—— Manhattan Luxury Sales Fall to One-Year Low; Treasury Yields Surge, Stocks Tumble; Oracle Confident in Revenue Goal; NYC Mayor Announces Zoning Overhaul; Nearly Half of Young Americans Live With Parents; Morgan Stanley Warns Equity Investors; SL Green Becomes Most Shorted REIT

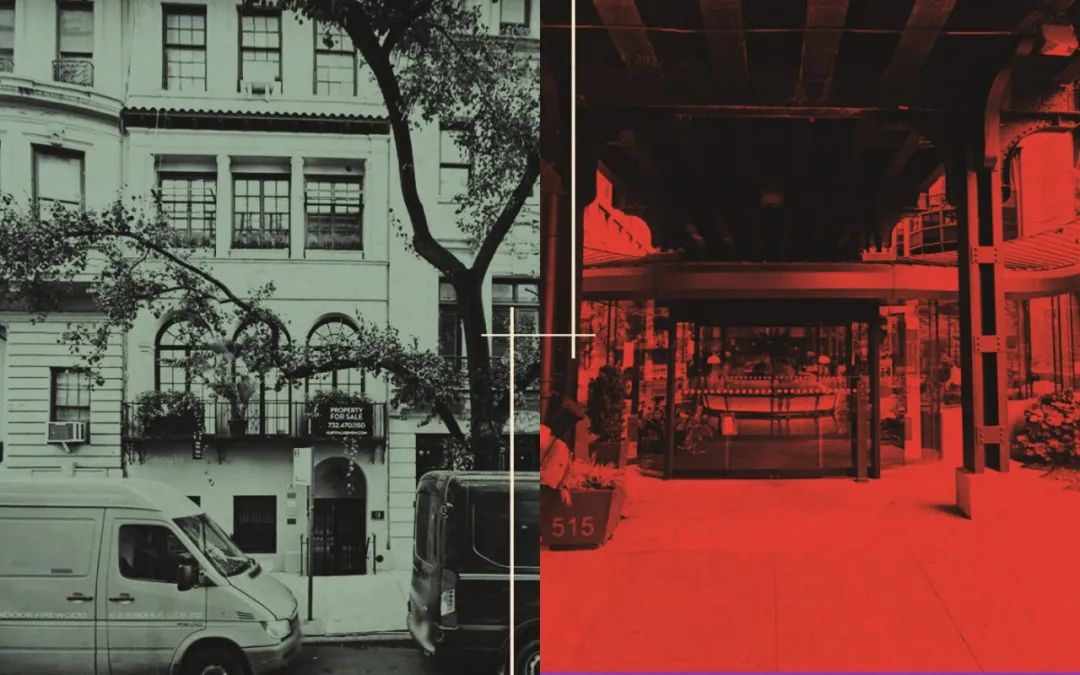

1. Manhattan Luxury Sales Fall to One-Year Low

According to the latest weekly report from Olshan Realty, only 10 Manhattan homes priced over $4 million went into contract during the week starting September 5, with prices also trending lower.

The most expensive sale was a home at 60 East 66th Street, which sold for $13.8 million—below its $18.5 million sale price in 2017.

Of the 10 homes sold, 7 were condos, 2 were townhouses, and 1 was a co-op. The total asking price for all 10 was $63.6 million, averaging $6.4 million—down from $7.1 million the week before.

These 10 properties spent an average of 1,183 days on the market and sold at an average 15% discount.

______

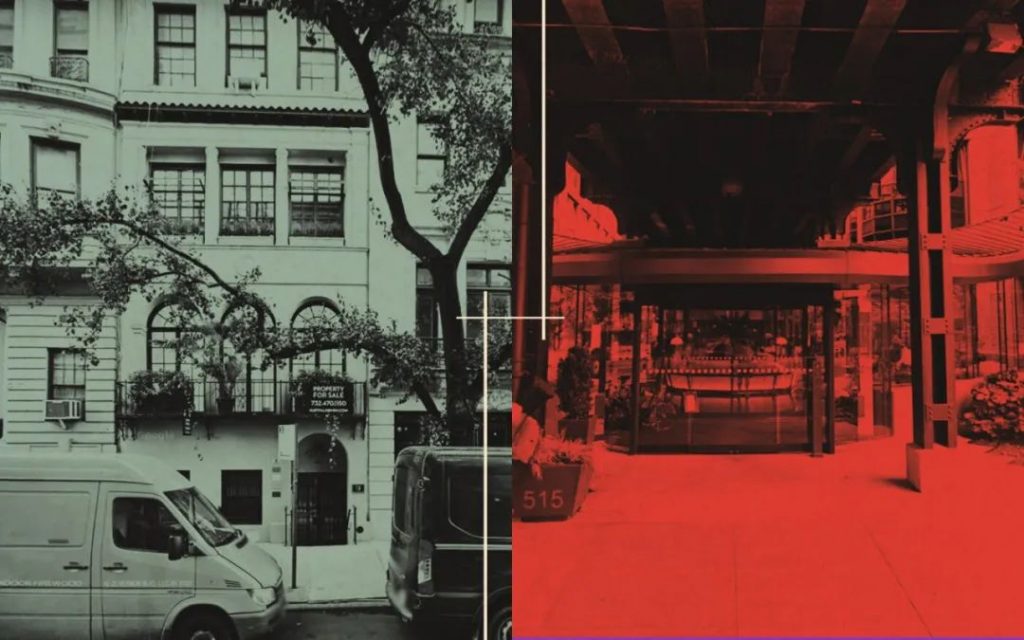

2. Treasury Yields Surge, Stocks Tumble

On Thursday, U.S. Treasury yields surged, triggering a broad selloff in risk assets including stocks.

The S&P 500 and Nasdaq 100 dropped 1.6% and nearly 2%, respectively, and are on track for their worst quarterly performance in a year.

Meanwhile, Treasury yields jumped 30 basis points over three weeks, approaching 4.5%.

Adam Phillips, portfolio manager at EP Wealth Advisors, noted that many assets outside of equities now offer attractive risk-reward profiles, reducing the need to overweight stocks.

As more investors turn to Treasuries, richly valued tech stocks have been hit hardest.

______

3. Oracle Confident in Revenue Goal

Doug Kehring, Executive VP at software company Oracle, said at the company’s annual analyst meeting that he’s confident Oracle will reach its $65 billion annual revenue goal by fiscal year 2026.

Oracle also aims to raise its operating margin to 45% by 2026 and grow annual EPS by more than 10%.

The company is expanding its cloud business to meet booming demand from AI computing workloads.

Last year, Oracle acquired electronic medical records firm Cerner, which has underperformed. Oracle plans to shift focus toward its cloud segment.

Year-to-date, Oracle shares are up 38%.

______

4. NYC Mayor Announces Zoning Overhaul

Today, New York City Mayor Eric Adams unveiled a major zoning overhaul aimed at adding 100,000 new housing units over 15 years to accommodate 250,000 people.

Adams announced that two to four additional residential stories can be added atop ground-level commercial space, and up to 800 square feet can be added to single- or two-family homes.

With many New Yorkers struggling to find affordable housing, Adams said the overhaul will bypass complex zoning and construction approval processes and genuinely increase housing stock.

New York’s complex rules and regulations have long been an obstacle to housing development.

______

5. Nearly Half of Young Americans Live With Parents

A new survey shows that nearly half of young Americans now live with their parents.

Since the pandemic, inflation, student debt, and job challenges have made living at home more common—and less stigmatized.

Among 4,106 surveyed U.S. adults, 90% said living with parents is not shameful but a practical decision.

Carol Sigelman, a social psychology professor at George Washington University, said the current economic climate makes living alone difficult.

Roughly 23 million Americans aged 18–29 live with their parents—a 45% share, comparable to the 1940s.

______

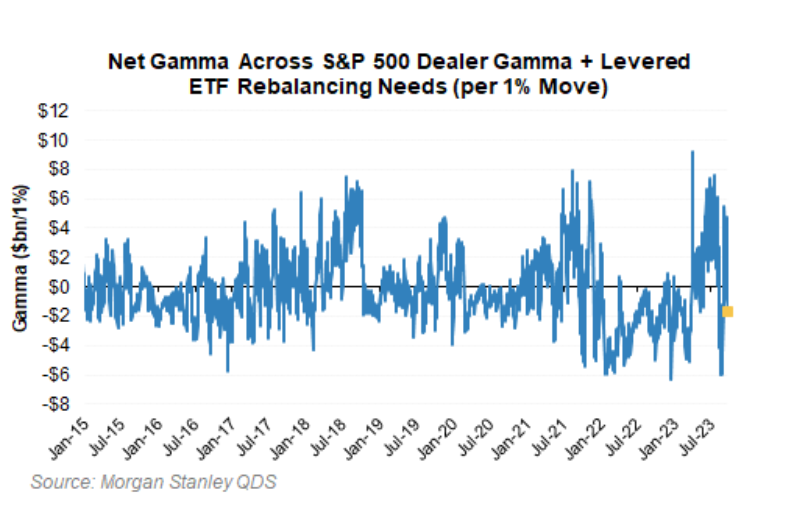

6. Morgan Stanley Warns Equity Investors

Morgan Stanley’s trading desk warned that Thursday’s hawkish Fed commentary has made stocks and other risk assets increasingly fragile, and that the selloff could intensify.

On Thursday, the S&P 500 fell below its 100-day moving average—a key negative signal.

Morgan Stanley traders estimate that if the market drops 1%, they could offload $7 billion in stocks. A 2% decline could trigger $18 billion in sales.

Before August, traders were piling into equities, but momentum has since reversed.

______

7. SL Green Becomes Most Shorted REIT

According to S3 Partners, SL Green Realty is now the most shorted REIT in the U.S., with 26% of its float sold short.

In contrast, Alexandria Real Estate Equities—which is down 29% this year—has only 2.5% of its float shorted.

SL Green’s portfolio is considered high quality, with 55% of assets located near Grand Central and Park Avenue, and 90% in Midtown Manhattan. The high short interest is difficult to justify.

Year-to-date, SL Green shares are up 11%, outperforming the broader office REIT sector’s 19% decline.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.