—— Google Jumps 13% After Strong Earnings; Huawei’s New Phone Uses Domestic Chip; Austin Home Prices Plunge; Intel Sees Biggest Drop in 4 Years; Porsche Profit Falls 30%; March PCE Stays Hot; White-Collar Job Growth Slows

1. Google Surges 13% After Strong Earnings

On Thursday evening, Google reported exceptionally strong first-quarter results, with revenue rising 15% to $80.5 billion, beating analyst expectations. The company also announced a $0.20 dividend per share and a $70 billion share buyback.

CEO Sundar Pichai noted robust performance across Search, YouTube, and Cloud, and said AI model Gemini is progressing well.

Shares jumped as much as 13% after hours, adding $250 billion in market cap and pushing Google past the $2 trillion mark.

______

2. Huawei’s New Phone Uses China-Made Chip

TechInsights’ teardown of Huawei’s latest Pura 70 series phone revealed that it is equipped with the domestically developed Kirin 9010 processor, a successor to the Kirin 9000 used in the Mate 60 Pro.

In Q1, Huawei and Apple had similar market shares. Despite sanctions during the Trump era, Huawei’s consumer business is recovering.

The debut of the Kirin 9010 highlights China’s improving capabilities in advanced chip development.

______

3. Austin Home Prices Plunge as Its Glow Fades

During the pandemic, Austin attracted companies and new residents with low taxes and sunny weather.

However, Oracle, which moved its headquarters to Austin in 2020, announced this week that it’s relocating to Nashville, Tennessee.

After 12 years as America’s fastest-growing large city, Austin lost that title in 2023. Office vacancy rates are 5% higher than the national average, according to Colliers.

Redfin data shows average home prices have dropped 18% since their May 2022 peak, and Austin remains one of the least affordable housing markets in the U.S.

______

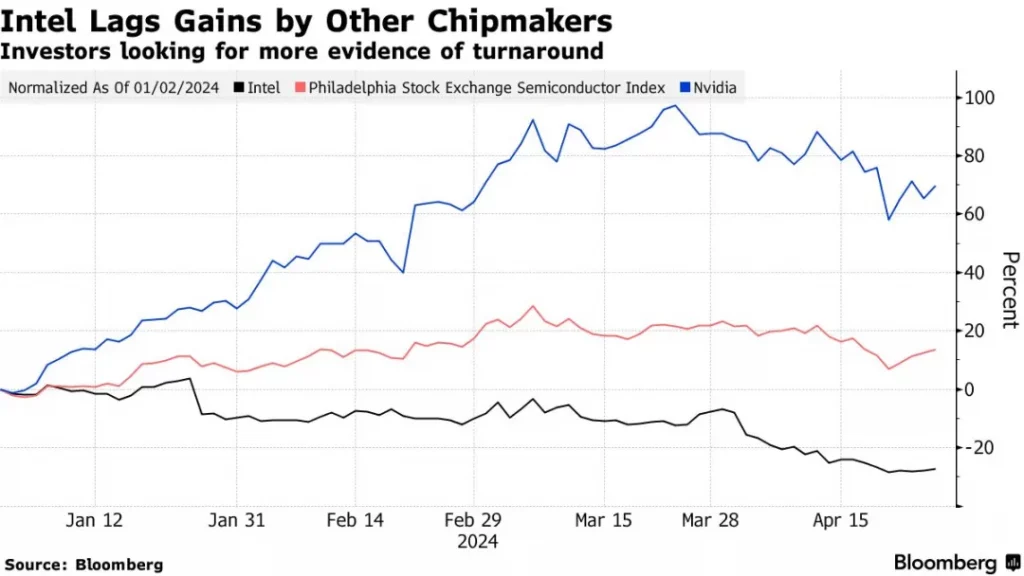

4. Intel Sees Biggest Drop in 4 Years

Intel, the world’s largest PC chipmaker, forecast Q2 revenue of $13 billion and earnings of just $0.10 per share—well below the $0.24 analysts expected.

The weak forecast sent shares tumbling more than 9%, the steepest decline in nearly four years.

CEO Pat Gelsinger’s turnaround plan may require more time and capital as Intel falls further behind TSMC and Nvidia in both revenue and technology.

As of Thursday, Intel shares were down 30% year-to-date, second worst in the semiconductor index.

______

5. Porsche Profit Drops 30%

Luxury car brand Porsche, owned by Volkswagen, reported Q1 operating profit of €1.28 billion, a 30% year-over-year drop, due to weakening demand in China and customs delays in the U.S.

The CFO said conditions should improve from Q2 onwards, citing the launch of electric Macan and new Cayenne SUVs.

Porsche said delays in developing the new Panamera and Taycan, along with large digital investments, hurt results.

China’s slowdown has affected earnings across luxury brands like Porsche, Apple, and LVMH.

______

6. March Inflation Remains Elevated

The U.S. government reported that March’s personal consumption expenditures (PCE) price index rose 2.7%, topping economist forecasts.

The Fed’s preferred core PCE measure held steady at 2.8%, also above the 2.7% estimate. January and February figures were revised higher as well.

Markets now price in the first 25-basis-point Fed rate cut for the November meeting, after the presidential election.

Controlling inflation remains a top priority for President Biden, and delayed rate cuts are politically unfavorable.

______

7. U.S. White-Collar Job Growth Slows

According to Bloomberg, Chicago, Los Angeles, and San Francisco lost a combined 120,000 white-collar jobs over the past year.

Full-time white-collar employment also declined in Phoenix and Seattle, with little to no growth in Miami and Austin.

Bureau of Labor Statistics data shows white-collar jobs grew just 0.6% year-over-year in March, one-third the rate of overall employment. Salary growth for high-income professionals has also slowed significantly.

Many laid-off tech workers have burned through severance pay and still struggle to find new roles.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.