—— U.S. Homebuilder Confidence Hits Lowest Since May; S4 Capital Shares Plunge 65%; Crypto VC Raises $580M; Microsoft Product Chief Joins Amazon; Vegas Hotel Took 23 Years to Build; CRE Loans Present Opportunity; Two PE Firms Sue Morgan Stanley

1. U.S. Homebuilder Confidence Hits Lowest Since May

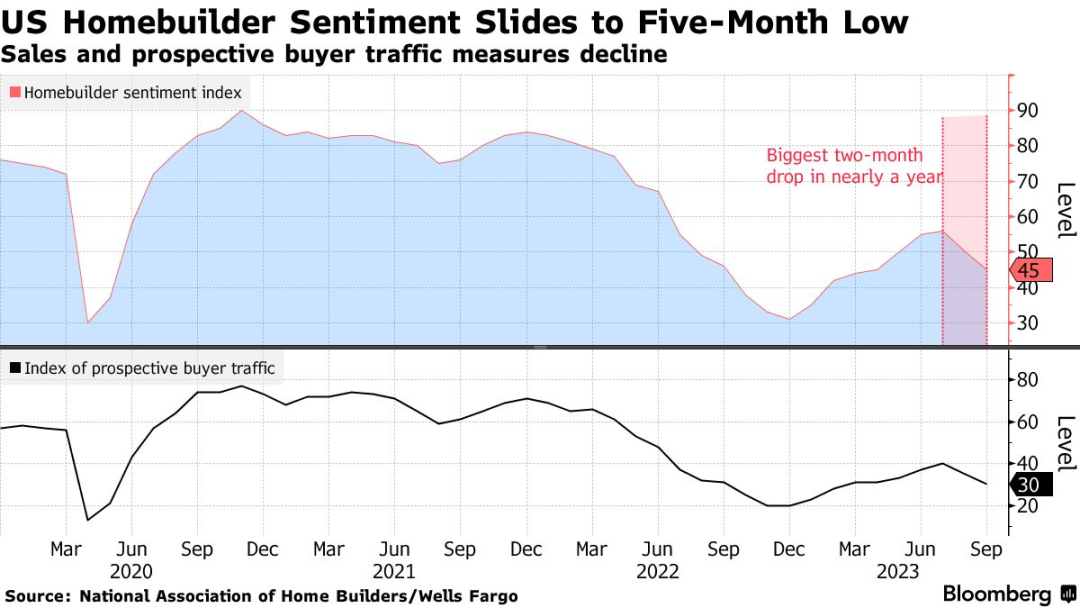

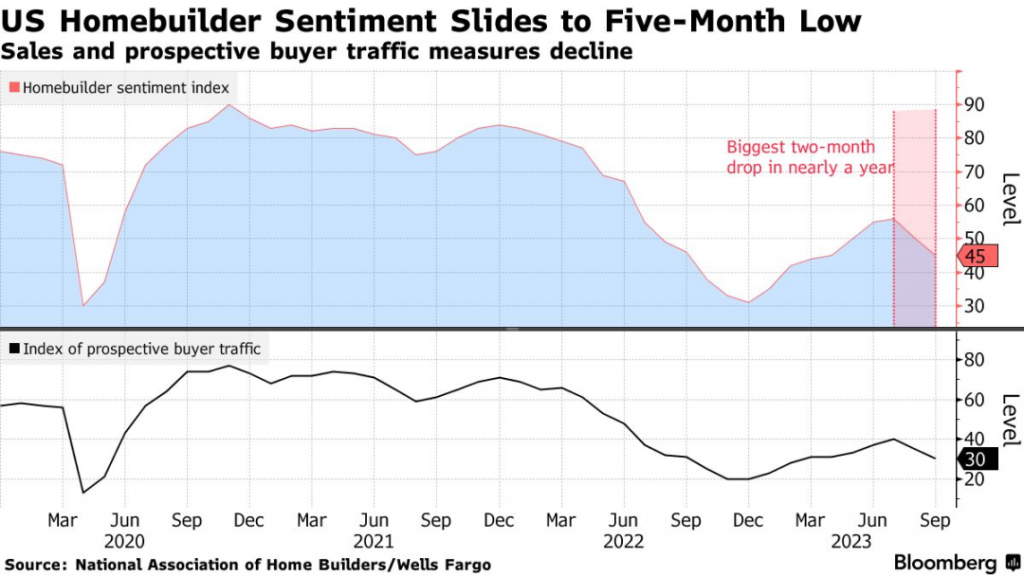

This month, the National Association of Home Builders (NAHB) reported a 5-point drop in its builder confidence index to 45 — the lowest level in five months and the steepest two-month decline in a year.

From early this year through July, builder confidence had gradually recovered due to limited supply of existing homes. But with mortgage rates climbing past 7%, demand for new homes may be affected.

NAHB Chief Economist Robert Dietz stated in a release that high rates are likely causing many buyers to delay purchases until long-term rates come down significantly.

NAHB found that nearly 33% of builders are offering price cuts to boost sales — the highest share in a year.

______

2. S4 Capital Shares Plunge 65%

Today, digital advertising firm S4 Capital saw its shares plunge 30% to a record low after posting dismal earnings and cutting its full-year revenue forecast for the second time.

CEO Mary Basterfield told investors that many of the company’s large tech clients have grown more cautious in recent months.

Many advertising firms have been affected by reduced ad spending from tech giants, but S4 appears hit hardest. Year-to-date, S4 shares are down 65%.

The ad industry has lost the growth momentum it enjoyed during the pandemic, as tech companies cut ad budgets.

______

3. Crypto VC Firm Raises $580 Million

Crypto-focused VC firm Blockchain Capital has raised $580 million for two new funds — the largest fundraising round in the firm’s 10-year history.

Managing over $2 billion in assets, Blockchain Capital plans to invest in crypto startups, with a focus on decentralized finance (DeFi), gaming, and crypto infrastructure.

Fund VI will target early-stage startups, while the Opportunity Fund will back later-stage companies.

Investors include Visa, PayPal, and the Texas Teachers Retirement System.

______

4. Microsoft Product Chief Joins Amazon

Sources revealed that Amazon.com is set to hire Microsoft’s product chief Panos Panay to lead its Alexa and Echo smart speaker divisions.

Panay played a major role in the launch of Microsoft’s Surface computers and announced today that he’s leaving Microsoft.

Amazon will hold its annual new device event this Wednesday at its Virginia campus.

Last year, Amazon’s devices division laid off many staff amid slowing growth and project cancellations.

______

5. Vegas Hotel Took 23 Years to Build

On December 13, Florida real estate mogul Jeffrey Soffer will open the long-awaited Fontainebleau Las Vegas.

The $3.7 billion resort includes seven pools, 36 restaurants and bars, and a rooftop private club with city views.

At 67 stories tall, the resort is the tallest building in Nevada. But what’s most surprising isn’t its height — it’s the time it took to build.

Soffer bought the land in 2000 but lost the nearly finished project during the 2008 financial crisis. Billionaire Carl Icahn took over the project for a time.

In 2021, Soffer reacquired the unfinished site for less than its original development cost and completed it himself.

Soffer, now 55, says this must be one of the craziest stories in the real estate industry.

______

6. CRE Loans Present Opportunity

Marathon Asset Management CEO Bruce Richards said the biggest opportunity in distressed debt today is in commercial real estate.

Managing $20 billion in assets, Marathon is bidding on a $33 billion portfolio of CRE loans formerly held by Signature Bank, mostly tied to NYC multifamily properties.

Richards also sees opportunity in well-run companies burdened by excessive debt. With tough lending conditions, thousands of small businesses need capital.

On September 5, the FDIC formally began the sale and auction of the loan portfolio.

______

7. Two PE Firms Sue Morgan Stanley

Certares Management LLC and Knighthead Capital Management LLC filed a lawsuit today in New York State court seeking $750 million in damages from Morgan Stanley.

The firms allege that Morgan Stanley unlawfully altered the structure of a loan deal related to Brightline Holdings. Brightline is also named as a defendant.

Morgan Stanley is suspected of cozying up to Brightline and its parent Fortress to gain access to future profitable deals.

Morgan Stanley issued a statement saying the claims are without merit and that it will vigorously defend itself.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.