—— Bank of Canada Cuts Interest Rate; US Service Sector Quickly Expands; Apollo Buys 49% Shares in Intel Ireland; NY Governor Cancels Congestion Fee Plan; ESG Funds Lost $40bn Year to Date; Nvidia Market Cap Hits $3tn; BlackRock Backs Texas Stock Exchange

1. Bank of Canada Cuts Interest Rate

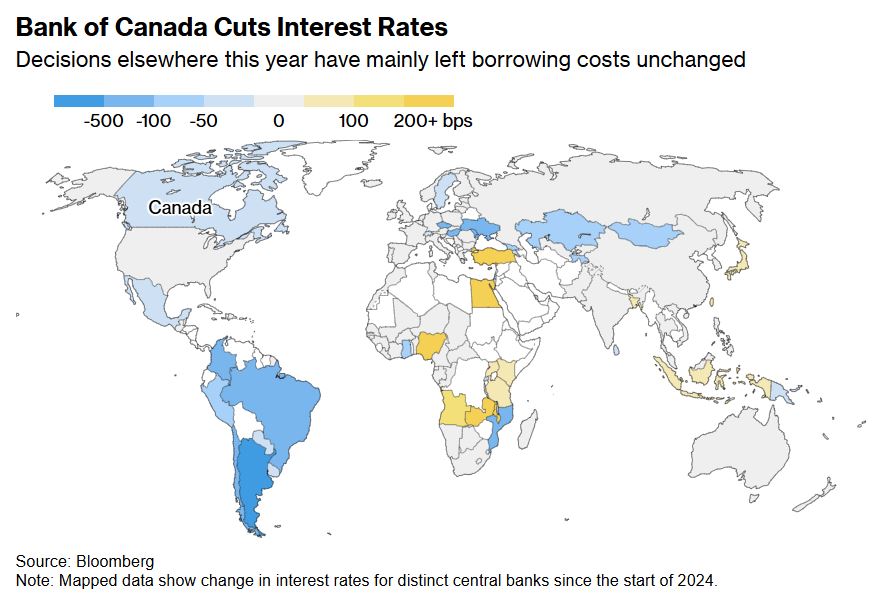

The Bank of Canada has reduced interest rates, anticipating a soft landing, becoming the first central bank among the Group of Seven to begin an easing cycle.

On Wednesday, policymakers led by Governor Tiff Macklem lowered the benchmark overnight rate by 25 basis points to 4.75%, a move that was widely anticipated by markets and economists surveyed by Bloomberg.

Officials expressed increased confidence that inflation is on track to reach the 2% target, suggesting that “further cuts” are likely if progress continues.

“With more sustained evidence that underlying inflation is easing, monetary policy no longer needs to be as restrictive,” Macklem stated in his opening remarks.

______

2. US Service Sector Quickly Expands

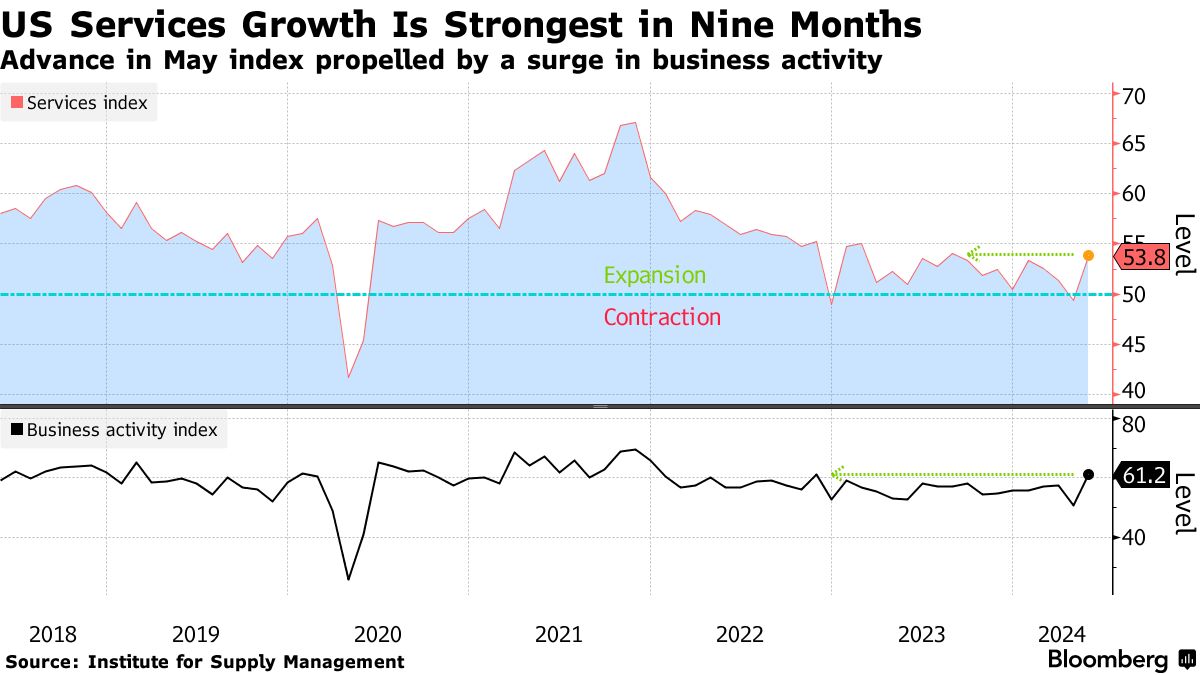

In May, the US services sector experienced its most significant expansion in nine months, driven by the largest monthly increase in business activity since 2021. The Institute for Supply Management’s (ISM) composite gauge of services rose by 4.4 points, reaching 53.8, the highest increase since early last year. A reading above 50 indicates growth, and the May figure surpassed all predictions from a Bloomberg survey of economists.

The ISM’s business activity index, similar to its factory output gauge, surged by 10.3 points, marking the largest monthly rise since March 2021. With a reading of 61.2, the highest since November 2022, this measure provides some reassurance for the economy following a series of weaker data points.

In May, thirteen service industries reported growth, with real estate and health care leading the way. However, five sectors, including retail trade, experienced a decline.

______

3. Apollo Buys 49% Shares in Intel Ireland

Intel Corp. has agreed to sell a stake in a venture controlling a plant in Ireland to Apollo Global Management Inc. for $11 billion, securing additional external funding for a significant expansion of its factory network.

According to the terms of the deal, the investment firm will acquire a 49% share in a joint venture that operates Intel’s Fab 34, as stated by Intel on Tuesday. This marks the second such investment program announced by Intel as part of its strategy to alleviate financial pressures.

Chief Executive Officer Pat Gelsinger is driving a bold and costly initiative to reclaim Intel’s position at the top of the semiconductor industry. He is heavily investing in revitalizing the company’s struggling product lineup and expanding its global plant network to strengthen its manufacturing capabilities and attract external manufacturing customers.

Intel, which was once the wealthiest company in the semiconductor industry, has had to seek external funding through a program it calls “Smart Capital.”

______

4. NY Governor Cancels Congestion Fee Plan

New York Governor Kathy Hochul has indefinitely postponed a plan to charge motorists driving into much of Manhattan, disrupting an initiative that was set to start at the end of the month.

Hochul may replace the tolling plan with a tax on New York City businesses, according to a person familiar with the situation who requested anonymity because the proposal hasn’t been made public.

The governor cited inflation and financial pressures on working-class New Yorkers as reasons for not implementing congestion pricing. “The decision is about doing what’s right for the people who make our city thrive,” she said Wednesday in a pre-taped statement posted on the state’s website. “My focus must be on putting more money back into people’s pockets.”

The tolling plan was scheduled to begin on June 30 and would have been the first of its kind in the US. It was expected to generate $1 billion annually to help modernize a century-old transit system affected by episodes of heavy rain and severe flooding.

The revenue was intended to finance subway signal upgrades to reduce train delays, purchase new electric buses, and extend the Second Avenue subway to Harlem.

______

5. ESG Funds Lost $40bn Year to Date

Global investors are increasingly withdrawing from sustainably focused stock funds due to poor performance, several scandals, and criticisms from US Republicans, dampening enthusiasm for a sector that had previously attracted trillions of dollars in assets.

According to Barclays research, clients have withdrawn a net $40 billion from environmental, social, and governance (ESG) equity funds so far this year, marking the first year of negative flow trends. In April alone, there was a record monthly net outflow of approximately $14 billion. These redemptions have occurred across all major regions.

This significant reversal indicates a loss of confidence in a sector that investors had eagerly supported in recent years, drawn by the promise that such funds could simultaneously drive positive change and yield comparable or superior returns compared to traditional stock portfolios.

______

6. Nvidia Market Cap Hits $3tn

Today, at a conference in Las Vegas, networking hardware and software company Cisco revealed that it will invest $1 billion in startups developing AI services.

Currently, the company has invested $200 million in this direction and is preparing to invest in Mistral AI and Scale AI.

In addition to investing in AI companies, Cisco plans to collaborate with these companies and help them expand their client base among enterprises and government institutions.

Cisco has already completed seven AI acquisitions and eleven investments.

______

7. BlackRock Backs Texas Stock Exchange

BlackRock Inc., Citadel Securities, and other investors are backing a new stock market in Texas, challenging the dominance of the New York Stock Exchange and Nasdaq Inc. This move signals a potential boost for Texas as it aims to capture more of the financial services industry.

The Texas Stock Exchange (TXSE) has raised $120 million and plans to file registration documents with the US Securities and Exchange Commission, according to a LinkedIn post by James Lee, the exchange’s chief executive officer.

The Texas bourse aims to attract companies looking to reduce compliance costs associated with the NYSE and Nasdaq, Lee told the Wall Street Journal, which initially reported the development. Although entirely electronic, the TXSE will be headquartered in Dallas, enhancing a metro area that has been attracting financial jobs from companies like Goldman Sachs Group Inc. and Charles Schwab Corp.

“The Texas Stock Exchange will focus on enabling US and global companies to access US equity capital markets and will provide a venue to trade and list public companies and the growing universe of exchange-traded products,” the TXSE said in a statement.

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。