1. Goldman Sachs Profit Beats Expectations;

2. Synopsys Closes Year’s Largest Acquisition;

3. Morgan Stanley Misses on Trading Revenue;

4. Apple Becomes World’s Top Smartphone Seller;

5. US Dollar Hits One-Month High;

6. Massive US Office Leases Set to Expire;

7. Harvard Business School Renews NYC Campus Lease.

1. Goldman Sachs Profit Beats Expectations

Goldman Sachs reported its highest quarterly revenue in two years, with net profit exceeding forecasts. CEO David Solomon said 2023 showcased the firm’s execution and laid a solid foundation for 2024.

Equity trading revenue jumped 26% to $2.61 billion, far beating analyst estimates and $1.5 billion higher than key rival Morgan Stanley.

Asset and wealth management revenue rose 23% to $4.39 billion, largely from management fees. Total client assets under supervision hit a record $2.81 trillion, up 10% YoY.

Goldman posted $2.01 billion in net profit for Q4, up 51% YoY, despite taking a $262 million writedown on commercial real estate.

The firm is still working to exit its credit card partnerships with Apple and General Motors.

______

2. Synopsys Closes Year’s Largest Acquisition

Chip design firm Synopsys announced a $35 billion enterprise value acquisition of software developer Ansys. Ansys shareholders will receive $197 in cash and 0.345 Synopsys shares per Ansys share.

Bloomberg previously reported Ansys was exploring a sale; its stock has since risen 14%.

The deal marks the largest acquisition globally in the past 12 months and a strong start for the 2024 M&A market.

Synopsys is one of the few major chip design software providers, competing with Cadence Design Systems.

Synopsys posted $5.84 billion in revenue for fiscal 2023 and is expected to grow 13% this year.

______

3. Morgan Stanley Misses on Trading Revenue

Morgan Stanley reported flat fixed income trading revenue, falling short of estimates.

On the bright side, wealth management revenue rose to $6.65 billion, beating expectations, supported by high interest rates.

With the Fed expected to ease policy, the investment banking division anticipates more M&A and IPO activity. Q4 equity underwriting came in at $225 million; M&A advisory was $702 million — both above forecasts.

New CEO Ted Pick has taken the reins from long-time chief James Gorman and must now prove Morgan Stanley can outpace rivals.

Q4 revenue totaled $12.9 billion, and wealth management pre-tax margin rose to 24.9%.

______

4. Apple Becomes World’s Top Smartphone Seller

IDC data shows Apple became the world’s top smartphone maker in 2023, ending Samsung’s 12-year reign.

Apple was the only major brand to post sales growth last year, with iPhone shipments up 3.7% to 234 million units, overtaking Samsung’s 226 million.

Global smartphone sales declined 3.2% YoY to 1.17 billion units — the worst year for the industry in a decade.

Apple, long the profit leader, now holds the volume crown too. Samsung’s shipments fell 13.6%, while Huawei gained share in China.

______

5. US Dollar Hits One-Month High

The US dollar climbed to a one-month high as traders scaled back expectations for aggressive Fed rate cuts.

The US Dollar Index — which tracks the greenback against six major currencies — rose 0.8%.

Markets are watching for remarks from Fed Governor Christopher Waller later today. In November, Waller’s dovish surprise triggered a sharp dollar selloff.

Stubbornly high rates could keep US Treasury yields elevated, attracting foreign capital and boosting the dollar.

______

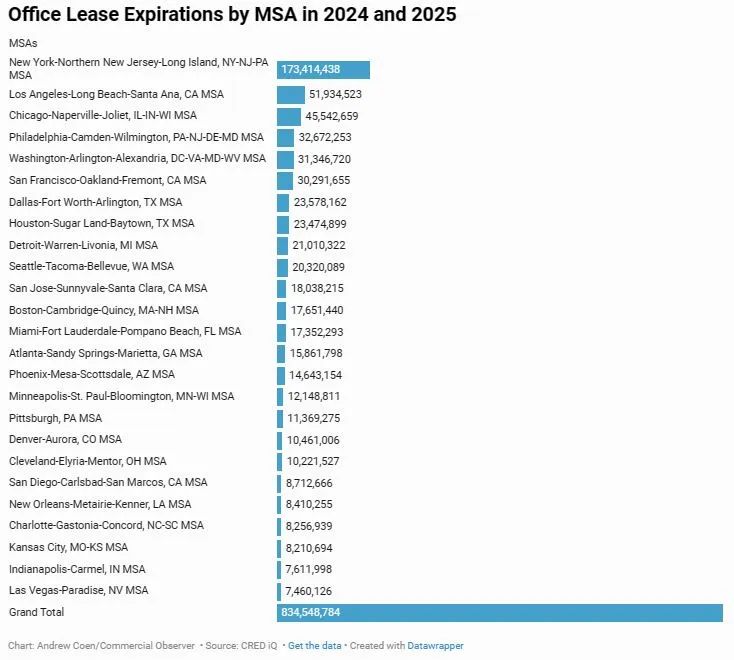

6. Massive US Office Leases Set to Expire

According to CRED iQ, the US office vacancy rate is at a record high. In 2024–25, leases covering 217 million square feet of office space will expire.

Experts expect many tenants to downsize or vacate, posing major challenges to the sector.

In late 2023, the delinquency rate for CMBS backed by office properties surged to 9.9%, more than double the prior year.

Commercial Observer analysis shows 500 million square feet of leases will expire over five years, including 112 million in 2024 and 105 million in 2025.

NYC has the most space set to expire.

______

7. Harvard Business School Renews NYC Campus Lease

Sources say Harvard Business School has renewed its 5,000 sq. ft. Manhattan lease at 3 Columbus Circle with landlord The Moinian Group.

Moinian’s Gregg Weisser negotiated with tenant rep Newmark. While lease terms weren’t disclosed, the rent reportedly ranges from $75 to $85 per sq. ft. annually.

Other tenants in the building include crypto trading firm XBTO and the Agency for the Performing Arts.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.