen extended its losses following his remarks.

The significant gap between interest rates in Japan—where borrowing costs remain near zero—and the US has kept pressure on the yen despite attempts to contain the decline. The next critical point may come from the Federal Reserve’s favored US inflation gauge, due to be released on Friday, which is key to the outlook for monetary policy.

______

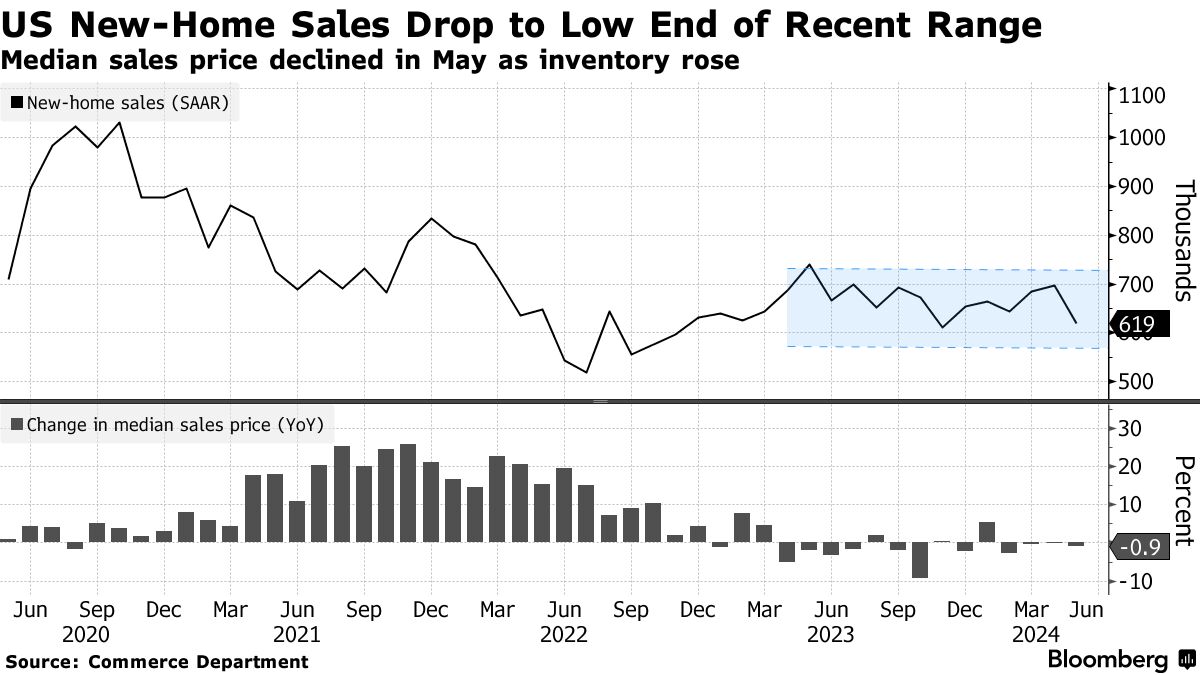

2. US New Single-family Homes Sales Slump

New-home sales in the US fell in May as elevated prices and mortgage rates continued to challenge the housing market.

Sales of new single-family homes decreased by 11.3% to an annual pace of 619,000, the slowest since November, according to government data released Wednesday. This figure was below almost all estimates in a Bloomberg survey of economists and reflected declines across all four major US regions.

The sales pace is now at the low end of the range seen over the past year, suggesting limited momentum amid affordability challenges. Although mortgage rates dipped below 7% in mid-June for the first time since late March, they remain more than double their levels from the end of 2021.

While high prices have deterred many buyers, an increase in inventory is slightly improving affordability. The median sale price of a new home decreased by 0.9% from a year ago to $417,400 in May. Meanwhile, the supply of available homes increased to 481,000, the highest level since 2008.

______

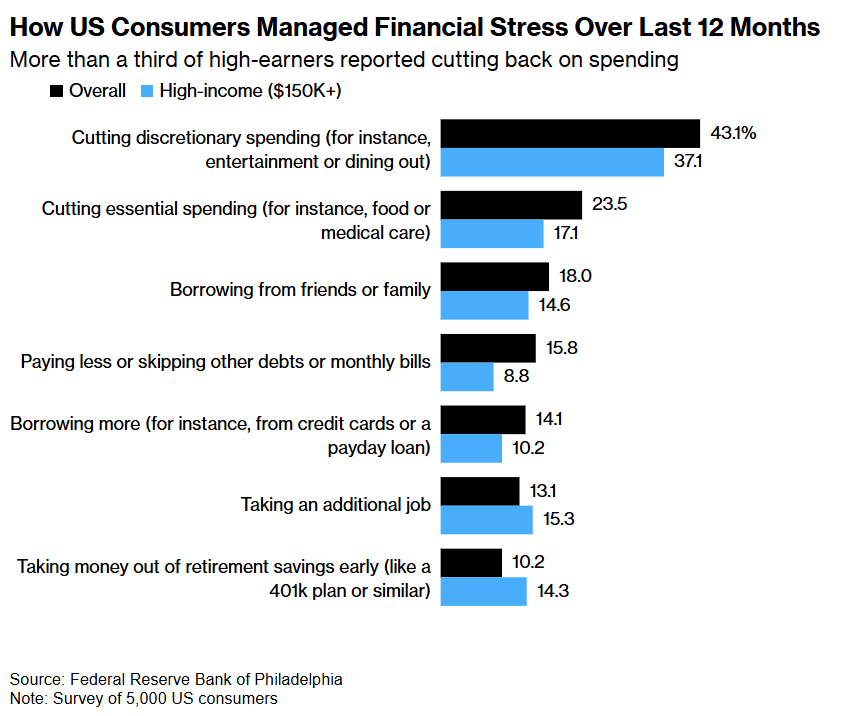

3. High US Earners Start Worrying about Finances

Making ends meet in the coming year is a growing concern for US consumers, including those earning $100,000 or more annually, according to a survey by the Federal Reserve Bank of Philadelphia.

The survey revealed that over a third of respondents expressed concern about making ends meet in the next six months, up from 28.7% a year ago. The proportion of those worried about their financial situation over the next seven to 12 months also increased.

Among those who were able to pay their bills in full in April, more than a quarter expressed concerns about the next six months, up from a fifth the previous year. Higher earners were notably worried, with about 30% of those making at least $150,000 expressing concern about their finances over the next six months.

Additionally, more than two-thirds of respondents took actions to cope with increased financial stress over the past year, such as cutting back on spending, skipping monthly bills, or taking on an additional job. Over 14% of those earning $150,000 and above reported withdrawing money early from their retirement savings to manage their financial strain.

______

4. Amazon Market Cap Hits $2tn

Amazon.com Inc. has reached a $2 trillion market valuation for the first time, driven by an artificial intelligence-fueled rally that has propelled the tech giant to new record highs.

Shares rose as much as 3.6% on Wednesday to $193.04, elevating the market value to over $2 trillion. This milestone places Amazon in an elite group of companies that have surpassed this significant market capitalization threshold. Alphabet Inc. reached the $2 trillion mark in late April, while rallies have pushed the market values of Nvidia Corp., Microsoft Corp., and Apple Inc. to over $3 trillion.

Amazon shares have fluctuated since the company’s first-quarter earnings, where the cloud unit posted its strongest sales growth in a year, helping the stock to recover and surpass its previous all-time high set in April.

The stock experienced a significant rally in June, recovering from losses at the end of May and gaining approximately 27% so far this year.

______

5. Interactive Brokers Lost $48mn from NYSE Glitch

A trading glitch on the New York Stock Exchange earlier this month cost Interactive Brokers $48 million after its customers rushed to buy Berkshire Hathaway shares following a 99% plunge in their price.

On Wednesday, the brokerage stated that it was considering its options, “including any claims at law it could assert against NYSE,” but noted that the financial impact was not material to its earnings.

The unexpected drop in Berkshire Hathaway’s class A shares on June 3 was among several caused by a technical issue during early trading on the NYSE, which is part of Intercontinental Exchange.

Berkshire’s shares fell from about $622,000 to $185 each before the exchange halted trading. During the halt, a significant number of buy orders were placed, with customers presumably expecting their orders to be filled at the low price of approximately $185 per share when trading resumed, Interactive Brokers explained.

When trading resumed almost two hours later, Berkshire’s shares surged to as high as $741,941 within minutes. As a result, Interactive’s customers had their orders filled at various prices during the run-up, including some at the peak price.

After markets closed on June 3, NYSE announced it would cancel all trades at or below $603,718.3 conducted before the trading halt.

______

6. Millions of Retirement Accounts Earn Big on Stocks

The bull market in US stocks has significantly boosted retirement accounts for millions of older Americans, with many high-income earners accumulating savings that far exceed their anticipated spending needs.

An analysis by Vanguard researchers on the retirement readiness of baby boomers revealed that the top 5% of income earners have a savings surplus of almost 30%. While the retirement outlook has improved for all but the bottom quartile of wage earners, a savings gap still persists.

Kelly Hahn, head of retirement research at Vanguard Investment Strategy Group, highlighted the positive trend in a blog post, stating, “We see a meaningful improvement in retirement readiness for many baby boomers.”

Despite stock-market gains enhancing retirement savings for most, the disparity between upper-income earners and those at the bottom has widened. Workers in the bottom quartile face a 36% savings gap between their sustainable replacement rate and their expected spending needs.

______

7. KKR Buys $2.1bn Multifamily Portfolio

KKR (KKR) has acquired an 18-asset apartment building portfolio from developer Quarterra Multifamily for approximately $2.1 billion, the firm announced late Tuesday.

The portfolio comprises recently built rental housing properties located in California, Washington, Florida, Texas, Georgia, North Carolina, Colorado, and New Jersey. The specific properties included in the deal were not immediately disclosed.

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。