—— Rate Cut Could Bring Down Inflation; PBOC Lends $42b to Buy Unsold Homes; JPMorgan Signs New Florida Office; Fed Chief Powell Tests Positive for Covid; Voters Prefer Trump on Economy; GameStop to Sell 45mn New Shares; Richemont Hires VCA Head as CEO

1. Rate Cut Could Bring Down Inflation

Rick Rieder of BlackRock Inc. offers unconventional advice: To curb inflation, the Federal Reserve should lower rates instead of keeping them high.

Rieder, BlackRock’s chief investment officer of global fixed income, argues that affluent Americans are earning more from fixed-income investments due to benchmark rates being at their highest in decades.

“I’m not certain that raising interest rates actually brings down inflation,” Rieder told Bloomberg’s David Westin in an upcoming episode of Wall Street Week airing Friday. “In fact, I would argue that cutting interest rates can reduce inflation.”

Middle- to higher-income Americans “are benefiting significantly from these interest rates,” he said. “As we shift to a service-oriented economy, more money is being spent on services. Because goods prices have dropped so much, disposable income is being redirected to services.”

Rieder highlighted persistent inflation in service sectors such as auto and health insurance as evidence. “These areas are unresponsive to interest rates, yet spending continues — especially among older, middle- to high-income individuals — which keeps service-level inflation elevated.”

______

2. PBOC Lends $42b to Buy Unsold Homes

The People’s Bank of China will launch a nationwide initiative to provide 300 billion yuan ($41.5 billion) in low-cost funding to help state-owned companies purchase unsold homes.

Deputy Governor Tao Ling announced the relending program at a briefing in Beijing on Friday, shortly after the government revealed an unprecedented package of measures to tackle the country’s ongoing property crisis.

The funding will be offered to 21 entities, including policy banks, state-owned commercial lenders, and joint-stock banks, at an interest rate of 1.75%, she said. These loans, which are intended to have a one-year term, can be renewed up to four times.

The PBOC’s relending programs provide low-cost funding to China’s banks, enabling them to increase lending for specific sectors of the economy. Tao mentioned that the 300 billion yuan from the central bank is expected to generate approximately 500 billion yuan in total credit.

______

3. JPMorgan Signs New Florida Office

JPMorgan Chase & Co. has signed a lease at 360 Rosemary, a newly developed office tower by Related Cos. in West Palm Beach, Florida, which has become popular with finance firms.

According to a statement from Related, JPMorgan joins other finance firms such as Goldman Sachs Group Inc. and Point72 Asset Management in occupying the tower, which opened in 2021. The developer, founded by billionaire Stephen Ross, has also secured tenants for nearby buildings, including Northwell Health and venture capital firm Clear Sky.

Finance firms are increasingly leasing space to accommodate employees who relocated to the South during the pandemic, driving demand for offices in West Palm Beach. South Florida has seen a significant influx of wealth as people move from cities like New York.

In response to this demand, Ross has increased investments in the area, developing more office and residential properties. At 360 Rosemary, the developer even converted garage space to expand office capacity.

______

4. Fed Chief Powell Tests Positive for Covid

Federal Reserve Chair Jerome Powell tested positive for COVID-19 late Thursday, according to a statement from a Fed spokesperson.

“Chair Powell tested positive for COVID-19 late yesterday and is experiencing symptoms. Following Centers for Disease Control and Prevention guidance, he is staying away from others and working at home,” the spokesperson said.

Powell was scheduled to speak at the commencement ceremony at Georgetown Law School in Washington on Sunday. The Fed announced that he will deliver his remarks via prerecorded video.

This is Powell’s second time testing positive for COVID-19, with his previous positive test occurring in January 2023. The next meeting of the Fed’s policy-setting committee is set for June 11-12.

______

5. Voters Prefer Trump on Economy

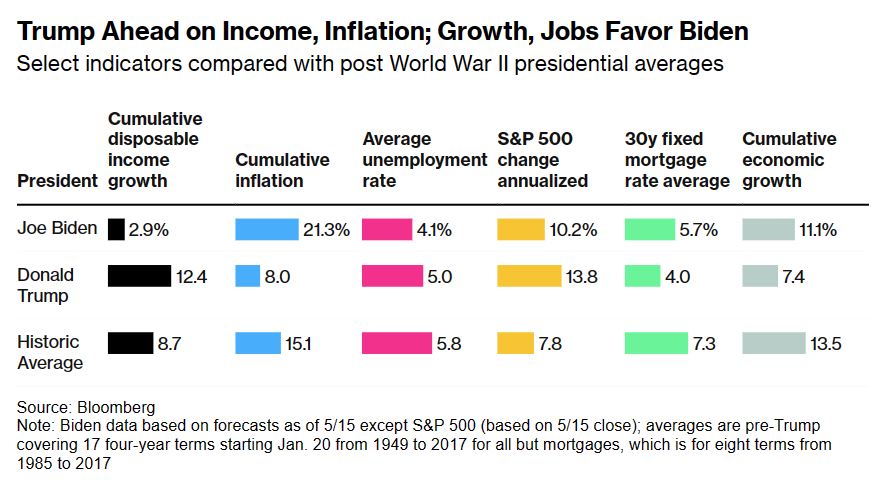

Poll after poll shows Americans giving Donald Trump the edge over Joe Biden when it comes to the economy.

This is despite the fact that the Biden years have seen the best job market since the 1960s, with the US recovering from the pandemic with stronger growth compared to international peers such as the EU, UK, and Japan, and experiencing overall stronger growth than under President Trump.

However, voters this year are primarily focused on the steep rise in prices due to the post-pandemic surge in inflation.

In the April Bloomberg/Morning Consult swing-state poll, 51% of respondents said they were doing better financially under Trump than Biden, compared to 32% who felt the opposite. Among 15 economic issues, the cost of everyday goods emerged as the top concern for registered voters in the poll.

______

6. GameStop to Sell 45mn New Shares

GameStop has announced plans to sell up to 45 million new shares, following a surge in its stock price due to the renewed interest from a well-known day trader associated with “meme stock” investing.

In a filing with the US securities regulator on Friday, the video game retailer detailed these plans, along with preliminary first-quarter results indicating an expected decline in net sales compared to the previous year.

By early afternoon in New York, GameStop shares had fallen 27%, trading at $20.21. If the company manages to sell all 45 million shares at this price, it would raise just over $900 million.

The latest move continues a volatile week for GameStop’s stock, which nearly quadrupled from last Friday’s close to a peak of $64.83 during Tuesday’s trading session.

Source: Financial Times – GameStop to sell up to 45mn new shares after latest ‘meme stock’ rally

______

7. Richemont Hires VCA Head as CEO

Richemont has appointed a new group chief executive and revamped the role as the Swiss luxury group navigates a market downturn.

Nicolas Bos, the head of Richemont’s jewelry brand Van Cleef & Arpels, will take on the CEO position starting June 1. He will report to Johann Rupert, the group’s controlling shareholder and chairman, and will oversee all of Richemont’s brands and regions.

“Building on Richemont’s expanded scale and stronger focus on retail and jewellery, Nicolas will steer the group through the next phase of its evolution,” Rupert stated. “The re-established CEO role will help streamline decision making and optimize operational management.”

Richemont already has a chief executive, Jérôme Lambert, but his role has been more limited than the one Nicolas Bos will assume. Lambert did not oversee the heads of top brands such as Cartier and Van Cleef, nor the group’s head of finance. He will remain on the board and transition to the role of chief operating officer.

Source: Financial Times – Richemont overhauls chief executive role as it navigates luxury downturn

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, and Bloomberg.