1. U.S. Consumer Confidence Falls to Lowest Since May

2. Tesla Drops 20% as EV Hype Fades

3. Caterpillar Stock Hits Lowest Since June

4. Investment Banker Bonuses Drop Sharply

5. JetBlue Misses Forecasts, Shares Tumble

6. Toyota Adds $8B Investment to NC Plant

7. Plaza Hotel Condo Sells for $66M

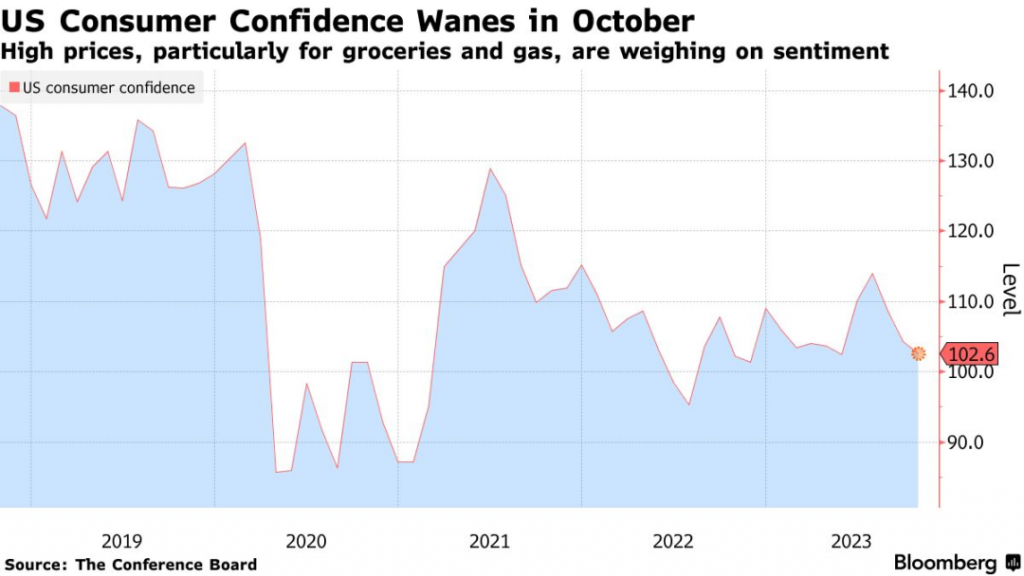

1. U.S. Consumer Confidence Falls to Lowest Since May

The Conference Board’s U.S. consumer confidence index fell to 102.6 in October, its lowest level in five months.

Chief economist Dana Peterson said consumers remain worried about high prices, especially for groceries and gasoline, as well as political instability and high interest rates.

The report also showed fewer Americans plan to purchase homes, vehicles, or large appliances in the near term.

______

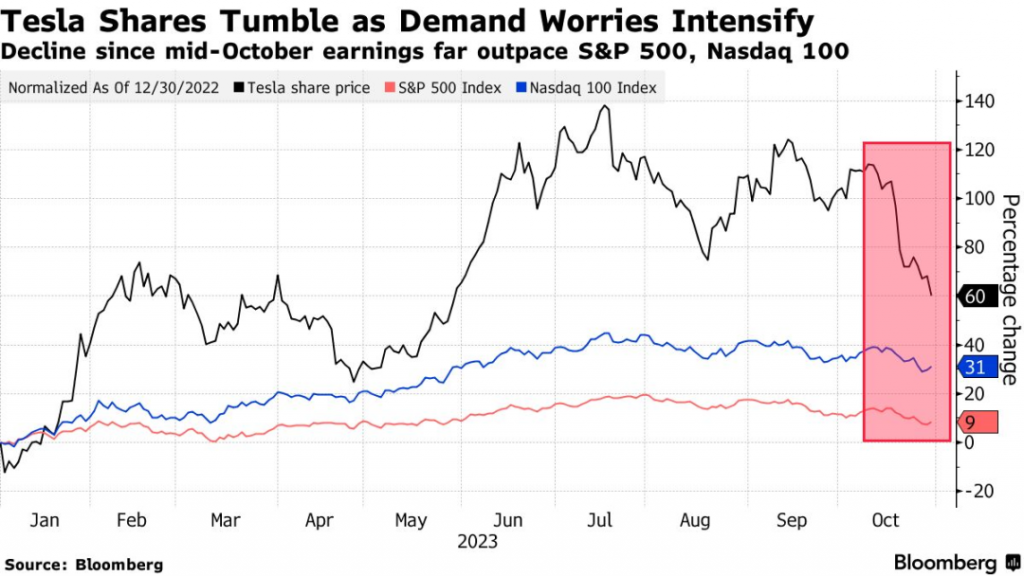

2. Tesla Drops 20% as EV Hype Fades

Tesla shares have dropped nearly 20% in the past two weeks after the company lowered its growth forecast in its Q3 earnings call, sparking concerns that electric vehicle demand is waning.

This week, battery supplier Panasonic also warned of weakening demand for Tesla and the broader EV market.

Morgan Stanley analyst Adam Jonas said the EV sector now faces low prices, high costs, high interest rates, and declining demand. Investor sentiment is shifting.

Since October 18, Tesla has lost $145 billion in market value.

______

3. Caterpillar Stock Hits Lowest Since June

Heavy machinery maker Caterpillar announced a $1.9 billion YoY drop in Q3 revenue, with a decline in order backlog.

Despite exceeding profit expectations due to strong pricing and sales, the economic outlook remains uncertain.

Caterpillar’s performance is seen as a broader economic barometer due to its exposure to construction, mining, and energy sectors.

Shares fell 5.5% today to $228.77, the lowest since early June.

______

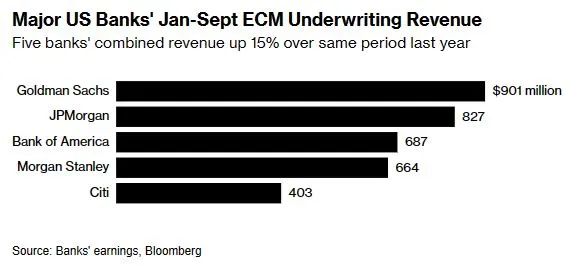

4. Investment Banker Bonuses Drop Sharply

ccording to Bloomberg’s Alison Williams, equity underwriting fees at the top five U.S. investment banks rose 14% to $3.5 billion in the first nine months of the year.

Initial expectations were for a 52% increase by year-end, but that’s now been lowered to 21%.

Recruitment firm Selby Jennings noted that analyst bonuses, which used to match their salaries, may now only reach 60–70%.

Goldman Sachs led the industry with $901 million in equity underwriting fees through Q3.

______

5. JetBlue Misses Forecasts, Shares Tumble

JetBlue Airways announced it expects a Q4 net loss per share of $0.35–$0.55, far worse than analyst estimates of $0.21. Revenue is expected to fall 6.5% to 10.5% YoY.

Shares plunged 11%, marking the biggest daily drop since June 2022. Year-to-date, JetBlue stock is down 35%.

COO Joanna Geraghty said the company’s growth relies on international routes as domestic demand weakens.

JetBlue currently has six aircraft grounded due to engine issues, and the number may exceed ten by the end of next year.

______

6. Toyota Adds $8B Investment to NC Plant

Toyota announced it will invest an additional $8 billion in its North Carolina battery plant, aiming to close the gap with Tesla.

The NC site is Toyota’s largest factory outside Japan. Total investment could reach $13.9 billion by 2030, creating up to 5,000 new jobs.

U.S. Ambassador to Japan Rahm Emanuel called North Carolina a future EV industry leader.

The new funds will support eight new production lines.

______

7. Plaza Hotel Condo Sells for $66M

A unit at Manhattan’s iconic Plaza Hotel (Unit 1109) sold last week for $66.8 million, the fourth-largest NYC residential sale of 2023.

The 12,000-square-foot apartment trails two Central Park South sales ($80M and $75M) and one on Madison Avenue ($68M).

The sale price is less than half its original asking price two years ago. It last changed hands in 2008 for $45 million.

About 20% of condos in the Plaza are currently listed for sale—double the normal rate.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.