—— Walmart Sees Impact of Weight-Loss Drugs on Sales; Only a Stock Market Crash Can Save Bonds; AT&T Weighs DirecTV Sale; GSK Offloads $1.1B in Haleon Shares; BlackRock Buys Blackstone Infrastructure Unit; Eagle Football Eyes IPO; Saudi Cargo Firm’s IPO Oversubscribed 72 Times

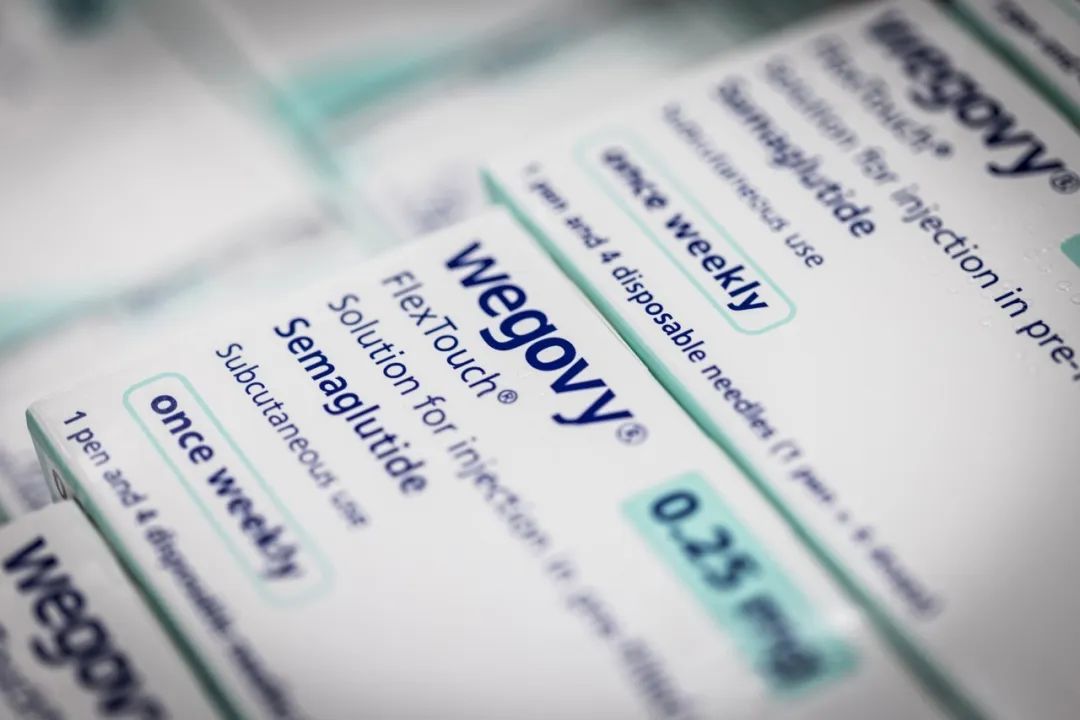

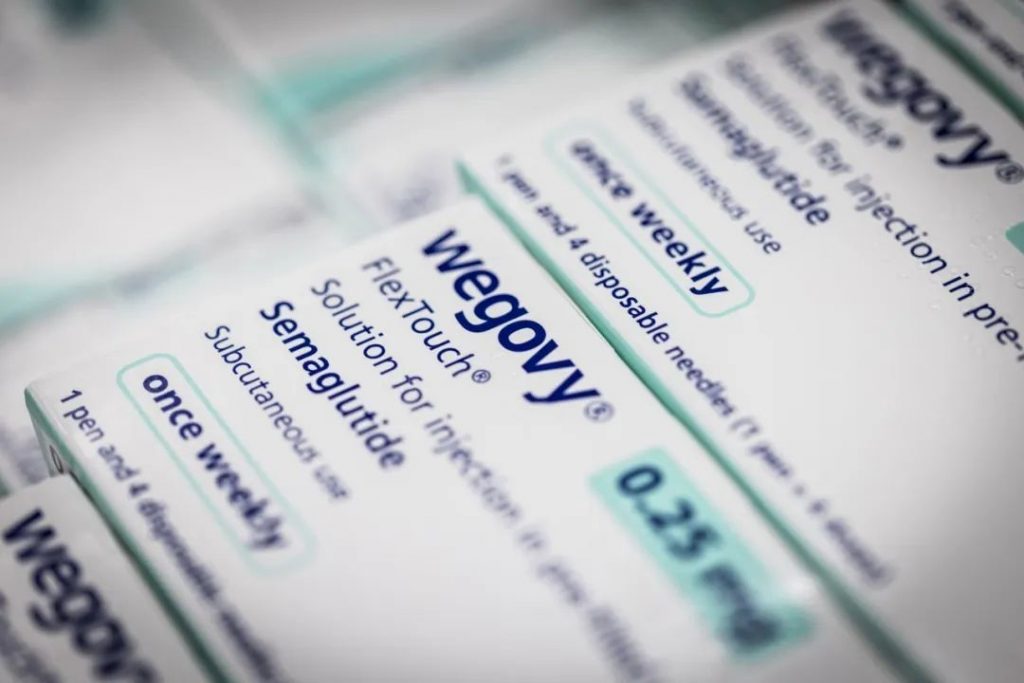

1. Weight-Loss Drugs Impact Walmart Sales

Walmart CEO John Furner said in an interview on Wednesday that many diabetic customers taking appetite-suppressing drugs like Ozempic and Wegovy are buying slightly less at Walmart. Less food also means fewer calories. While John believes it’s too early to draw definitive conclusions about the drugs’ true economic impact, more CEOs and investors are beginning to discuss the broader implications of weight-loss drugs on companies and the economy.

Walmart also sells GLP-1 weight-loss medications and noted that these drugs are contributing to revenue growth.

Between 2020 and 2022, GLP-1 drug sales increased by 300%.

______

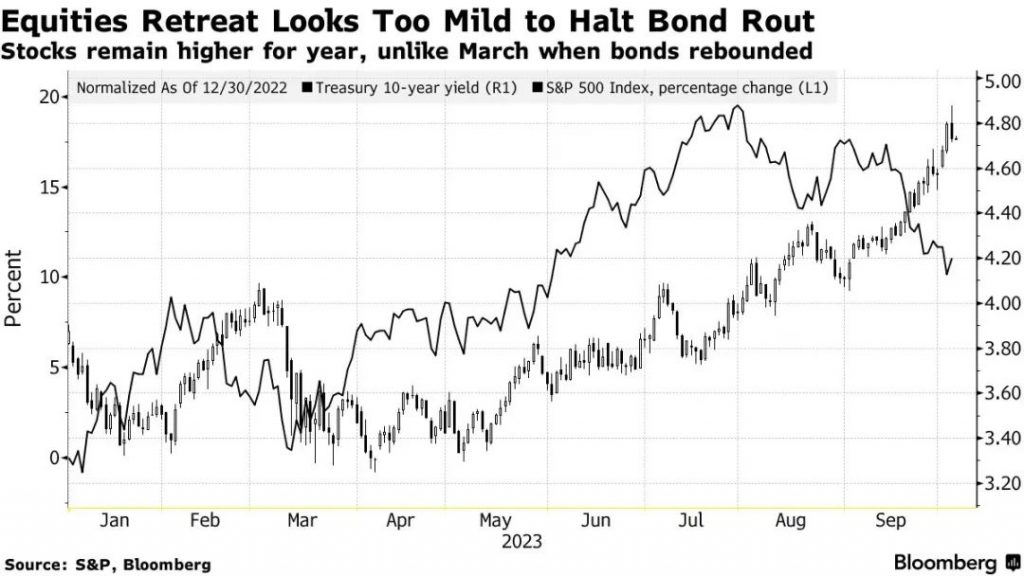

2. Only a Stock Market Crash Can Save the Bond Market

Barclays said global bond prices are likely to keep falling unless equity markets experience a steep drop in the coming weeks. Investors are preparing for prolonged high interest rates, putting severe pressure on global bond markets. Although Wednesday’s selloff eased slightly, traders expect renewed volatility — especially if Friday’s U.S. jobs report is too strong.

The Fed is unlikely to reverse monetary tightening in the short term, which means it will remain a net seller of Treasuries.

At the same time, the U.S. government is issuing more debt to cover budget deficits, adding downward pressure on bond prices.

______

3. AT&T Considering Sale of DirecTV

AT&T is exploring the sale of its 70% stake in DirecTV, the third-largest TV provider in the U.S., as the current agreement between the two firms nears expiration. The company will soon be legally allowed to sell its shares.

Sources say AT&T’s options include a dividend recapitalization, bringing in a new investor, or a full sale of DirecTV before August 2024.

In recent years, DirecTV and other pay-TV providers have struggled to compete with streaming services. In Q2, DirecTV lost 400,000 subscribers, leaving it with 12.4 million total users.

In 2021, AT&T and private equity firm TPG jointly acquired DirecTV in a deal valuing the business at $16 billion.

______

4. GSK Offloads $1.1 Billion in Haleon Shares

UK pharmaceutical company GSK Plc plans to sell 270 million shares of Haleon Plc, generating $1.1 billion in proceeds.

Haleon manufactures Aquafresh toothpaste and Panadol. After the sale, GSK will still retain a 7.4% stake in Haleon.

Haleon was originally created by spinning off the consumer health units of GSK and Pfizer.

GSK aims to refocus entirely on drug and vaccine development.

The proceeds from this transaction will help improve its balance sheet and fund R&D efforts.

______

5. BlackRock Buying Blackstone Infrastructure Unit

Sources said a consortium led by BlackRock and Grain Management is in talks to acquire a 20% stake in Phoenix Tower International from Blackstone’s BREIT fund.

BlackRock’s infrastructure division and Grain — a communications infrastructure investor — may acquire the cell tower operator for around $6.5 billion.

Phoenix, based in Florida, operates 22,000 telecom towers across the U.S. and Europe. Last week, it secured $1.3 billion in senior credit facilities in Europe.

In recent years, cell towers — seen as stable and predictable investments — have attracted strong interest from alternative asset firms.

______

6. Multi-Club Owner Eagle Football Plans IPO

Sources say Eagle Football Holdings, parent company of multiple football clubs, is working with advisers to raise $200 million in private financing and plans to raise another $300 million through an IPO later.

Eagle owns English Premier League club Crystal Palace FC, Brazil’s Botafogo, and Belgium’s RWD Molenbeek. Proponents of multi-club models argue that sharing resources reduces costs and improves advertising opportunities.

Last year, Eagle acquired Olympique Lyonnais, previously backed by Ares and high-net-worth investors.

______

7. Saudi Cargo Firm’s IPO 72x Oversubscribed

Saudi cargo company SAL Saudi Logistics Services aimed to raise $678 million through its IPO but received $48.6 billion in orders.

The 72-times oversubscription shows strong investor enthusiasm and indicates a revival in Saudi Arabia’s IPO market.

SAL is the country’s leading cargo firm, holding 95% market share. The Saudi government is emphasizing the development of international freight and airport infrastructure as part of broader economic diversification plans.

SAL’s IPO could be the second-largest in Saudi history, behind only oil drilling firm ADES Holding’s $1.2 billion offering.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.