—— Brookfield Acquires Bankrupt Retailer; Global Stocks Rebound; SAP Cloud Revenue Surges; U.S. Student Loan Rates Hit 16-Year High; Miami Airport Bond Rating Raised; UK’s FTSE 100 Hits Record; German Property Prices May Fall

1. Brookfield Acquires Bankrupt Apparel Retailer

U.S. retail chain Express announced today that it has been acquired out of Chapter 11 bankruptcy by a consortium led by Simon Property Group and Brookfield Properties.

Simon and Brookfield partnered with WHP Global—which owns or licenses several consumer brands—to help rescue Express. In 2018, WHP also helped revive Toys “R” Us after its bankruptcy.

WHP’s current shareholders include private equity giants Ares and Oaktree Capital.

______

2. Global Stocks Rebound From Sharp Sell-Off

U.S. stocks bounced back from last week’s $2 trillion sell-off as investors bet on strong earnings from major tech firms. Asian markets followed the rally.

Equity futures in Japan and Hong Kong rose over 1%, while Australian stocks also advanced. The S&P 500 snapped a six-day losing streak and reclaimed the 5,000 level. Nasdaq rose 1%.

Analysts say it’s not enough for Big Tech to beat expectations—top companies must also issue strong full-year guidance.

______

3. SAP Cloud Revenue Surges

SAP’s Q1 results show cloud revenue rose 25% year-over-year to €3.9 billion, in line with analyst expectations, fueled by rising AI demand.

Europe’s largest software firm has aggressively pushed its cloud software and integrated AI features to attract clients. This year, SAP offered existing customers a 50% discount to speed up the transition to subscription models.

CEO Christian Klein expressed confidence in hitting full-year targets, citing robust demand for enterprise AI and SAP’s strong product portfolio.

______

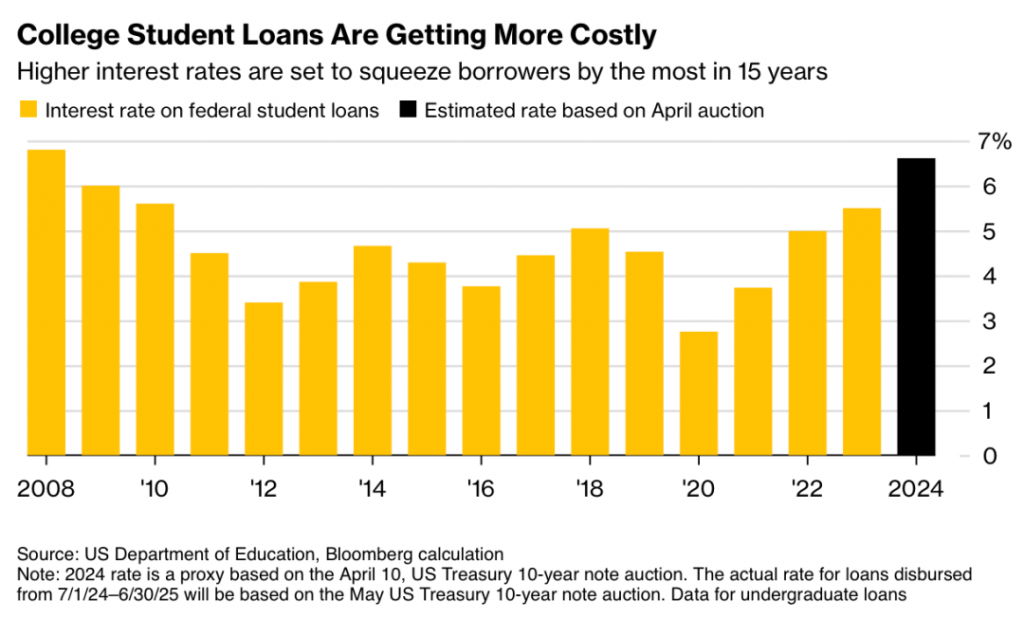

4. U.S. Student Loan Rates Hit 16-Year High

At April’s loan auction, interest rates for undergraduate federal student loans for the 2024–2025 school year hit 6.61%—the highest since 2008.

Another Treasury auction in May could push rates even higher. Student loan rates are tied to a fixed formula: the 10-year Treasury yield plus 2.05%.

As the Fed delays interest rate cuts, Treasury yields have risen—leading to a jump in student loan costs.

______

5. Miami Airport Bond Rating Raised

S&P Global upgraded the credit rating for Miami International Airport on Monday, citing booming population growth and surging travel demand.

S&P analyst Nora Wittstruck said the airport has surpassed pre-pandemic traffic levels and ranks among the fastest-growing in the U.S.

In 2023, Miami Airport handled 52.3 million passengers and announced a $7 billion infrastructure upgrade to meet rising demand.

______

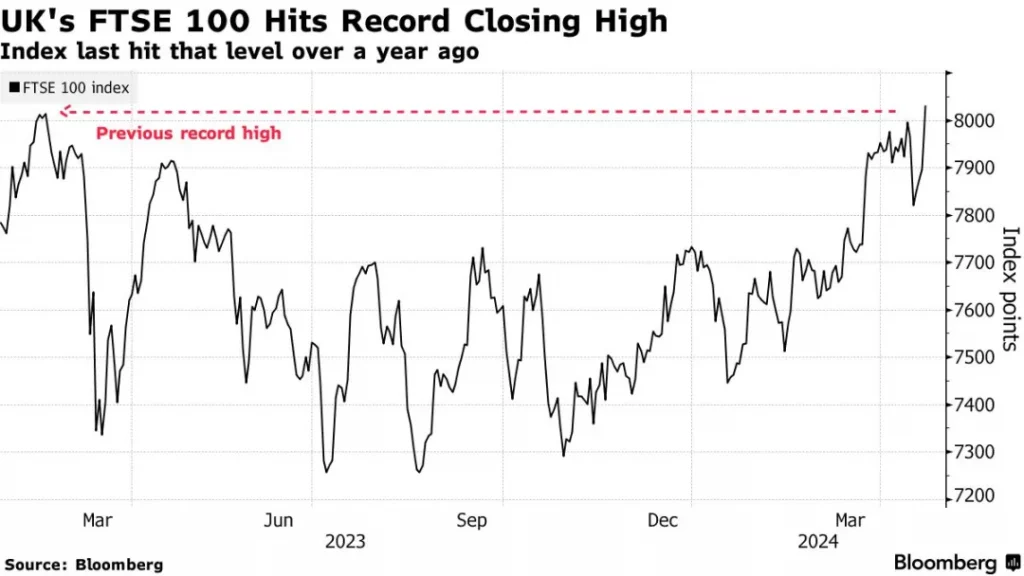

6. UK’s FTSE 100 Hits Record High

Boosted by energy stocks and optimism around easing geopolitical tensions, the UK’s FTSE 100 rose 1.6% to a record 8,023, surpassing its previous peak from February 2023.

Analysts say a weaker British pound attracted foreign investors, while market sentiment improved as Middle East concerns eased.

So far in 2024, the FTSE 100 is up 4%, driven by names like Rolls-Royce and AstraZeneca.

______

7. German Property Values May Decline Broadly

Germany’s banking association VDP expects property values across all sectors to fall this year.

Office property values are projected to drop 5%–10%, while retail and residential values could fall 7.5% and 5%, respectively.

VDP Chairman Gero Bergmann warned that 2024 will be challenging for all stakeholders, and does not expect a property rebound even if rate cuts are coming.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.