—— Amazon Builds Satellite Calibration Facility; American Express Net Profit Hits Record High; AutoNation New Car Sales Rise; US Student Loans May Impact GDP; ‘Barbie’ Posts Strong Box Office Debut; Unemployment Near Record Lows in 25 US States; Energy Trader Salaries Double

1. Amazon Builds Satellite Calibration Facility

Amazon plans to build a $120 million Kuiper satellite processing facility in Florida, near the Kennedy Space Center and several satellite launch sites.

The facility will calibrate Kuiper satellites prior to launch. Similar to SpaceX satellites, Kuiper satellites operate in low Earth orbit and provide broadband internet services.

Steve Metayer, Amazon’s Vice President responsible for Kuiper satellite production and operations, stated that due to the size and launch frequency of Kuiper satellites, the company must develop specialized facilities.

CEO Andy Jassy said in April that hundreds of millions of people worldwide still lack internet access, and that Kuiper’s business could become very large.

______

2. American Express Net Profit Hits Record High

American Express (Amex) reported that its credit card network volume rose 8% to $426.6 billion in Q2, setting a new record but falling short of analysts’ $441.6 billion forecast.

Amex stated that travel and entertainment spending rose by 14%, with dining expenditures surpassing airfares and hotels.

CFO Jeff Campbell noted that the pandemic-era habit of ordering takeout persists even after economic reopening.

In Q2, Amex’s cost growth was lower than expected, and net income reached a record $2.17 billion. The company projects full-year revenue growth of 15% to 17%.

______

3. AutoNation New Car Sales Rise

AutoNation, the largest US auto dealership chain, reported Q2 revenue of $6.89 billion, beating Wall Street’s forecast of $6.75 billion.

Adjusted EPS came in at $6.29, exceeding the Wall Street average estimate of $5.89.

New car inventory shortages eased, driving new car sales up 12% to $3.3 billion. However, used car inventory dropped 11%, leading to a 17% decline in used car sales revenue to $2.1 billion.

Luxury and domestic vehicle gross profit per unit fell 25% to $4,600, and used car gross profit declined 3% to $1,870.

______

4. US Student Loans May Impact GDP

According to a new Oxford Economics report, once student loan repayments resume this October, US consumer spending could decrease by up to $9 billion monthly, or over $100 billion annually.

After repayments resume, US GDP growth could shrink by 0.1% in 2023 and 0.3% in 2024, increasing the risk of recession.

Student loan repayments were paused in March 2020, with an average monthly repayment of around $400.

Recent increases in Americans’ savings could help cushion the repayment burden.

______

5. ‘Barbie’ Posts Strong Box Office Debut

Warner Bros. announced today that the Barbie-themed blockbuster Barbie earned $22.3 million in early screenings on Thursday.

Barbie outperformed Guardians of the Galaxy Vol. 3 ($17.5 million) and Top Gun: Maverick ($19.3 million) in early box office numbers.

On Wednesday, lucky fans attended a special “Barbie Blowout Party” premiere event, where those dressed in pink received free candy and prizes.

With a stronger debut than Top Gun: Maverick, Barbie could become a major box office hit in 2023.

______

6. Unemployment Near Record Lows in 25 US States

The US Bureau of Labor Statistics reported today that unemployment rates in 25 states are within 0.1% of historic lows. New Hampshire and South Dakota both posted the lowest unemployment rate at 1.8%.

However, California’s unemployment rate rose by 0.7% year-over-year to 4.6%, mainly due to tech layoffs impacting Silicon Valley.

Employment numbers in New York and Hawaii also remain below pre-pandemic levels.

Nevada holds the highest unemployment rate nationwide at 5.4%.

______

7. Energy Trader Salaries Double

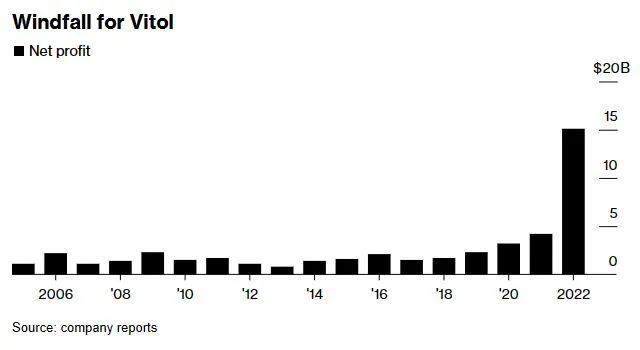

Thanks to massive volatility in the energy market, commodity trading giant Vitol Group earned a record $15.1 billion last year.

According to audited financials seen by Bloomberg, Vitol’s 3,311 employees received an average salary and bonus package of $785,000 in 2022 — double the previous year.

More than 450 partner-level managers and traders received $2.5 billion in shareholder dividends.

In 2022, Vitol’s net profit surged 258% year-over-year, exceeding the combined total profit from the previous six years.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.