—— US Producer Prices Jump More Than Forecast; US Retail Sales Miss Forecasts; Mnuchin Wants to Buy TikTok; NYC Has Lost 546,000 Residents; Manhattan Apartment Rents Climb; JPMorgan Fined $348 Million; Blackstone Recommends Buy the Real Estate Dip

1. US Producer Prices Jump More Than Forecast

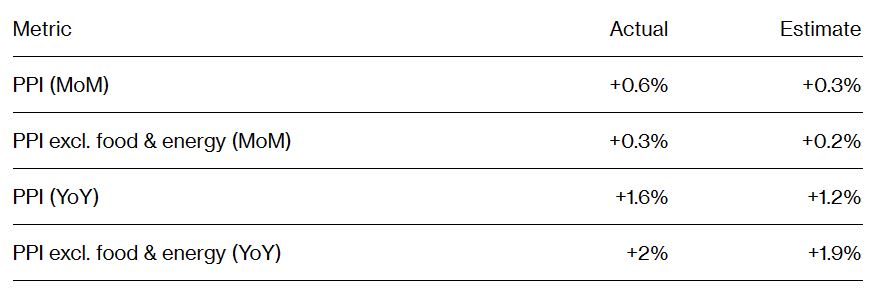

In February, prices paid by US producers saw a notable increase, marking the largest surge in six months. This rise was primarily fueled by higher costs of fuel and food, underscoring ongoing concerns about elevated inflation levels.

According to data from the Labor Department, the producer price index for final demand climbed by 0.6% from January. Compared to the same period last year, the gauge rose by 1.6%, marking the most significant annual increase since September.

This data indicates a moderate but still notable rise in prices when volatile food and energy components are excluded from consideration.

______

2. US Retail Sales Miss Forecasts

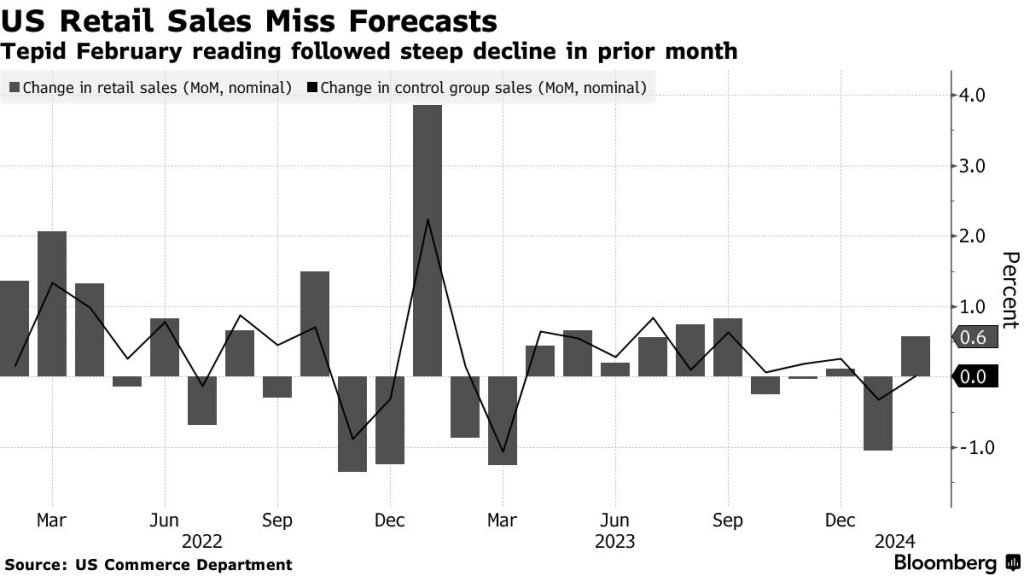

US retail sales experienced a lower-than-expected increase following a significant decline at the beginning of the year, raising concerns about the strength of consumer spending.

According to data from the Commerce Department, the value of retail purchases, not adjusted for inflation, rose by 0.6% from January, with a downward revision to the previous month’s figures. Excluding automobile sales, retail sales advanced by 0.3%.

Among the thirteen categories tracked, eight reported increases, with notable gains seen in building material stores and auto dealers, marking the largest increase since May.

However, spending declined at furniture outlets, stores for health and personal care, clothing, and e-commerce.

______

3. Mnuchin Wants to Buy TikTok

Former US Treasury Secretary Steven Mnuchin has expressed interest in leading a purchase of TikTok from its Chinese parent company, ByteDance, following a bipartisan bill passed by House lawmakers aimed at banning the social media app in the US.

Mnuchin disclosed in an interview with CNBC that he has been in discussions with potential co-investors about acquiring TikTok, although he did not provide specific details. The proposed ban on TikTok stems from concerns among US lawmakers about Chinese government influence on American users.

However, it remains uncertain whether Mnuchin, who heads a private investment firm with backing from Saudi Arabia, will be successful in finalizing a deal.

Bloomberg Intelligence estimates the value of TikTok’s US business to be between $35 billion to $40 billion.

Source: Mnuchin Now Wants to Buy TikTok, Days After Leading NYCB Rescue

______

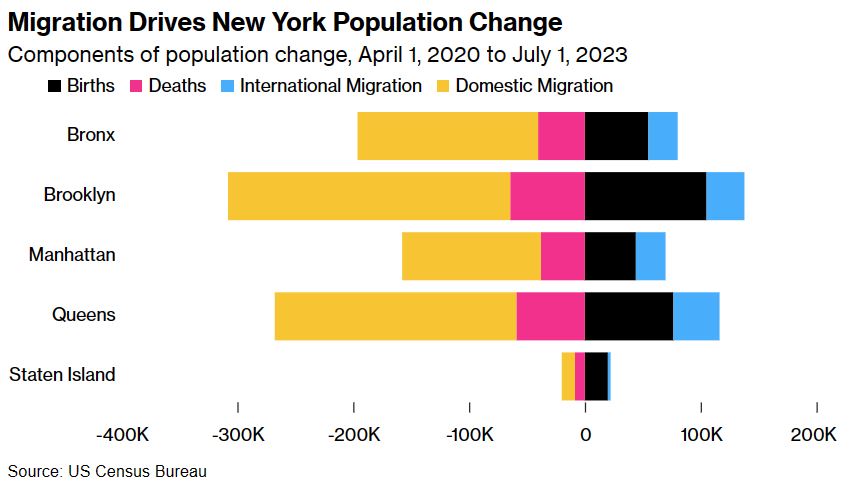

4. NYC Has Lost 546,000 Residents

New York City experienced a significant population decline of nearly 78,000 residents in the past year, contributing to a total loss of over half a million since April 2020. While the rate of departure has slowed compared to the peak of the pandemic, the exodus continues, according to US Census data.

In the 12 months leading up to July 1, approximately 160,000 individuals left the city, while around 52,000 arrived through international migration. This resulted in a population of approximately 8.3 million when births and deaths are factored in. In contrast, the previous year saw roughly 216,000 people leaving the city, with 54,037 arriving through international migration.

Despite an influx of new international arrivals, the city has still seen a net loss of 546,164 residents since April 2020.

It’s important to note that these Census figures only cover until July 2023 and do not account for the past nine months of international arrivals.

______

5. Manhattan Apartment Rents Climb

In February, Manhattan apartment rents saw an increase, reflecting a robust economy and a challenging sales market that led to heightened leasing activity.

The median rent for new leases signed last month stood at $4,230, marking a 3.3% rise compared to the previous year, as reported by appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. However, this monthly figure remains below the record high of $4,400 reached last summer.

Similarly, rents in Brooklyn rose by 2.9% to $3,499, while in northwest Queens, the median rent increased by $1 to $3,239.

Traditionally, rental prices tend to decrease during the winter months, but this year, the decline was less pronounced than expected, according to Jonathan Miller, president of Miller Samuel.

Factors such as low unemployment rates have contributed to the buoyancy of the market.

______

6. JPMorgan Fined $348 Million

JPMorgan Chase & Co. has been fined a total of $348 million by US regulators due to deficiencies in its trade-surveillance program. The Office of the Comptroller of the Currency (OCC) imposed a $250 million fine, while the Federal Reserve added a $98 million penalty.

The regulators stated that the bank’s surveillance program failed to adequately monitor the behavior of its employees and clients. These issues persisted until at least last year, according to the regulators.

The OCC highlighted that these deficiencies led to the bank’s failure to monitor billions of instances of trading activity across at least 30 global trading venues. In response, both regulatory bodies have mandated corrective actions to address the identified issues.

JPMorgan Chase & Co. neither admitted nor denied the OCC’s findings.

______

7. Blackstone Recommends Buy the Real Estate Dip

According to Jon Gray, President of Blackstone Inc., real estate prices have reached their lowest point, presenting a compelling opportunity to swiftly acquire assets at reduced prices. Gray emphasized that despite prevailing negative perceptions, the decline in value has already taken place, making this period opportune for action. He made these remarks during an interview with Bloomberg Television’s Francine Lacqua at the Bank of America Global Investor Summit conference in Rome.

Gray noted that there hasn’t been significant competition for purchasing discounted assets thus far. He anticipates a strong demand for new capital, particularly as financial institutions start recognizing losses from loans originated when borrowing costs were lower.

While Gray foresees a wave of buying opportunities arising as some banks and insurance funds may need to sell assets at discounted rates/

While Gray foresees a wave of buying opportunities arising as some banks and insurance funds may need to sell assets at discounted rates.

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, and Bloomberg.