—— PBOC Cuts Reserve Ratio; BlackRock Dominates Bitcoin ETF Market; Microsoft Surpasses $3 Trillion Valuation; Abbott Bets on Nutrition Sales; AI Boom Pushes Google Stock to Record; Netflix Subscriber Growth Surges; U.S. Treasury Bonds Face Continued Selloff

1. PBOC Cuts Reserve Ratio

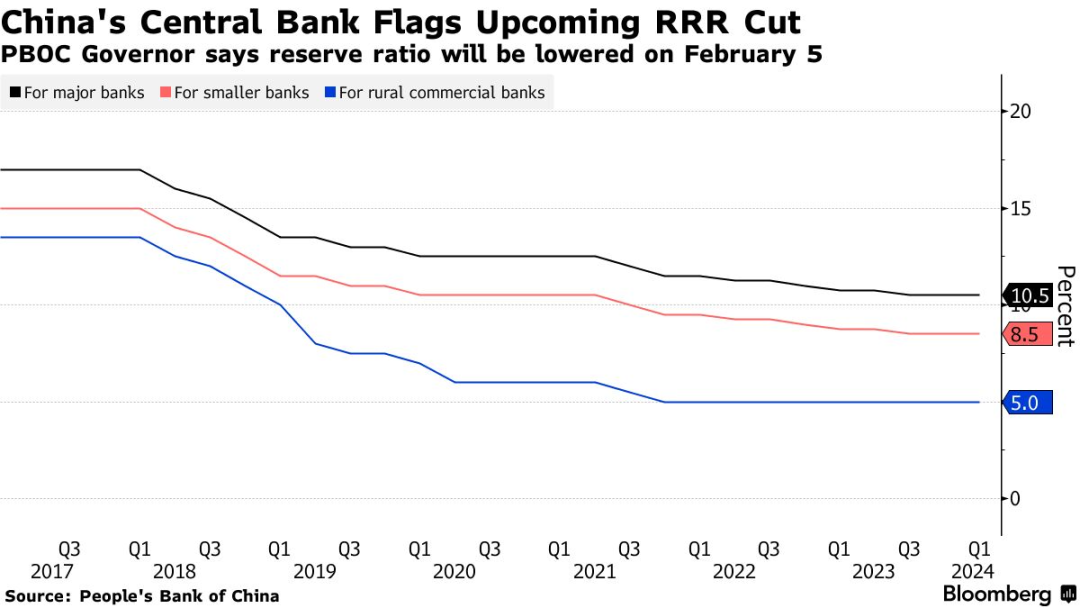

PBOC Governor Pan Gongsheng announced that China will cut the Reserve Requirement Ratio (RRR) by 0.5% starting February 5, injecting ¥1 trillion of long-term liquidity into the market.

Hours later, regulators also eased restrictions on the use of commercial real estate loans, allowing developers to repay loans more flexibly.

Following the twin policy announcements, A-shares and Hong Kong stocks both rallied. The yield on China’s 10-year government bonds dipped briefly but rebounded to 2.51%.

Analysts expect many investors may use this opportunity to trim positions, and the real impact of the policies remains to be seen.

______

2. BlackRock Dominates Bitcoin ETF Market

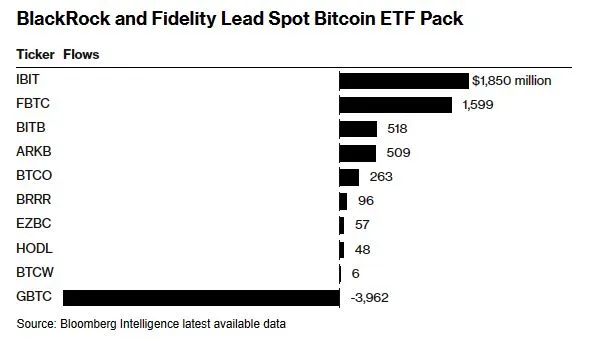

According to Bloomberg data, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) have attracted $1.9 billion and $1.6 billion respectively, accounting for 70% of the spot Bitcoin ETF market.

The SEC approved Bitcoin ETFs less than two weeks ago, yet BlackRock and Fidelity have already taken a commanding lead due to their vast retail and institutional client bases, superior sales networks, liquidity, and strong reputations.

In comparison, Bitwise’s Bitcoin ETF (BITB) has only attracted $518 million—far behind the top two.

Since ETF approval, Bitcoin prices have fallen more than 10%.

______

3. Microsoft Surpasses $3 Trillion Valuation

Microsoft’s stock rose 1.3% to $403.95, briefly pushing its market capitalization past $3 trillion, overtaking Apple for a moment.

Microsoft was one of 2023’s “Magnificent Seven” stocks, surging 57% that year. It is already up 7.4% in 2024, outperforming the Nasdaq’s 4.6%. Microsoft now accounts for 7.3% of the entire S&P 500, highlighting its market impact.

As one of the biggest beneficiaries of the AI boom, Microsoft’s surging stock reflects investors’ excitement around artificial intelligence.

Bloomberg expects Microsoft’s 2024 revenue to grow 15%—well above the tech sector average.

90% of Wall Street analysts rate the stock a ‘Buy,’ with target prices 7% above current levels.

______

4. Abbott Bets on Nutrition Sales

Abbott Laboratories CEO Robert Ford told analysts today that the company expects nutrition product sales to grow faster than the pre-pandemic rate of 4–6% in 2024.

Abbott’s nutrition products include infant formulas and adult nutritional drinks or powders. Last year, the division’s revenue rose 9.3%, reversing a 10% decline in 2022. Analysts project 2024 growth of about 4.7%.

Despite strong growth in this segment, Abbott’s earnings and revenue missed expectations, sending its stock down as much as 3.7%.

Abbott said it remains the dominant player in the infant formula market.

______

5. AI Boom Pushes Google Stock to Record High

Alphabet shares rose 1.9% today to $149.86, surpassing the company’s previous all-time high of $149.84 set in November 2021. Alphabet’s market value now stands at $1.9 trillion.

The AI frenzy has fueled the rise of the “Magnificent Seven” tech stocks, and Alphabet is now the third-most valuable U.S. company behind Apple and Microsoft.

BMO Capital Markets analyst Brian Pitz named Google his top stock pick for 2024, citing its leadership in AI.

In December, Google launched Gemini, its rival to OpenAI’s GPT-4.

______

6. Netflix Subscriber Growth Surges

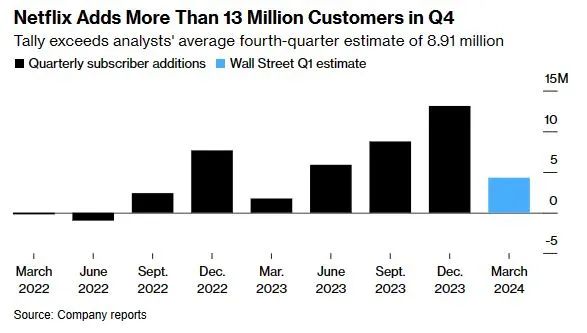

Netflix’s latest earnings report showed the company added 13.1 million new users in Q4—well above the 8.91 million expected by Wall Street. In EMEA (Europe, Middle East, and Africa), each region added over 5 million subscribers.

Q4 revenue rose to $8.33 billion, also beating forecasts. On Wednesday morning, Netflix stock jumped as much as 14% to $559, its biggest surge since October.

Top-performing titles in Q4 included the thriller Leave the World Behind and the Beckham documentary series.

Many had thought Netflix hit its user growth ceiling two years ago, but recent strategies have proven effective.

______

7. U.S. Treasury Bonds Face Continued Selloff

This afternoon, stronger-than-expected January manufacturing and services data led to another wave of U.S. Treasury selling, pushing yields higher.

A string of robust economic indicators in recent weeks has dampened traders’ expectations of Federal Reserve rate cuts.

The two-year Treasury yield, which is highly sensitive to interest rate changes, rose 0.03% to 4.38%, while the 10-year yield climbed 0.04% to 4.18%.

On Thursday, the U.S. will release Q4 GDP data, followed by December’s personal consumption index on Friday.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.