1. Manhattan Housing Market Shows Early Signs of Rebound;

2. U.S. Auto Sales Decline;

3. U.S. Labor Market Continues to Cool;

4. Tech ‘Magnificent Seven’ Slump for Four Straight Days;

5. Fed Wants to Keep Rates Higher for Longer;

6. Lululemon Responds to Founder’s Comments;

7. Canadian Auto Sales Surge.

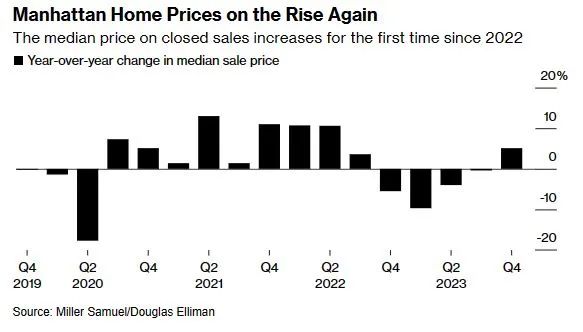

1. Manhattan Housing Market Shows Early Signs of Rebound

According to the latest data from Douglas Elliman Real Estate, the median sales price for Manhattan residential properties rose 5.1% year-over-year to $1.16 million in Q4—the first increase in over a year.

Although the number of transactions declined, deals priced above $5 million rose. With interest rates remaining high, more than two-thirds of buyers paid in all cash, the highest percentage since 2014.

In December, mortgage applications for Manhattan homes rose year-over-year, driven by falling rates.

______

2. U.S. Auto Sales Decline

According to Bloomberg data, U.S. auto sales in Q4 2023 slowed to an annualized pace of 15.4 million units, down from 15.5 million in the previous two quarters.

Auto loan interest rates are nearing 10%, and the average car price is now $48,000.

Research firm Cox Automotive found that middle- and lower-income households are significantly reducing new car purchases, while the top 20% of earners remain the dominant buyers. 2024 sales are expected to grow by less than 2% and may take years to return to the pre-pandemic norm of 17 million units.

A JD Power survey showed the average monthly car payment rose to $739—$9 more than last year.

______

3. U.S. Labor Market Continues to Cool

The U.S. Bureau of Labor Statistics’ latest JOLTS survey showed job openings fell to 8.79 million in December, down from 8.85 million in November. Hiring dropped to the lowest level since April 2020, and layoffs also declined.

The quits rate fell to its lowest level since September 2020, as Americans increasingly believe it’s difficult to find new jobs.

The data indicates continued cooling in the labor market, giving the Fed more confidence to lower rates.

There are now 1.4 job openings per unemployed person, significantly down from a year ago.

______

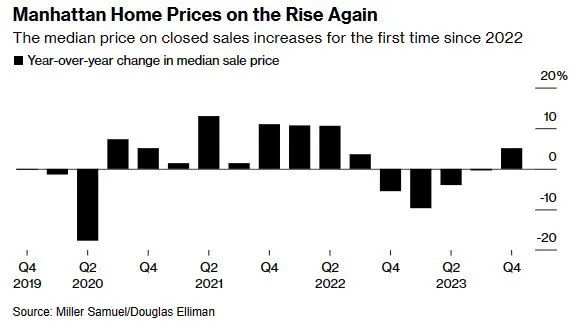

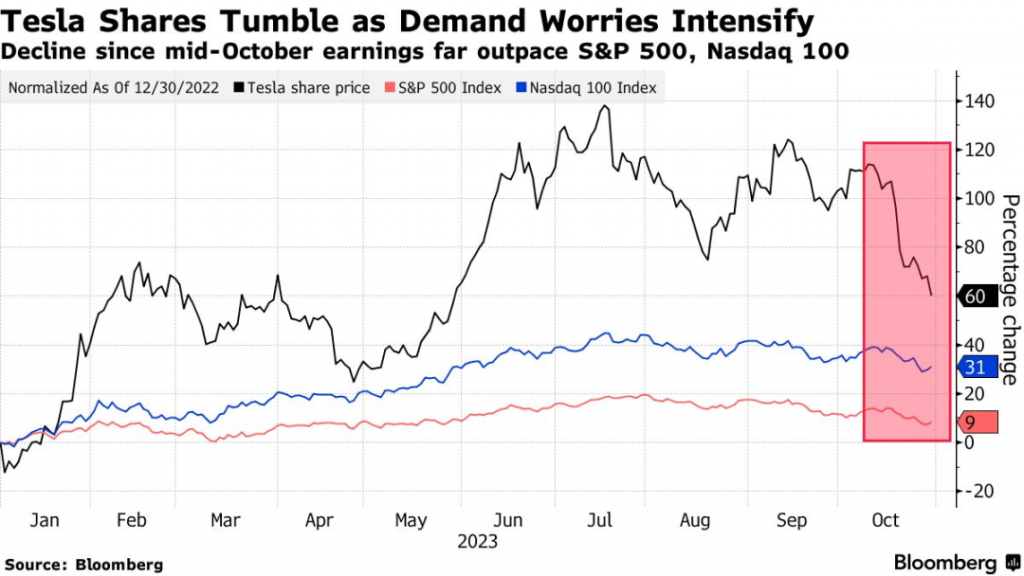

4. Tech ‘Magnificent Seven’ Slump for Four Straight Days

Over the past four trading days, the so-called “Magnificent Seven”—Apple, Amazon, Google, Microsoft, Meta, Tesla, and Nvidia—have all declined, marking the longest losing streak in a month and wiping out $370 billion in market value. Apple alone fell nearly 5%.

Steve Sosnick, chief strategist at Interactive Brokers Group, said it’s unclear whether last year’s massive rally is truly over, but “the party” seems to be winding down.

In 2023, the “Seven” soared over 100%, driven by AI hype. Several large-cap tech stocks fully rebounded from pandemic-era losses, with some hitting record highs.

Despite Tesla’s Q4 sales beating expectations, the stock fell 8% over the past four days.

______

5. Fed Wants to Keep Rates Higher for Longer

Minutes from today’s Fed meeting reveal that while officials are optimistic about taming inflation, most want to maintain high benchmark interest rates for a longer period to avoid premature rate cuts and potential setbacks.

David Kelly, chief strategist at JPMorgan Asset Management, said the Fed is hesitant to “declare victory” and is displaying a cautious stance. He expects the first rate cut to come in June.

The minutes didn’t surprise investors—10-year and 2-year Treasury yields remained flat. Futures markets still expect six rate cuts from the Fed this year.

______

6. Lululemon Responds to Founder’s Comments

Chip Wilson, outspoken founder of Lululemon and long estranged from the company, said in an interview that the brand is too worried about public and media perception, its ads are uninspiring, and its models aren’t “aspirational.” He also criticized the company’s focus on diversity and inclusion, saying Lululemon shouldn’t try to appeal to everyone.

A company spokesperson stated today that Wilson’s comments do not reflect the company’s values. He fully separated from the board in 2015. In 2020, Lululemon hired an executive to lead diversity and inclusion efforts, which has helped the company grow faster.

Last month, Lululemon issued a mixed Q4 revenue forecast, with slowing growth.

In 2023, Lululemon stock rose 60%, outperforming most peers.

______

7. Canadian Auto Sales Surge

According to DesRosiers Automotive Consultants, Canadian auto sales in 2023 rose 11.8% year-over-year to 1.664 million units, marking the biggest jump in 25 years.

The surge was driven by easing supply chain constraints post-pandemic. Auto sales in Canada have now seen year-over-year growth for 14 consecutive months.

Pickup trucks were especially popular, accounting for 86% of all sales.

General Motors was the best-selling brand of the year, with a 16% market share.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.