—— US Housing Starts Fall Short; Dow Jones Hits 40,000 Milestone; Billionaire Increases Chinese Stock Holdings; Walmart Posts Better Than Forecast Earnings; AI Hype Fades For Lack of Breakthrough; Ray Dalio Warns of US Debt Risk; Starwood Tapes Credit As Investors Withdraw

1. US Housing Starts Fall Short

In April, new home construction in the US increased by less than anticipated, while permits for new projects declined, indicating that the recent rise in mortgage rates may be causing hesitation among builders.

According to government data released on Thursday, housing starts rose by 5.7% to an annualized rate of 1.36 million, following downward revisions for previous months. Economists surveyed by Bloomberg had predicted a rate of 1.42 million.

Authorized permits for single-family home construction have declined for three consecutive months, reaching their lowest level since August after an upward trend toward the end of last year. This may limit the initiation of new home construction in the future.

Building permits for all units, which serve as an indicator of future construction, dropped by 3% to a rate of 1.44 million, the lowest since the end of 2022. This decrease was primarily due to a significant reduction in authorizations for apartment complexes.

______

2. Dow Jones Hits 40,000 Milestone

The Dow Jones Industrial Average surpassed 40,000 for the first time on Thursday, as investors grew confident that the stock market rally could continue, fueled by hopes that the Federal Reserve will begin cutting interest rates later this year.

Wall Street’s oldest stock index has been bolstered by the prospect of a resilient US economy, declining inflation, and strong corporate earnings. According to data compiled by Bloomberg, it took 872 trading sessions through Wednesday for the Dow to achieve its latest 10,000-point milestone, representing a 33% gain and recovering all losses from the Fed’s aggressive rate hikes over the past two years.

“All traders wanted in the past year was for the Fed to signal that interest rates have peaked,” said Jamie Cox, managing partner at Harris Financial Group. “With rate cuts still expected later this year, the latest surge in stocks has been propelled by the realization that profits for companies beyond the tech sector are also strong, helping to broaden the rally.”

______

3. Billionaire Increases Chinese Stock Holdings

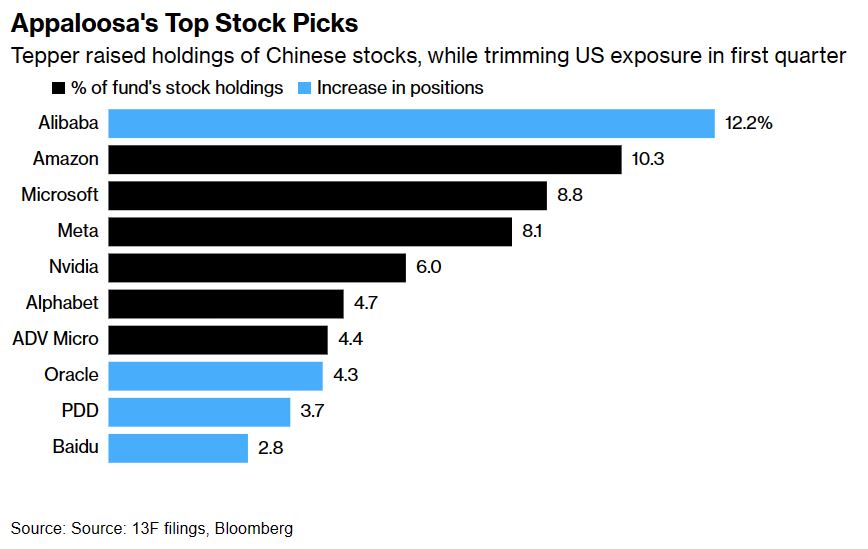

Last quarter, billionaire investor David Tepper significantly increased his investments in beaten-down Chinese stocks while reducing his stakes in high-performing US tech firms. This shift indicates that hedge fund managers are gradually warming up to China amidst a record gap in valuations between the two markets.

According to a regulatory filing, Tepper’s Appaloosa Management more than doubled its investment in Alibaba Group Holdings during the first three months of the year, making the Chinese e-commerce giant the largest position in its $6.7 billion equity portfolio. The fund also increased its stakes in PDD Holdings and Baidu Inc., and added JD.com and two Chinese exchange-traded funds to its portfolio.

While Tepper expanded his positions in Chinese stocks, he trimmed his holdings in the so-called Magnificent Seven stocks, including Amazon.com, Microsoft Corp., Meta Platforms Inc., and Nvidia Corp. As a result, Chinese shares and ETFs accounted for 24% of the fund’s equity portfolio by the end of the quarter.

______

4. Walmart Posts Better Than Forecast Earnings

Walmart Inc. reported another quarter of sales growth and adjusted its full-year outlook slightly upward, as the big-box retailer continues to attract consumers seeking essentials and discounts.

For the quarter ended April 26, sales at US Walmart stores open at least a year rose by 3.8%, surpassing Wall Street expectations. With inflation easing, the average transaction amount remained flat, but the number of transactions increased by 3.8% from a year ago. E-commerce was a significant driver, with a 22% jump during the same period, and upper-income households contributed substantially to the retailer’s gains.

Walmart now anticipates adjusted earnings to be at the high end or slightly above its initial guidance of $2.23 to $2.37 per share, with revenue growth of 3% to 4% for the full year. Analysts expect adjusted earnings of $2.37 per share and a nearly 4% increase in revenue for the full year.

The shares surged by as much as 7.3% in New York trading, marking the most significant increase since late 2022. Up to Wednesday’s close, the stock had already risen by 14% this year, surpassing the 11% gain in the S&P 500 Index.

______

5. AI Hype Fades For Lack of Breakthrough

When OpenAI launched its ChatGPT chatbot in 2022, it seemed poised to revolutionize the economy and people’s lives with a new generation of artificial intelligence tools. Fast forward to 2024, and while AI features have been integrated into numerous services, the impact has been less dramatic than anticipated.

AI has neither created vibrant new professions nor devastated entire industries. Traffic for ChatGPT, after an initial surge in user growth, has leveled off and even declined over the past year, according to some estimates. Much of the recent news about the new generation of AI has highlighted its downsides, such as perpetuating harmful biases and effectively amplifying misinformation.

Now, Microsoft-backed OpenAI and its competitor Google are focusing on making these AI products more practical in everyday life. Soon, instead of typing a prompt and receiving a written response, users will be able to ask questions aloud and receive near-instantaneous verbal replies from chatbots.

The goal is to accelerate the development of truly conversational digital assistants that can handle tasks both at work and at home, thereby reinforcing AI’s long-term potential.

______

6. Ray Dalio Warns of US Debt Risk

Ray Dalio, the billionaire founder of hedge fund giant Bridgewater Associates, has expressed concerns about the impact of the US government’s rising debt levels on Treasury bonds. In an interview with the Financial Times, Dalio advised investors to consider diversifying their portfolios by moving some of their money to foreign markets.

Dalio outlined several issues troubling the US, including its significant debt load, the risk of what he terms a “civil war,” and the potential for involvement in another international conflict. He warned that these factors could dissuade foreign investors from purchasing US bonds.

“I am… concerned about Treasury bonds because of the high debt levels, which high interest rates are adding to,” Dalio stated.

Source: Financial Times – Bridgewater founder Ray Dalio warns of danger of US debt to Treasury market

______

7. Starwood Tapes Credit As Investors Withdraw

A $10 billion US property fund is facing a liquidity crunch as investors seek to withdraw their money, highlighting the challenges in a sector troubled by rising debt costs and concerns over real estate valuations.

Starwood Real Estate Investment Trust (SREIT), one of the largest unlisted property funds, has utilized more than $1.3 billion of its $1.55 billion unsecured credit facility since the beginning of 2023 due to heavy redemption requests. Managed by Barry Sternlicht’s Starwood Capital, the fund entered 2023 without having used the credit line, but recent filings reveal it now has only about $225 million of cash left to draw.

At the current pace of redemptions, SREIT is projected to exhaust its credit and cash reserves in the second half of this year unless it secures additional borrowing or sells more property assets.

Source: Financial Times – Starwood’s $10bn property fund taps credit line as investors pull money

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, and Bloomberg.