— EQT Plans £4.6 Billion Takeover of Dechra; Disney+ Losses May Widen Further; Golf Boom Cools as Callaway Plunges; Honda Raises Forecast on Supply Chain Gains; Global Luxury Home Prices Fall for the First Time in Over a Decade; Safety Risk Found in 2 Million Peloton Bikes; BlackRock Revamps Alternative Investments Division

1. EQT Plans £4.6 Billion Takeover of Dechra

Sources reveal that Swiss private equity firm EQT AB is seeking £1.2 billion in acquisition loans from banks and private credit funds to complete the privatization of veterinary pharmaceutical firm Dechra Pharmaceuticals. The deal is set to be one of the largest take-private transactions in the UK this year.

Due to the current scarcity of high-profile, large-scale debt issuance, both banks and private credit funds are showing strong interest in providing the loan. Lenders are reportedly offering loan packages worth £1 billion to £1.2 billion, equivalent to 5 to 6 times Dechra’s EBITDA. The funds will likely be issued in either euros or US dollars.

EQT plans to acquire Dechra for £4.6 billion, a 51% premium over its closing share price prior to the news.

With few high-profile M&A deals in recent years, this transaction is attracting significant attention from banks and credit funds.

______

2. Disney+ Losses May Widen Further

On Wednesday, Walt Disney reported that its Direct-to-Consumer (DTC) segment — which includes Disney+ — posted a $659 million loss in the fiscal second quarter, significantly narrower than the $850 million loss analysts had expected and less than half of the loss recorded two quarters earlier.

Meanwhile, the company’s traditional television business, which includes ABC and ESPN, also showed clear signs of weakening demand.

CFO Christine McCarthy told analysts during an earnings call that this quarter’s loss may grow by another $100 million, mainly due to higher marketing expenses.

To improve profitability, Disney launched an ad-supported Disney+ tier last December and raised the ad-free monthly subscription fee by 38% to $11.

Disney shares fell as much as 4.8% after hours to $96.26. Streaming remains a capital-intensive business, and fierce content and pricing competition make major losses almost inevitable.

______

3. Golf Boom Cools as Callaway Plunges

On Wednesday, golf apparel and equipment company Topgolf Callaway Brands lowered its full-year net profit forecast, citing signs that the golf boom triggered by the pandemic may be losing steam.

The company also revised its outlook on same-store sales at its high-tech golf venues downward, which caused the stock to drop more than 13%.

CFRA analyst Zachary Warring downgraded his rating on the stock from “buy” to “hold” in a client note, citing concerns that demand for golf equipment — which surged during the pandemic — could now be softening.

Golf experienced a renaissance during COVID, as the sport naturally facilitated social distancing and outdoor activity. Capitalizing on this trend, Callaway decided in late 2020 to acquire the remaining shares of golf venue operator Topgolf, valuing the deal at $2 billion.

Golf surged during the pandemic, boosting demand for Callaway’s equipment and venues — but that momentum now appears to be fading.

______

4. Honda Raises Forecast on Supply Chain Gains

Honda Motor announced today that it expects to achieve ¥1 trillion in operating profit for the fiscal year ending March 2024, surpassing analyst estimates.

Net income is also expected to reach ¥18.2 trillion, in line with market forecasts. The upward guidance is attributed to lower material costs and strong motorcycle sales.

Honda aims to shift its entire lineup to EVs by 2040 and sell only EVs in China by 2035. However, the company has yet to release an electric vehicle for the mass market. It is currently working with Sony on a joint EV project named Afeela.

In April, CEO Toshihiro Mibe revealed that Honda would partner with TSMC to strengthen the resilience of its chip supply chain.

With collaborations involving TSMC and several battery manufacturers, Honda has made significant progress in securing its supply chain.

______

5. Global Luxury Home Prices Fall for the First Time in Over a Decade

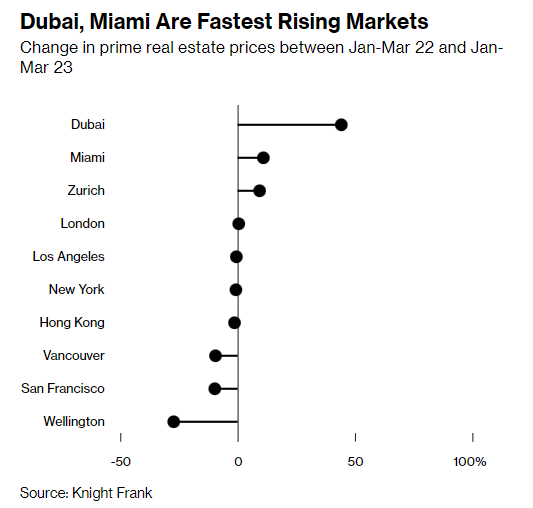

According to new data from real estate consultancy Knight Frank, in Q1, the global luxury housing price index — tracking the top 5% of property values across 46 cities — declined by 0.4% year-on-year, marking the first drop since 2009. That compares sharply with a 10% gain in Q4 2021.

Several cities in New Zealand led the decline with double-digit drops. High-end home prices also fell in San Francisco, New York, Los Angeles, Hong Kong, and Vancouver.

Liam Bailey, global head of research at Knight Frank, attributed the cooling trend to tighter global monetary policy.

The good news is that most cities in the index still saw luxury price gains, with Dubai and Miami posting double-digit increases. Dubai’s high-end property prices rose 44% in Q1 and have surged 149% since March 2020.

______

6. Safety Risk Found in 2 Million Peloton Bikes

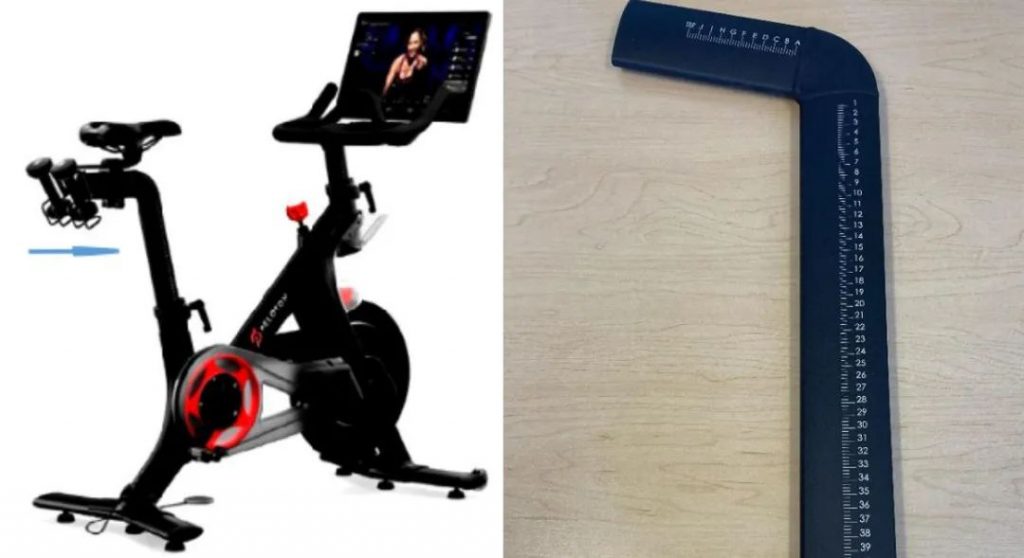

The U.S. Consumer Product Safety Commission (CPSC) announced today that over 2.2 million Peloton Interactive exercise bikes have defective seat posts and that consumers should stop using them immediately. Peloton will ship replacement seat posts for self-installation, and returns are not required.

Following the news, Peloton shares dropped 7% to $7, the lowest level since October.

Peloton identified the seat post defect earlier this month and said it has caused injuries to at least 13 people.

Over the past few years, Peloton has issued four major equipment recalls, including one involving its high-end treadmill pedals, which led to a child’s death. That product was pulled for two years, and refunds were issued.

The seat post on more than 2 million Peloton bikes poses a breakage risk, and the company urges all users to stop using the bikes immediately.

______

7. BlackRock Revamps Alternative Investments Division

BlackRock, which manages $300 billion in alternative assets, plans to establish teams more specifically focused on private credit and direct equity investment strategies.

Jim Keenan, who previously oversaw global credit, will now be fully responsible for private credit. Rick Rieder will take charge of leveraged finance, high yield, and credit strategies, as well as the traditional fixed-income division.

Edwin Conway, who formerly led BlackRock’s alternative investment division, will now oversee strategies related to venture capital, growth equity, and private equity.

Following the reorganization, different investment strategies will fall under distinct alternative asset units within BlackRock.

Conway noted that investors used to view private markets as a substitute for fixed income or equity, but today they have become a necessary part of clients’ portfolios.

In response, BlackRock plans to build more specialized teams to strengthen its private investment platform.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.