1. Multiple E-Commerce Platforms Scale Back Free Shipping;

2. US Unemployment Rate Unexpectedly Drops Again;

3. Hermès Becomes Wealthiest Family in Europe;

4. Trafigura Issues $5.9 Billion Dividend;

5. Jewish Alumni Criticize Harvard in Open Letter;

6. FDA Approves Breakthrough Gene-Editing Therapy;

7. SmileDirectClub Fails to Secure Funding, Begins Liquidation.

1. Multiple E-Commerce Platforms Scale Back Free Shipping

For years, free and fast shipping has been a marketing hook for e-commerce giants like Amazon, Walmart, Chewy, and Wayfair. Regardless of product size, items would arrive within a day or two—something consumers came to expect.

However, with profit margins under pressure, many companies have gradually started to eliminate free shipping over the past year. Amazon, Nordstrom, and Walmart have stopped building new logistics centers and raised the minimum spend required for free shipping.

As the e-commerce model matures, companies are finding that removing free shipping doesn’t significantly reduce customer retention. Experts expect free shipping may start becoming a thing of the past by next year.

Shipping costs typically account for 10% to 15% of a company’s net profit—an expense sellers have long absorbed to stay competitive.

______

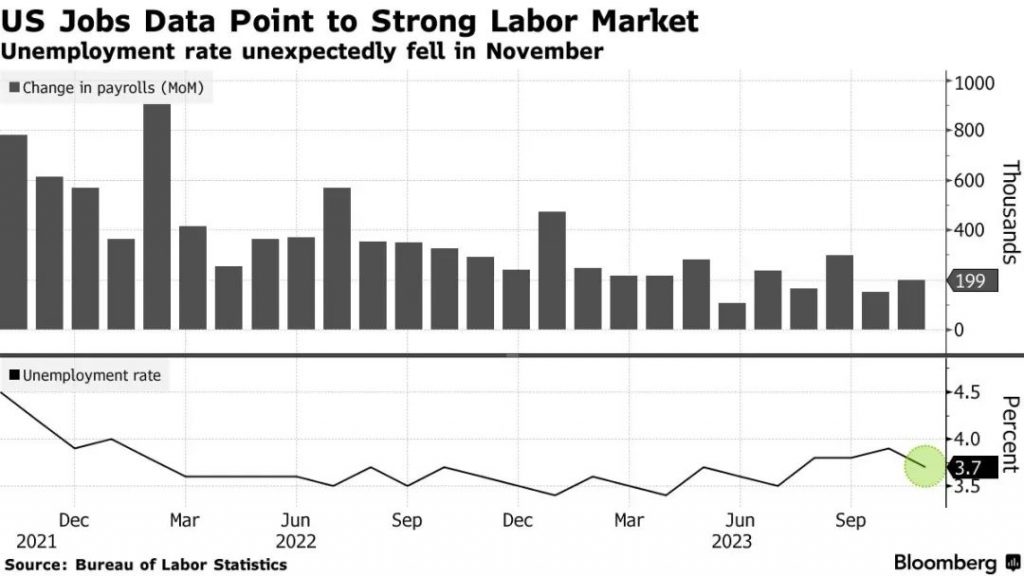

2. US Unemployment Rate Unexpectedly Drops Again

The US Bureau of Labor Statistics reported today that nonfarm payrolls rose by 199,000 in November, exceeding October’s gain of 150,000. The return of workers after strike actions contributed an additional 30,000 jobs.

Meanwhile, the unemployment rate unexpectedly fell to 3.7%, labor force participation increased, and wage growth outpaced expectations.

Job growth was strongest in healthcare, leisure and hospitality, government, and manufacturing. Other sectors saw little to no change, or even declines.

Following the data release, Treasury yields surged, as a strong labor market decreases the likelihood of imminent Fed rate cuts and raises questions about how long high benchmark rates may stay in place.

Fed Chair Jerome Powell has previously warned against assuming that rate cuts are coming soon.

______

3. Hermès Becomes Wealthiest Family in Europe

In October 2010, Hermès’ Bertrand Puech received an unexpected call from LVMH founder Bernard Arnault, who revealed he had acquired a sizable stake in Hermès and offered strategic and operational “help.”

However, Bertrand and other Hermès family members quickly realized that Arnault, a so-called “wolf in sheep’s clothing,” had intentions of a hostile takeover.

Ultimately, the Hermès family united to block Arnault’s bid, preventing the brand from becoming one of LVMH’s 75 labels.

Thirteen years later, Hermès shares have soared over 1,000%, far outpacing LVMH’s 600%. Today, the Hermès family, with over 100 members, has become the wealthiest in Europe.

The family’s united front against LVMH’s takeover turned out to be one of their wisest decisions.

______

4. Trafigura Issues $5.9 Billion Dividend

In 2023, commodity trading giant Trafigura reported a record $7.4 billion in net profit and announced a $5.9 billion dividend payout to its 1,200 shareholders and employees—more than triple last year’s $1.7 billion.

Since 2020, Trafigura has distributed a total of $9 billion in dividends, marking the most successful period in its history.

Founded in 1993, Trafigura grew from an obscure trading house into one of the world’s most important commodity traders, operating in 150 countries with assets spanning ports, oil wells, and energy infrastructure.

On average, each shareholder is set to receive roughly $5 million in dividends.

______

5. Jewish Alumni Criticize Harvard in Open Letter

Amid growing concerns over antisemitism, more than a thousand Harvard alumni have written an open letter calling for change, while a Jewish scholar resigned from an advisory board and a congressional investigation into the university looms.

The Harvard Jewish Alumni Alliance stated in the letter that recent events demonstrate the school cares more about legal risk than about student comfort or democratic values. The group called on Harvard to expel any student or faculty who promotes violence.

The Harvard Jewish Alumni Alliance includes over 2,000 Jewish and non-Jewish members.

______

6. FDA Approves Breakthrough Gene-Editing Therapy

The US FDA has just approved a gene-editing treatment for sickle cell disease.

CRISPR Therapeutics, a pioneer in gene editing, saw its stock rise 1.8% today. The therapy works by altering patients’ faulty genomes to treat inherited genetic conditions. CRISPR won the Nobel Prize in Chemistry in 2020.

Goldman Sachs analysts project that CRISPR and Vertex Pharmaceuticals could generate up to $3.9 billion in annual revenue from gene-editing treatments.

The therapy costs around $1 million per patient, takes several months, and requires accompanying chemotherapy drugs.

______

7. SmileDirectClub Fails to Secure Funding, Begins Liquidation

In September, SmileDirectClub filed for bankruptcy and began searching for funding to continue operations.

But today, attorney Spencer Winters told the bankruptcy court that the company had failed to persuade key investors and creditors, and would now enter liquidation proceedings.

SmileDirectClub went public in 2019 with a peak valuation of $8.9 billion, making its founders billionaires. However, revenues declined, and the company never turned a profit. It also faced legal battles with competitors during the pandemic, while demand for orthodontics dropped.

HPS Investment Partners, which provided $138 million in credit, will receive SmileDirectClub’s accounts receivable and intellectual property.

At the time of bankruptcy filing, the company held around $900 million in debt.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.