— Apple Loses $200 Billion in Market Cap; Jobless Claims Fall Below Expectations; Ford Raises Wages for 8,000 Hourly Workers; Deloitte Reports Leading Revenue Growth; Pinault Acquires Hollywood Talent Agency; Brookfield Plans $2.5B Resort Sale; AI Startup Imbue Raises $200M

1. Apple Loses $200 Billion in Market Cap

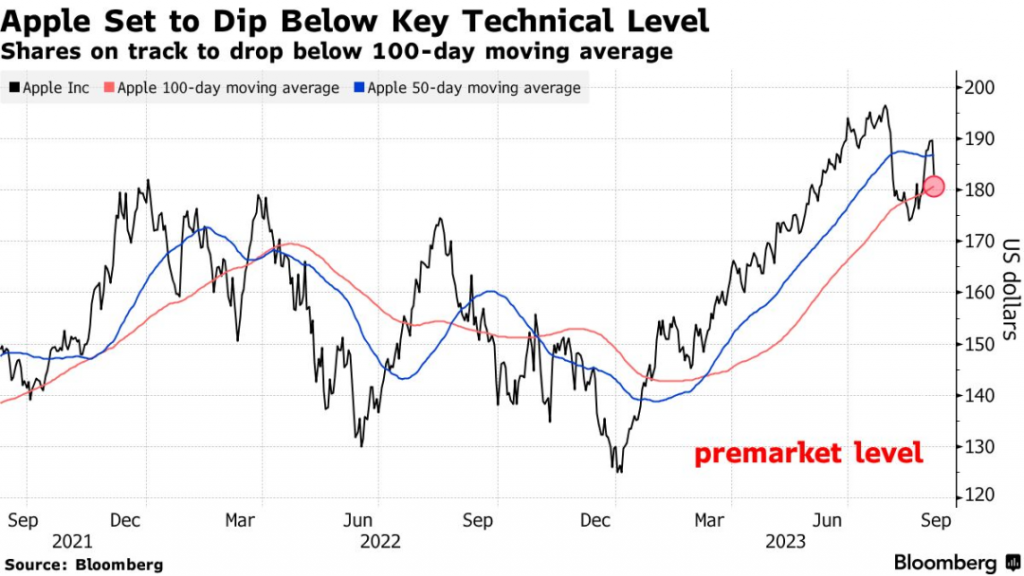

Before markets opened today, Apple’s stock dropped as much as 3.2%, wiping out $194 billion in market capitalization over two days. As Apple is the largest component of many major U.S. indexes, broader markets also declined this week.

The drop was triggered by China’s announcement banning government and state-owned enterprise employees from using Apple products.

However, Wedbush Securities analyst Daniel Ives, who remains bullish on Apple, said the iPhone ban is being overblown. He estimates that Apple will sell 45 million iPhones in China over the next year, with the new policy affecting fewer than 500,000 units.

Apple’s stock may break below its 100-day moving average — a key technical threshold.

______

2. Jobless Claims Fall Below Expectations

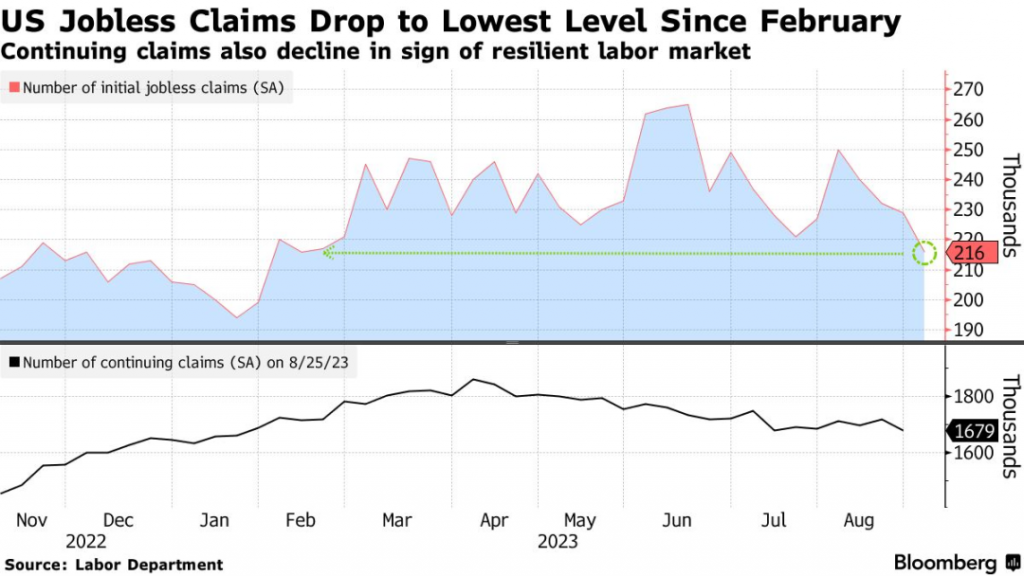

The U.S. Department of Labor reported today that initial jobless claims for the week ending September 2 fell by 13,000 to 216,000 — below all economists’ forecasts.

Continuing claims for the week ending August 26 dropped to 1.68 million, the lowest since July.

Oxford Economics U.S. economist Nancy Houten said that while the labor market is cooling, demand and supply remain tight, meaning interest rates may stay higher for longer.

Strong hiring and limited layoffs continue to support the economy and consumer spending.

______

3. Ford Raises Wages for 8,000 Hourly Workers

Ford Motor Company announced today that it will raise wages for 8,000 U.S. hourly workers represented by the United Auto Workers (UAW), just ahead of the September 14 contract expiration deadline, potentially avoiding a major strike.

Under the new agreement, workers will receive a $4.33 hourly raise — $9,000 more annually. Previously, it took 8 years to reach Ford’s $32 top hourly wage; now it will take just 4 years.

Ford VP Bryce Currie said the company values its hourly workers and plans to offer even more benefits in the next contract round.

The last UAW-Ford contract negotiation was in 2019; contracts typically last 4 years.

______

4. Deloitte Reports Leading Revenue Growth

Deloitte reported today that its revenue for the fiscal year ending May 31 rose 15% to $64.9 billion — leading the Big Four accounting firms.

The firm noted that many client companies are upgrading IT and digital services, with tech consulting performing strongly. Deloitte also launched AI and metaverse consulting offerings.

Consulting — Deloitte’s largest business — continued to grow rapidly, with revenue up 19.1% to $29.6 billion.

Although M&A activity slowed, Deloitte said restructuring work helped offset the revenue decline.

Globally, Deloitte’s headcount grew 11% to 457,000 employees last fiscal year.

______

5. Pinault Acquires Hollywood Talent Agency

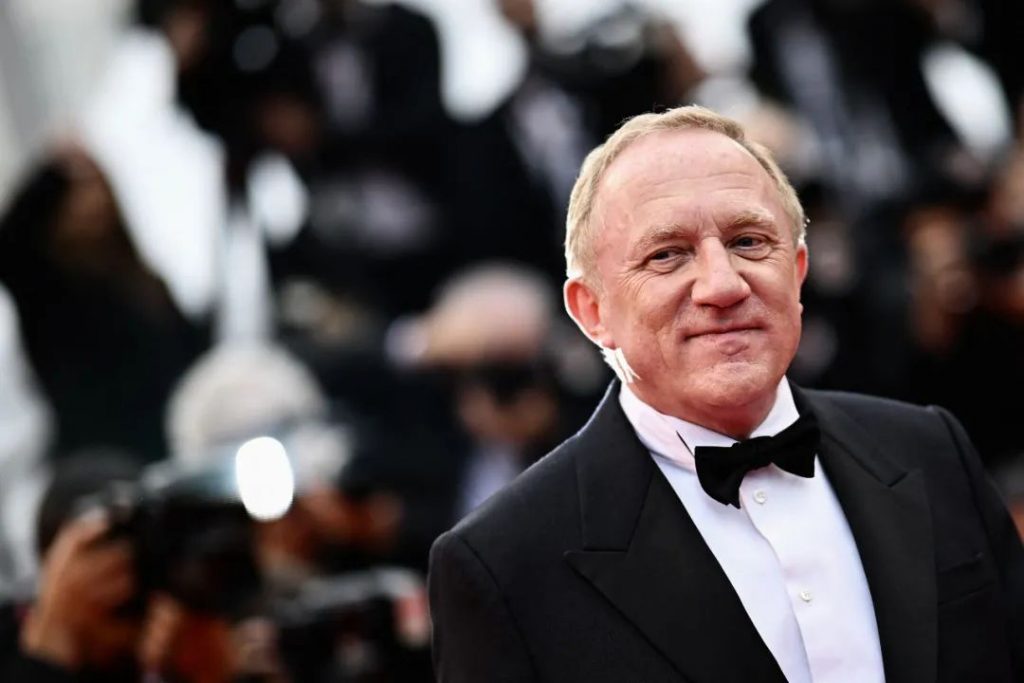

French billionaire François Pinault’s holding company Artemis has agreed to acquire a majority stake in Hollywood talent agency Creative Artists Agency (CAA).

Founded in 1975, CAA represents numerous entertainment and sports celebrities, including Pinault’s wife, Salma Hayek.

Artemis owns luxury fashion brands such as Gucci and Saint Laurent, and Pinault is also chairman of luxury group Kering.

The transaction may value CAA at around $7 billion.

______

6. Brookfield Plans $2.5B Resort Sale

Sources say Brookfield Asset Management is exploring a sale of its luxury resort Atlantis Paradise Island Bahamas, with a potential price tag of up to $2.5 billion.

Brookfield is working with advisors to gauge buyer interest in the resort, which includes hotels, event spaces, and a water park.

Brookfield acquired the resort via debt restructuring in 2012; it was originally developed by South African hotel magnate Sol Kerzner.

To date, Brookfield has invested $100 million in renovations.

Brookfield first attempted to sell the asset in 2019, but plans were delayed by the pandemic.

______

7. AI Startup Imbue Raises $200M

AI language model startup Imbue has raised $200 million in a funding round that included Nvidia, bringing its valuation above $1 billion.

The round was led by crypto billionaire Jed McCaleb’s nonprofit Astera Institute, with additional investment from Cruise CEO Kyle Vogt.

Other AI startups like OpenAI, Anthropic, Cohere, and Inflection AI have each raised hundreds of millions of dollars.

Imbue aims to develop systems that allow users to build their own AI tools and experience the power of AI firsthand.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.