—— US Inflation Rate Falls to 3%; Montage to Build $500 Million Resort; Carrefour Acquires French Supermarket Chains; Boston Offers Tax Incentives for Office-to-Housing Conversions; Musk Launches AI Company; Nvidia Interested in Arm Investment; Sequoia Heritage Eyes Real Estate Investments

1. US Inflation Rate Falls to 3%

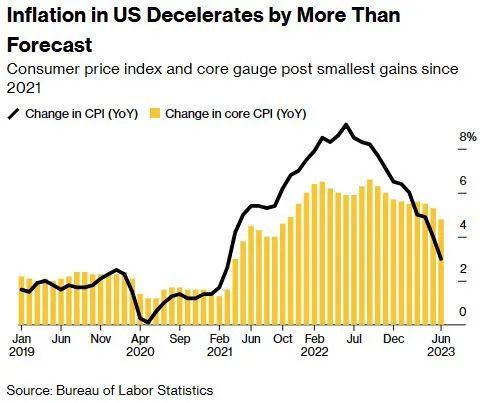

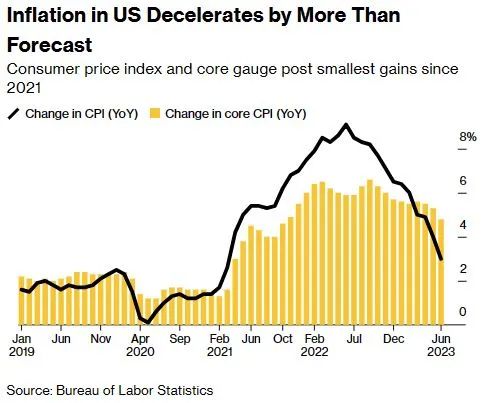

Today, the US Bureau of Labor Statistics released its latest data showing that in June, the US CPI rose 3% year-over-year, marking the smallest increase in more than two years. Additionally, the CPI rose 0.2% compared to May, below economists’ expectations.

Excluding food and energy, the core CPI rose 4.8% year-over-year, the lowest since 2021, providing hope that the Federal Reserve might end rate hikes sooner.

Following the release, US Treasury yields fell, the S&P 500 Index rose, and the dollar weakened. The likelihood of another Fed rate hike after this month has now dropped below 50%.

Richmond Fed President Thomas Barkin stated today that inflation is still well above the 2% target, and if vigilance is relaxed too soon, inflation could rebound sharply.

A rate hike this month by the Fed is almost certain, but the probability of further hikes afterward has decreased.

______

2. Montage to Build $500 Million Resort

Today, Montage International announced it has partnered with developer Dine to build two resorts in Riviera Nayarit, Mexico.

The properties include a 140-room Montage resort and a 115-unit Pendry hotel, with a total development cost of $500 million, scheduled to open in 2026.

Montage CEO Alan Fuerstman stated that the brand is well recognized in North America, and there is strong interest from other global regions.

Currently, Montage and its Pendry brand have 14 properties. New developments are underway in the Bahamas, Saudi Arabia, and the US.

Last year, billionaire Tilman Fertitta acquired Montage’s Laguna Beach hotel.

______

3. Carrefour Acquires French Supermarket Chains

Today, Carrefour announced it would acquire the French Cora hypermarkets and Match supermarkets from Louis Delhaize Group for $1.2 billion.

The all-cash deal is expected to close in the summer of 2024, covering 60 hypermarkets and 115 supermarkets primarily located in eastern and northern France, where Carrefour has a smaller presence. Last year, these stores generated €5.2 billion in net revenue.

Carrefour said the acquisition would help expand its home market footprint, marking its largest domestic acquisition in over 20 years.

Carrefour stated that the acquisition would be accretive to EPS in the first year.

______

4. Boston Offers Tax Incentives for Office-to-Housing Conversions

This week, Boston Mayor Michelle Wu announced a major tax incentive plan to encourage developers to convert office spaces into residential units—potentially reducing annual property taxes from $250,000 to $26,000 on a $10 million property.

According to CBRE data, Boston’s office vacancy rate rose to 14.2% in the second quarter, the highest in 20 years. Meanwhile, housing costs have surged, with median one-bedroom rent up 8% year-over-year to $2,800.

Wu emphasized the need to boost housing affordability to accommodate current and future residents.

Boston hopes that offering a 29-year, up to 75% tax reduction will effectively spur office conversions.

Major cities like Boston, New York, and San Francisco face similar challenges, and Boston could become a test case.

______

5. Musk Launches AI Company

Several months ago, Musk stated he would create an AI chatbot company similar to ChatGPT. Today, the company xAI officially launched its website, listing 12 employees led by Musk, from DeepMind, Microsoft, Tesla, and the University of Toronto.

Musk had previously participated in OpenAI’s development but left the board in 2018 and has since criticized it, claiming Microsoft now fully controls OpenAI.

Although Musk is entering AI, he remains cautious; in March, he urged developers to pause training powerful AI models to prevent rapid, uncontrolled development.

Musk now oversees six companies, including Tesla and xAI.

______

6. Nvidia Interested in Arm Investment

Sources revealed that Nvidia is interested in investing in chip designer Arm, although there are valuation disagreements—Nvidia values Arm at $35 billion to $40 billion, while Arm believes it’s closer to $80 billion.

If Nvidia successfully invests, Arm’s planned IPO in September could gain greater momentum and support.

Many private tech companies are closely watching Arm’s IPO. A successful IPO could boost confidence among tech firms and investors.

Arm could become the largest IPO since Rivian’s listing at the end of 2021.

______

7. Sequoia Heritage Eyes Real Estate Investments

Sequoia Capital’s $16.4 billion wealth management arm, Sequoia Heritage, is considering investments in credit and real estate for the first time.

Due to US-China geopolitical tensions, Sequoia Heritage and venture capital firm Sequoia Capital are preparing to split, with Heritage seeking opportunities that do not overlap with venture investments.

Heritage’s returns are private, but filings show that as of April 30, the firm managed $16.4 billion, up from $4.2 billion in 2018.

The Financial Times previously reported that Heritage achieved a 73% net return during the year following June 2020.

After the split from Sequoia Capital, Heritage’s network and resources might be affected.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.