—— US Mortgage Rate Rises to 4-Month High; Morgan Stanley Plans Biggest China Job Cut; VIX Soars on War and Inflation Fear; Trump Donar Base Shrunk; IMF Criticizes US Fiscal Policy; Jane Street Trading Revenue Doubles; Quantitative Tightening Could Stop in 2025

1. US Mortgage Rate Rises to 4-Month High

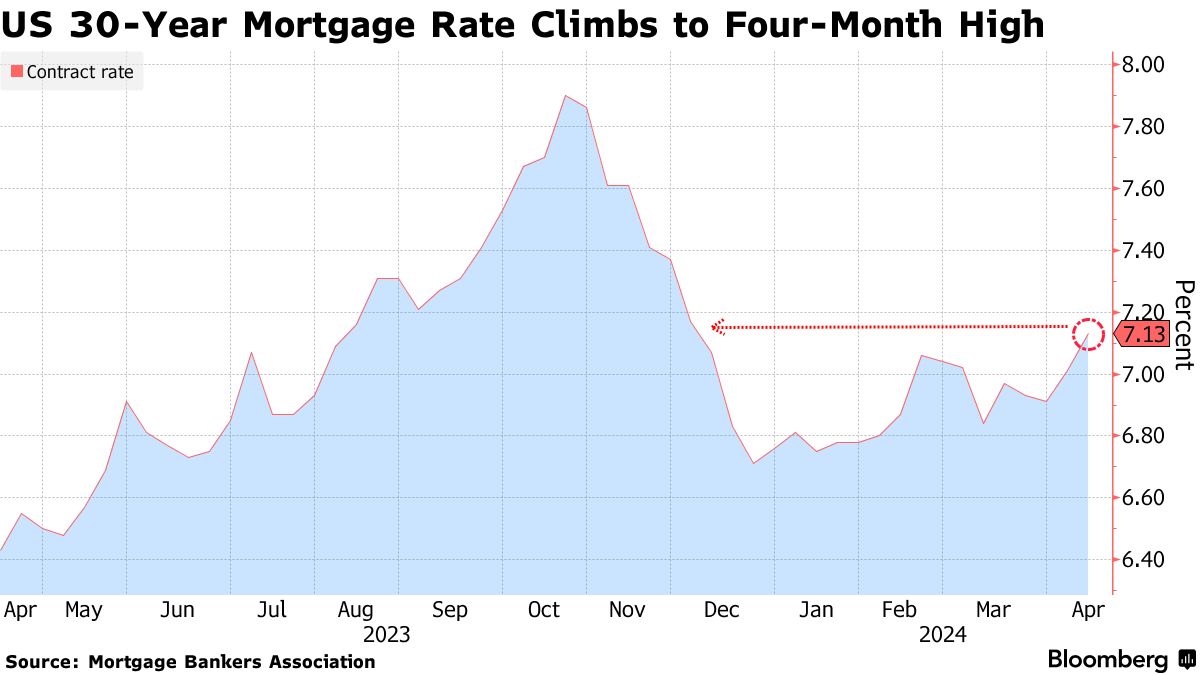

Mortgage rates in the US reached their highest point in four months last week, indicating a possible challenge ahead for the residential real estate market’s recovery.

According to data from the Mortgage Bankers Association released on Wednesday, the contract rate for a 30-year fixed mortgage saw a 12 basis point increase to 7.13% for the week ending April 12. The effective rate, which factors in fees and compound interest, rose to 7.32%.

Even with the rise in borrowing expenses, home purchase activity remained steady last week. The Mortgage Bankers Association reported a 5% increase in its index of mortgage applications for home purchases, marking the first uptick in five weeks.

However, there’s a potential for further increases in mortgage rates, given the current 10-year Treasury yield, which is at its highest level since November. According to Mortgage News Daily’s latest update, the 30-year fixed rate stood at 7.5% on Tuesday.

On Tuesday, Federal Reserve Chair Jerome Powell stated that the recent inflation figures in the US suggest that it will require more time for the central bank to gain the confidence necessary to reduce its benchmark interest rate.

______

2. Morgan Stanley Plans Biggest China Job Cut

Morgan Stanley is reportedly gearing up to trim approximately 50 investment-banking positions across the Asia-Pacific area this week, with insiders suggesting that at least 80% of the reductions will be concentrated in Hong Kong and China. Sources familiar with the matter revealed that the planned downsizing will affect roughly 13% of the 400 bankers in the region, excluding Japan.

It’s anticipated that over 40 individuals in Hong Kong and mainland China will be impacted by the upcoming staff reduction, according to those familiar with the situation who preferred anonymity when discussing confidential matters. The exact scale and timing of the layoffs are subject to change, as per the sources.

When reached for comment, a spokesperson for the New York-based bank opted not to provide any statement.

According to one source, the firm postponed the layoffs towards the end of last year, hoping that the historically low bonuses for dealmakers would lead to voluntary departures. However, only a handful of bankers chose to leave, prompting the company to proceed with more extensive cuts as revenue from China experiences a decline.

______

3. VIX Soars on War and Inflation Fear

American investors are currently facing the largest premiums since October to safeguard their investment portfolios against market fluctuations. This surge in volatility is being driven by escalating tensions in the Middle East and diminishing expectations of interest rate cuts.

The Vix index, often referred to as Wall Street’s ‘fear gauge,’ reached 19.6 this week, marking its highest level since October 20, shortly after the Hamas attack that triggered a conflict in Gaza. This index assesses the cost of options that allow investors to capitalize on movements in the S&P 500.

The metric gauges the cost of options that empower investors to capitalize on fluctuations in the S&P 500.

Source: Financial Times – Vix ‘fear gauge’ soars on Middle East tension and interest rate shift

______

4. Trump Donar Base Shrunk

According to a Financial Times analysis of federal campaign data, Donald Trump’s presidential campaign has garnered $75 million less in fundraising compared to Joe Biden’s campaign. Additionally, Trump has 270,000 fewer unique donors at this stage of his presidential bid than he did during his previous run for the White House four years ago.

These findings raise concerns about the sustainability of Trump’s support base, especially in light of anticipated costly legal battles and what is projected to be the most expensive presidential race in history.

From July 2023 through the first quarter of 2024, the Trump campaign and affiliated political action committees have amassed around 900,000 donors, whereas they had 1.17 million donors during the equivalent period of the 2020 race, as per the FT’s analysis of federal data.

According to the data, President Biden has secured a significant fundraising lead, raising $165 million in the first three months of the year. This amount surpasses the fundraising efforts of pro-Trump groups, which amassed just under $90 million during the same period, marking a $75 million difference.

Source: Financial Times – Donald Trump falls $75mn behind Joe Biden in money race as donor base shrinks

______

5. IMF Criticizes US Fiscal Policy

The International Monetary Fund leveled an unusually direct criticism at US policymakers Tuesday, saying the country’s recent standout performance among advanced economies was in part driven by an unsustainable fiscal policy.

“The exceptional recent performance of the United States is certainly impressive and a major driver of global growth,” the IMF said in its annual World Economic Outlook. “But it reflects strong demand factors as well, including a fiscal stance that is out of line with long-term fiscal sustainability.”

Washington’s overspending, the report said, risks reigniting inflation and undermining long-term fiscal and financial stability around the world by ratcheting up global funding costs.

In recent years, deficit spending in the US has been propelled by several factors, including COVID-related stimulus measures, substantial investments in infrastructure and clean energy initiatives, and escalating interest expenses.

______

6. Jane Street Trading Revenue Doubles

Jane Street, the secretive high-speed trading firm, has experienced a significant surge in its quarterly trading revenues, reaching their highest level since the beginning of the pandemic. Documents reviewed by the Financial Times reveal that the group expects its net trading revenue for the first quarter to be approximately $4.4 billion.

This figure represents more than double the revenue achieved a year earlier and a 35% increase from the end of 2023. These impressive results highlight Jane Street’s emergence as a dominant force in global financial markets, surpassing numerous big rivals and banks in terms of earnings.

Jane Street, headquartered in New York, has projected that it earned approximately $2.7 billion in net income for the quarter, resulting in a net profit margin exceeding 60%. This figure brings its profits for the past 12 months to around $7.4 billion. The company, known for trading a wide array of products such as currencies, exchange traded funds, and options, reported profits of $5.9 billion in 2023 and $6.7 billion in 2022.

The figures provide a rare insight into the substantial growth of Jane Street’s trading business in recent years, positioning it as a formidable competitor to even the largest banks’ operations.

______

7. Quantitative Tightening Could Stop in 2025

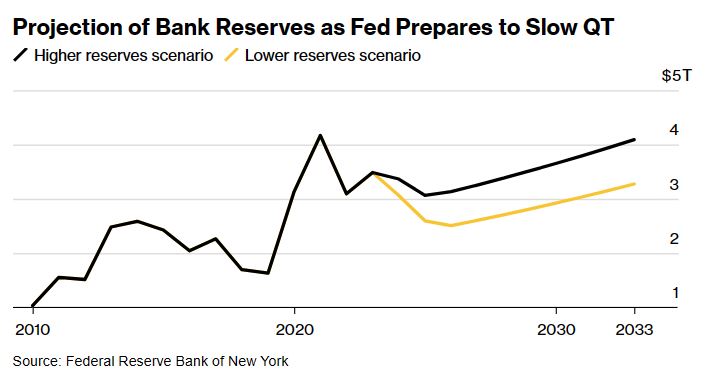

According to projections from the Federal Reserve Bank of New York, the US central bank may cease the unwinding of its balance sheet in 2025. In two scenarios outlined in an annual report released on Wednesday, the New York Fed’s trading desk estimated that the process of balance-sheet reduction, also known as quantitative tightening, could conclude in either early or mid-2025. As a result, bank reserves are anticipated to decrease to approximately $2.5 trillion or $3 trillion by the following year.

At last month’s policy meeting, Federal Reserve officials initiated discussions regarding a plan to commence the gradual slowing of balance-sheet reduction. However, no definitive decisions were reached during the gathering. Minutes from the meeting revealed that policymakers opted for a cautious stance, considering the market turbulence experienced in 2019, which occurred during the last attempt by the Fed to shrink its portfolio. Consequently, they concluded that it would be prudent to begin reducing the pace of runoff of maturing assets “fairly soon.”

In the scenario termed “higher reserves” as outlined in the New York Fed report, the balance sheet would be reduced to approximately $6.5 trillion. Conversely, in the “lower reserves” scenario, it would decline to $6 trillion.

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, and Bloomberg.