—— Bill Ackman Sells 10% Stake in Pershing Square; Ex-Millennium Trader Debuts $5bn Hedge Fund; US Homebuyers Revolt Over High Prices; NYSE Has Second Glitch in a Week; Oil Prices Fall More Than 3%; Planet Fitness Issues $800mn Loan; NYC Families Rush to Apply for Affordable Housing

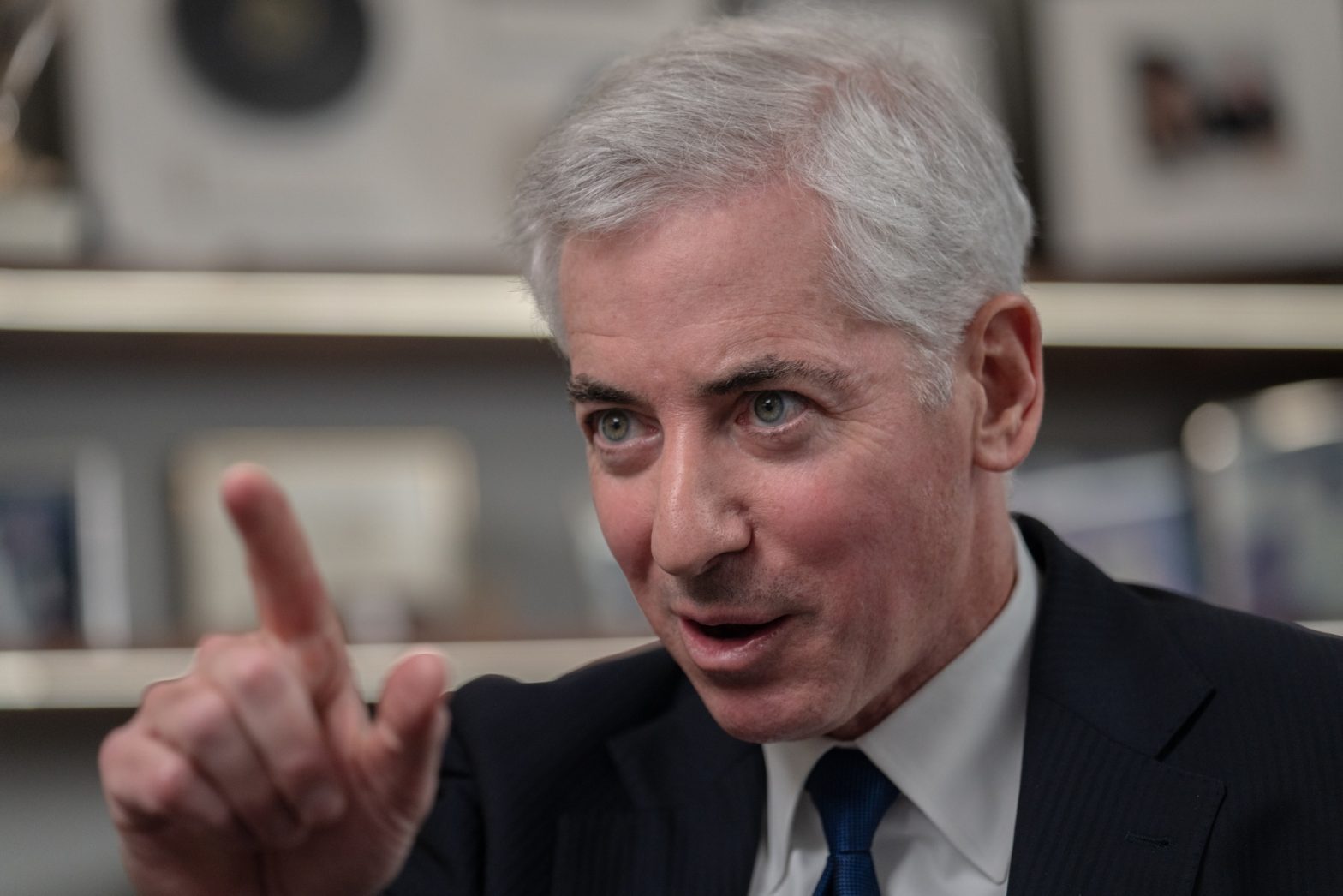

1. Bill Ackman Sells 10% Stake in Pershing Square

Hedge-fund manager Bill Ackman sold a 10% stake in Pershing Square ahead of its planned initial public offering, in a deal that values the company at over $10 billion.

According to a statement released on Monday, investors include Arch Capital Group Ltd., BTG Pactual, Consulta Ltd., ICONIQ Investment Management, Menora Mivtachim Holdings, and an international consortium of family offices. The purchase price for the stake was $1.05 billion.

“We are thrilled to welcome a group of world-class, long-term partners as investors in our business, which has been solely owned by Pershing Square employees since our founding more than 20 years ago,” Ackman said in the statement.

Ackman is reportedly planning to list Pershing Square on the stock market as early as late 2025, according to a person familiar with the matter.

______

2. Ex-Millennium Trader Debuts $5bn Hedge Fund

Diego Megia, a former senior trader at Millennium Management, launched his new hedge fund, Taula Capital Management, with $5 billion and closed it to new investments on the first day, marking one of the largest hedge fund startups in recent years.

According to a source familiar with the details, approximately $3 billion of Taula Capital’s initial capital came from Millennium, with the remaining funds contributed by asset managers, pension plans, and sovereign wealth funds. Stefan Ericsson, a colleague of Megia from Millennium, joined as deputy chief investment officer. Taula Capital Management officially started operations on June 1.

Megia’s firm is part of a select group of hedge funds capable of launching with such substantial capital, at a time when the industry faces challenges for startups due to a shift of clients towards larger, multistrategy hedge funds that offer more stable returns. Additionally, Bobby Jain, a former co-chief investment officer at Millennium, is also anticipated to start his own hedge fund of similar scale later this year.

Taula’s launch is the largest since ExodusPoint Capital Management, led by another Millennium alumnus, Michael Gelband, debuted in 2018 with $8 billion.

______

3. US Homebuyers Revolt Over High Prices

The US housing market, long hampered by a shortage of inventory, is finally seeing an increase in listings. However, in many areas, buyers are now scarce.

Sellers are facing the reality that persistently high interest rates are stifling demand during what is usually a peak season for the market. As a result, more owners are reducing their asking prices than at any time since November 2022, as inventory sits on the market longer, according to Redfin Corp.

“With mortgage rates climbing back above 7%, homebuyer enthusiasm this season has waned,” said Ralph McLaughlin, senior economist at Realtor.com. “You can have high prices or high mortgage rates, but you can’t sustain both for long.”

Buyers are receiving little to no relief from high borrowing costs, as the average rate on a 30-year mortgage has remained near 7% since mid-April. Despite this, prices have continued to rise. For the four weeks ending May 26, the median sale price increased by 4.3% from the previous year, reaching a record high of $390,613, according to Redfin.

______

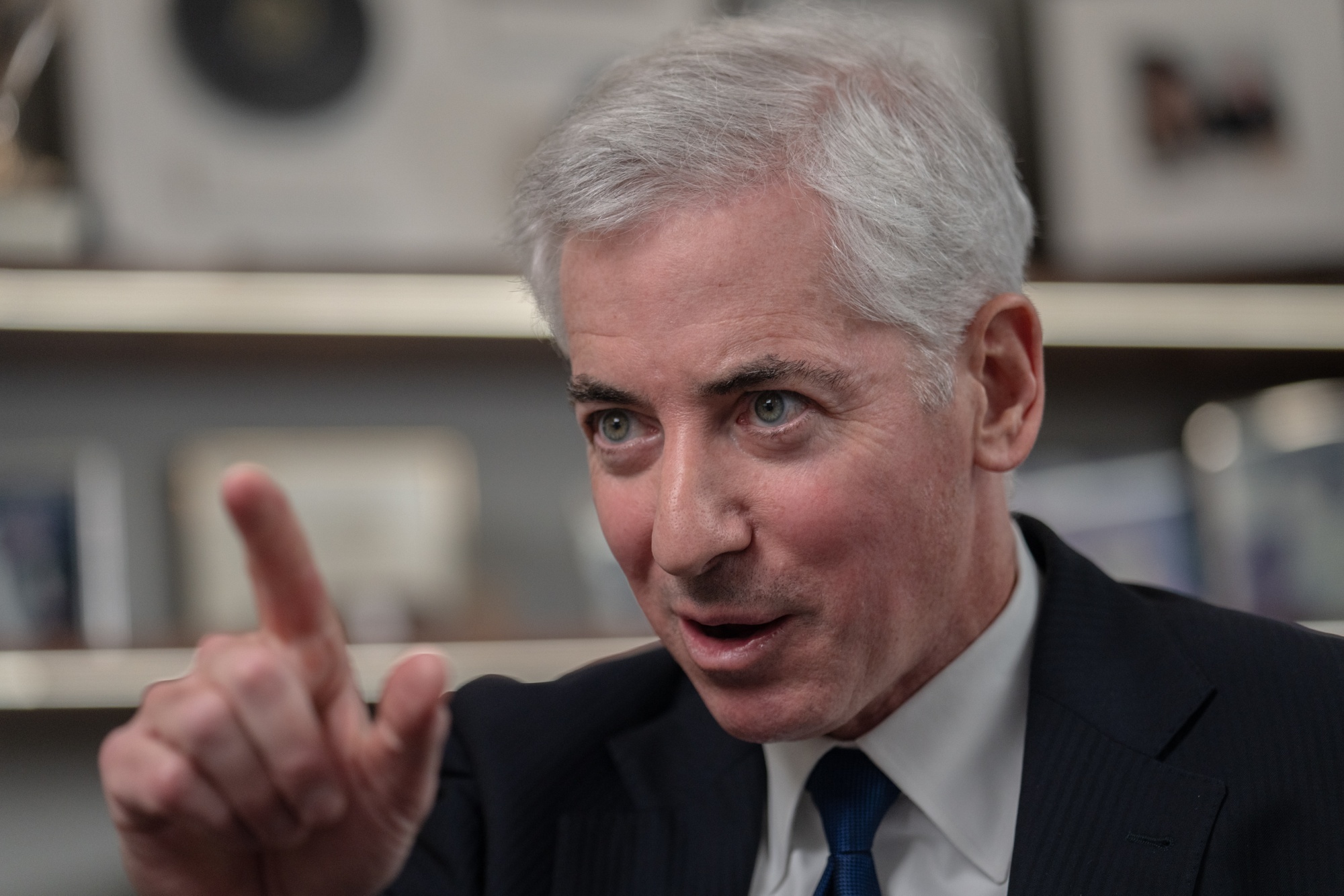

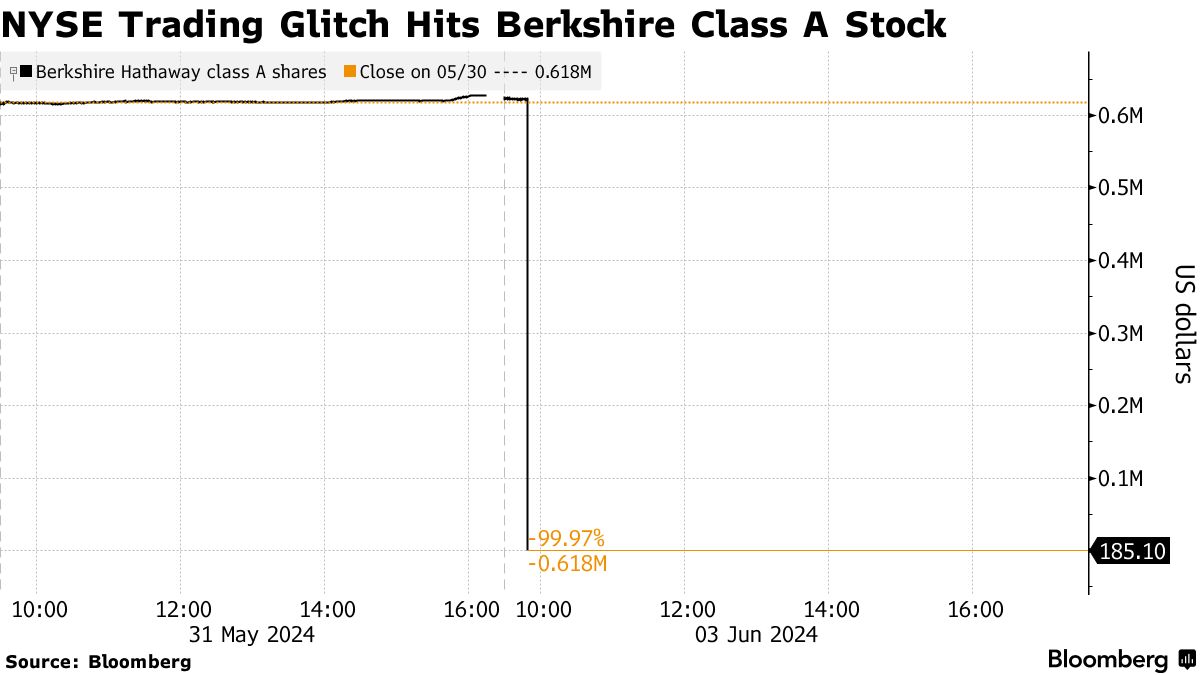

4. NYSE Has Second Glitch in a Week

An apparent glitch at the New York Stock Exchange (NYSE) operator caused volatility trading halts shortly after the market opened, affecting about a dozen companies, including Chipotle Mexican Grill Inc. and Abbott Laboratories.

The NYSE reported issues related to the limit up-limit down trading bands, which usually determine when stocks are paused due to volatility. These sudden disruptions occurred just days after a previous glitch caused the S&P 500 Index to lack live pricing for an hour. This incident comes as the market is adjusting to faster settlement times for US stock trades.

“NYSE Equities is currently investigating a reported technical issue,” the exchange stated on its online status page. “Additional information will follow as soon as possible.”

A representative for the NYSE declined to comment further, referring to the exchange’s market status update page. The New York Stock Exchange is owned by Intercontinental Exchange Inc.

______

5. Oil Prices Fall More Than 3%

Oil prices dropped more than 3% on Monday in a wave of selling after the US market opened.

Earlier in the day, prices had remained steady following Opec+’s decision on Sunday to gradually release more oil into the market in the fourth quarter of 2024.

However, Brent crude later fell more than 3%, dipping below $79 a barrel, while WTI dropped to below $75 a barrel. Spot prices declined more sharply than oil for delivery in the fourth quarter.

Giovanni Staunovo, a commodities analyst at UBS, noted there was no clear “trigger point” for the sell-off. He suggested that the decline might have accelerated after Brent prices breached the $80 support level.

Source: Financial Times – Oil prices fall more than 3%

______

6. Planet Fitness Issues $800mn Loan

Planet Fitness, a gym chain, on Monday started selling $800 million of bonds backed by most of the company’s assets, the latest in a string of recent deals known as whole business securitizations.

Guggenheim structured the deal and is helping sell the fixed-rate bonds, which comes in two portions of $400 million each. Both are rated BBB by S&P Global Ratings and Kroll Bond Rating Agency, according to people familiar with the matter. Proceeds will be used to refinance debt issued in 2018 and potentially return some capital to shareholders, according to the people.

In a whole business securitization, a company commits substantially all of its revenue-generating assets to an entity called a special purpose vehicle, which then issues bonds to investors. The asset-backed securities are a popular funding source for businesses that tend to heavily franchise their operations.

Other fitness companies that have borrowed in this market include Self Esteem Brands, which owns Anytime Fitness, and Orangetheory Fitness, which recently raised $570 million after combining.

______

7. NYC Families Rush to Apply for Affordable Housing

More than 150,000 households submitted applications within 12 hours for a chance to join New York City’s waiting list for a federal program that subsidizes rent for low-income families.

Currently, about 100,000 New York City households use the voucher program, known as Section 8. However, the program has been at maximum capacity for a long time, and the waiting list has been closed since 2009.

The portal for new applications will remain open until 11:59 p.m. on June 9, according to New York City Housing Authority spokesperson Michael Horgan. The city aims to add 200,000 households to the list. These households will then be eligible for a Section 8 lottery in August, which will select 1,000 households each month for the program.

Obtaining one of the coveted vouchers does not guarantee that recipients will find affordable housing. Recipients of Section 8 and other housing vouchers often struggle to find brokers willing to assist them in their search and landlords who will accept the government assistance.

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, and Bloomberg.