1. World’s First Carbon Removal Facility Completed

2. Global High Inflation Could Last for Decades

3. NYC Apartment Rents Retreat From Peak

4. Wegovy Faces Major New Rival in Obesity Drug Market

5. Powell’s Hawkish Remarks Sink U.S. Stocks

6. U.S. Delinquent Commercial Real Estate Loans Hit New High

7. AI May Slash Animated Film Costs by 90%

1. World’s First Carbon Removal Facility Completed

Bay Area startup Heirloom Carbon Technologies has completed the first commercial U.S. facility designed to capture carbon emissions from the air. Located near San Francisco, the plant can remove and store 1,000 tons of CO₂ annually.

Several similar direct air capture facilities are also in the works.

Companies like JPMorgan and Google have invested hundreds of millions of dollars in carbon removal services. In 2022, Heirloom raised $53 million from Microsoft’s Climate Innovation Fund and Bill Gates’s Breakthrough Energy Ventures.

Heirloom aims to lower carbon removal costs to $100 per ton by 2030 — a figure not yet achievable.

______

2. Global High Inflation Could Last for Decades

At the Bloomberg New Economy Forum in Singapore, Citadel founder Ken Griffin warned that the world is undergoing structural deglobalization — and that baseline inflation may remain elevated for decades.

Griffin criticized the U.S. for issuing $33 trillion in debt without accounting for rising interest rates and called federal spending reckless. He warned this could lead to serious consequences in the future.

He also noted that the U.S. fiscal deficit is unsustainable, and while the job market remains strong, many unresolved problems persist.

In Europe, the prolonged war in Ukraine has disrupted access to cheap energy, further straining the economy.

Griffin added that while the U.S. could avoid default by printing more money, the long-term consequences would be disastrous.

______

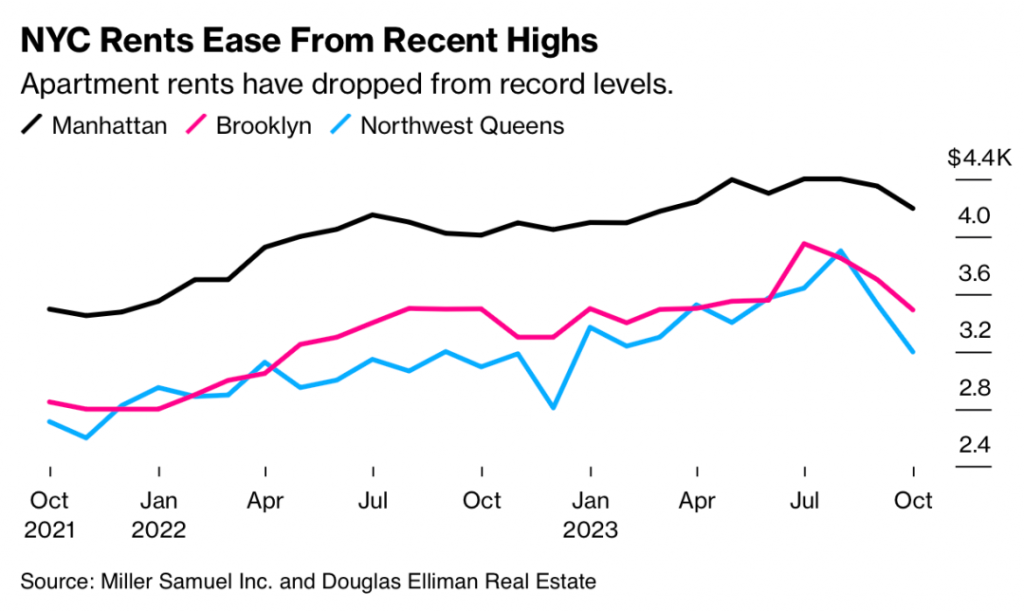

3. NYC Apartment Rents Retreat From Peak

According to Douglas Elliman, Manhattan’s median new lease rent dropped 3.6% month-over-month in October to $4,195, down from the record high of $4,400 in July.

Brooklyn and Long Island City rents saw even sharper declines, falling for the third straight month to $3,490 and $3,198, respectively.

The data shows NYC’s rental market is returning to pre-pandemic seasonal trends after two years of relentless price increases.

Despite the pullback, rents remain roughly 20% above pre-COVID levels and are unlikely to revert soon.

______

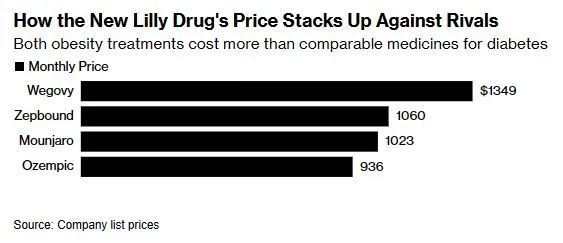

4. Wegovy Faces Major New Rival in Obesity Drug Market

On Wednesday, Eli Lilly received FDA approval for its obesity drug Zepbound, setting the stage for direct competition with Novo Nordisk’s blockbuster Wegovy.

Wegovy has driven billions in revenue for Novo and propelled its valuation to the top among European companies. In the U.S., Wegovy costs $1,349 per month — more than its active-ingredient sibling Ozempic.

Lilly’s Zepbound will sell at a 21% discount and hit the market just ahead of Thanksgiving.

Meanwhile, Lilly’s diabetes drug Mounjaro also costs $37 less per month than Novo’s competing treatment.

______

5. Powell’s Hawkish Remarks Sink U.S. Stocks

At the IMF forum in Washington, Fed Chair Jerome Powell said the central bank would not hesitate to raise rates again if necessary.

Powell reiterated that current rates are likely not high enough to bring inflation down to the 2% target.

JPMorgan’s chief economist Michael Feroli noted that while the Fed may be done hiking, Powell’s comments underscore their readiness to act.

Following Powell’s speech, U.S. stocks and bonds declined. The Fed’s benchmark rate currently stands at 5.25%–5.5%, its highest in 22 years.

______

6. U.S. Delinquent Commercial Real Estate Loans Hit New High

According to BankRegData, delinquent U.S. commercial real estate loans surged 30% in Q3 to $17.7 billion — a $10 billion increase since the start of 2023.

Though only 1.5% of bank-issued CRE loans are delinquent, experts warn that many more properties — especially offices — could soon be in trouble.

Notably, the data does not yet reflect the impact of WeWork’s bankruptcy. WeWork was among the largest office tenants in cities like New York and San Francisco.

The 1.5% delinquency rate marks a 10-year high in terms of dollar volume.

______

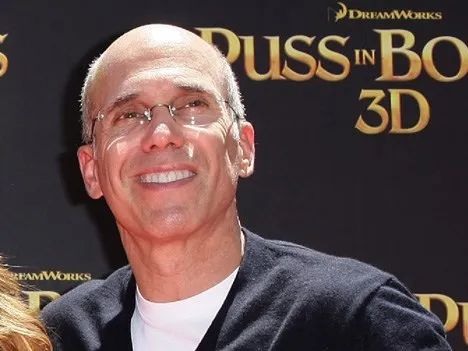

7. AI May Slash Animated Film Costs by 90%

At the Bloomberg New Economy Forum, entertainment executive Jeffrey Katzenberg said AI will have an outsized impact on media, entertainment, and creative industries.

He claimed that top-tier animated films once required 500 artists working for years — a workload AI could cut by 90%.

Sara Menker, CEO of GRO Intelligence, cautioned that there are already 2.9 million AI models in her sector alone, raising questions about oversight and quality.

Experts warn that AI could cause social disruption, and that education and training are not keeping pace.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.