—— PPI Rises by Most in 11 Months; Harvard Brings Back SAT Test; Citadel Building Lands Refinancing; Ford Cuts EV Pickup Price; Fed’s Official Sees No Rush to Cut Rate; Interpreter Stole $16mn from Baseball Star; ByteDance Buys Back Employee Shares

1. PPI Rises by Most in 11 Months

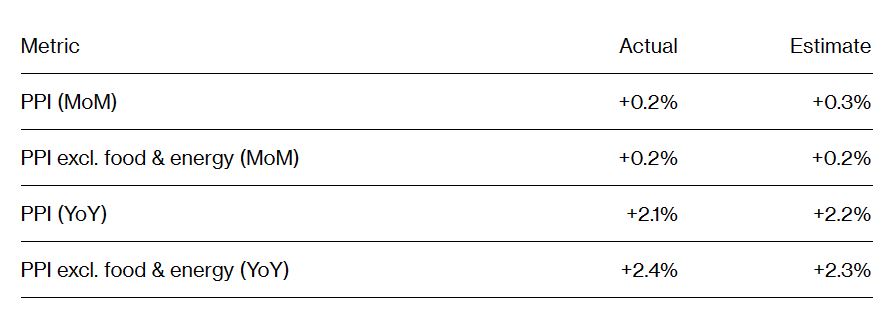

In March, US producer prices saw their most significant year-over-year increase in 11 months, although specific categories contributing to the Federal Reserve’s favored inflation measurement showed more restrained growth. According to data from the Labor Department released Thursday, the producer price index for final demand rose by 2.1% from March 2023. However, on a monthly basis, the PPI only increased by 0.2%, which was below expectations following a notable surge in February.

For investors and Federal Reserve officials, these details provide some reassurance following a report on Wednesday indicating faster-than-anticipated consumer price growth. Certain categories in the PPI report, crucial for the Fed’s preferred inflation gauge, such as healthcare and portfolio management, exhibited softer increases.

The ongoing trend of deflation in goods faces a potential halt as a result of increasing prices in oil and certain other commodities.

______

2. Harvard Brings Back SAT Test

Harvard University intends to reintroduce the SAT or ACT as part of its admissions requirements, aligning with some of its counterparts that have resumed the use of standardized test scores after a hiatus prompted by the pandemic.

The revised policy will apply to students applying for fall 2025, as stated in a Thursday announcement by the university, reversing an earlier decision to remain test-optional for several more years.

Since the Supreme Court’s ruling last June, which prohibited colleges from considering race in admissions, admissions offices have been grappling with how best to attract prospective students. Dartmouth, Yale, and Brown have all emphasized that a test score can provide admissions officers with valuable context about an applicant’s potential for success at their institutions.

Following Massachusetts Institute of Technology’s announcement two years ago, all three schools adjusted their approach this year.

______

3. Citadel Building Lands Refinancing

A newly constructed skyscraper located on Manhattan’s Park Avenue, where Ken Griffin’s Citadel serves as a primary tenant, has successfully obtained a refinancing package totaling $911 million.

Sumitomo Mitsui Trust Bank has taken the lead as the primary lender for the five-year, floating-rate loan for 425 Park Ave., as announced on Thursday. The funds from this refinancing will be utilized to repay a loan of identical size obtained in 2021, which initially facilitated construction and leasing activities.

This 670,000-square-foot (approximately 62,245 square meters) building was finalized in 2022 through a collaboration between L&L Holding, Tokyu Land US Corp., and BGO. Presently, the building boasts a 90% occupancy rate, with a predominant presence of finance and investment firms among its tenants. Citadel alone occupies 440,000 square feet spanning across 22 floors within the premises.

Buildings featuring enhanced amenities have been successful in attracting tenants and obtaining financing.

______

4. Ford Cuts EV Pickup Price

Ford Motor Co. has reduced prices for its electric F-150 Lightning pickup truck by up to 7.5%, ahead of resuming deliveries this month after a pause earlier this year due to an undisclosed quality concern.

The price adjustments, implemented on April 5, partially offset increases made in January when Ford was scaling back production of its flagship electric vehicle by 50% and eliminating a worker shift. The most significant reduction, amounting to $5,500, applies to the Flash extended-range model, which now starts at $67,995, the automaker announced.

In an email statement, Ford explained that these price cuts are aimed at helping the company “adjust to the market to achieve the optimal mix of sales growth and customer value.”

Ford has indicated that it anticipates a potential loss of up to $5.5 billion on electric vehicles (EVs) this year. As a result, the company is redirecting its focus towards gas-fueled models, such as the Bronco sport-utility vehicle.

______

5. Fed’s Official Sees No Rush to Cut Rate

Federal Reserve Bank of New York President John Williams stated that the central bank has made “tremendous progress” in achieving better balance regarding its inflation and employment objectives. However, he emphasized that there is currently no immediate need for rate cuts.

Speaking to reporters in New York after an event on Thursday, Williams mentioned that inflation still has “a ways to go” before reaching the Fed’s target of 2%. He also noted that monetary policy is currently well-positioned and highlighted the continued strength of the labor market.

Additionally, he highlighted signs indicating a shift toward a more “normal” labor market. Williams expressed his anticipation that the unemployment rate would reach its peak at 4% this year before gradually declining.

______

6. Interpreter Stole $16mn from Baseball Star

Shohei Ohtani’s former interpreter, Ippei Mizuhara, has been charged with fraud by the US Department of Justice. He is accused of transferring over $16 million from the bank account of the Los Angeles Dodgers baseball star to settle gambling debts.

Mizuhara, who previously served as Ohtani’s interpreter in Major League Baseball, faces a potential sentence of up to 30 years in prison. According to the US Attorney’s Office in California, Ohtani, who speaks only Japanese, was unaware that Mizuhara was accessing his bank accounts to cover gambling losses.

The Department of Justice stated that Mizuhara conducted “unauthorized transfers” totaling more than $16 million from Ohtani’s checking account between November 2021 and January 2024.

Source: Financial Times – US charges former interpreter of baseball star Shohei Ohtani over $16mn bank fraud

______

7. ByteDance Buys Back Employee Shares

ByteDance, the Chinese company behind TikTok, has extended its buyback program to include shares held by employees outside the US. The offer is priced at approximately $171 per share, according to internal documents obtained by the Financial Times. This expansion follows a similar buyback initiative launched in the US in March. ByteDance explained in a global communication to its staff that it had received requests from employees seeking to address their cash and liquidity needs.

The company previously offered to purchase employee shares in December at a rate of $160 each. However, shares that vested in the first quarter of this year are reportedly valued at $176. This suggests that ByteDance’s internal valuation may have increased since the beginning of the year, though this does not account for potential share dilution.

Globally, employees collectively own around 20% of ByteDance’s stock. The company has an estimated 100,000 employees located outside the US.

Source: Financial Times – ByteDance extends employee share buyback programme to non-US workers

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, and Bloomberg.