—— U.S. Job Openings Fall Below 10 Million; Walmart Cuts 2,000+ Warehouse Jobs; LBO Loans Struggle to Find Buyers; Warner Plans Harry Potter Series; Meta Becomes Hottest Tech Stock; PIMCO Backs Mortgage-Backed Bonds; GM Overtakes Ford in EV Sales

1. U.S. Job Openings Fall Below 10 Million

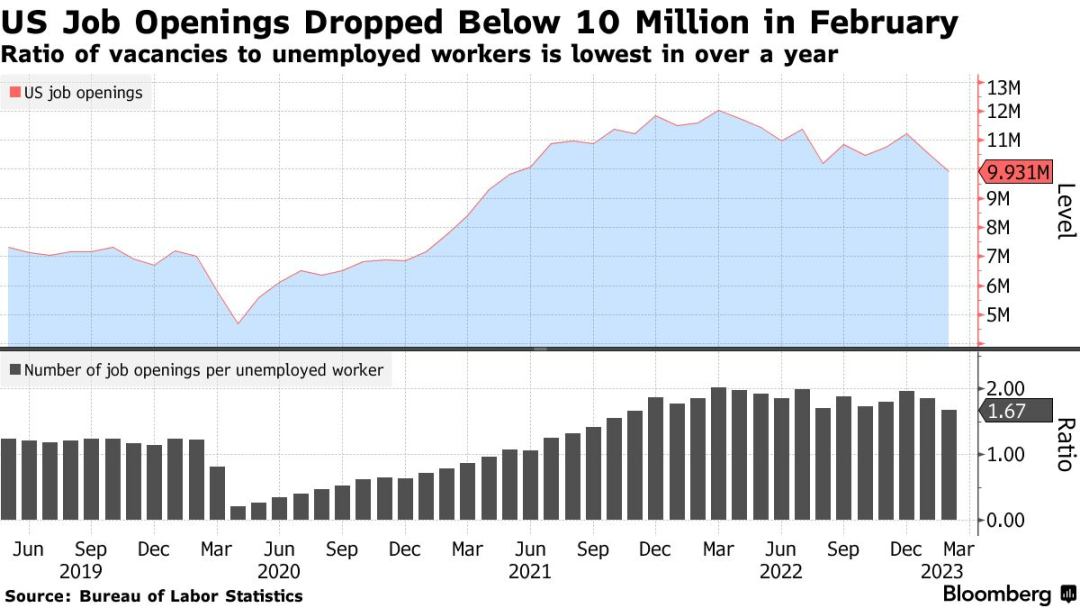

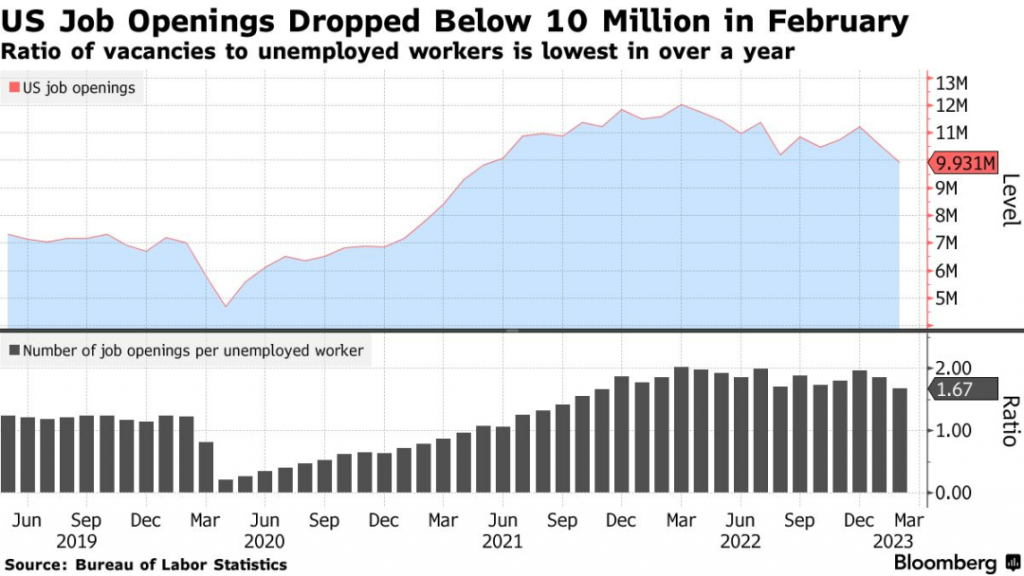

According to the U.S. Department of Labor’s JOLTS survey, job openings fell from 10.6 million in January to 9.9 million in February, falling short of all economists’ forecasts.

The new data may indicate that labor supply is moving toward a more balanced level. There are now 1.67 job openings per unemployed worker, down from 1.9 a month earlier, and the lowest since November 2021.

By industry, job openings rose in construction and entertainment but fell most sharply in professional services, healthcare, social assistance, transportation, manufacturing, and energy.

Fewer job openings mean less competition for hiring, which could ease wage inflation.

______

2. Walmart Cuts 2,000+ Warehouse Jobs

According to Walmart’s regulatory filings, the company plans to cut over 1,000 workers at its e-commerce warehouse in Fort Worth, Texas, as well as 600 in Pennsylvania, 400 in Florida, and 200 in New Jersey.

A company spokesperson said Walmart is rebalancing staffing between retail stores and logistics centers to better handle online orders. Some workers may be reassigned rather than laid off.

So far, Walmart has avoided mass layoffs on the scale seen at Amazon and other tech firms.

Because Walmart can relocate many workers, the net number of layoffs remains uncertain.

______

3. LBO Loans Struggle to Find Buyers

A banking syndicate including Goldman Sachs, Bank of America, and Credit Suisse is trying to sell high-risk acquisition loans tied to the leveraged buyout of Citrix Systems.

Sources say banks are offering steep discounts to investors, which could result in realized losses exceeding $600 million. They are also attempting to offload $3.8 billion in second-lien bonds at 78 cents on the dollar.

Over the past year, economic uncertainty and bond market volatility have made it difficult for investment banks to find institutional buyers for buyout debt. As the Fed keeps hiking rates, investor appetite for riskier bonds has faded, forcing banks to sell at deep discounts.

Higher Fed interest rates mean greater market risk and make government bonds more attractive by comparison.

______

4. Warner Plans Harry Potter Series

Two sources say Warner Bros. is close to acquiring the streaming rights for a new TV series based on the Harry Potter book series.

Author J.K. Rowling wrote seven books, and the show is expected to span seven seasons—one for each book.

Warner Bros. CEO David Zaslav hopes the Harry Potter series will become a cornerstone of HBO’s new streaming strategy.

Although J.K. Rowling has approved stage plays and theme park projects, she has not yet approved any new film or TV series. She is expected to be involved during the show’s production to ensure fidelity to the storyline.

Over the past 25 years, the Harry Potter book series has sold 600 million copies worldwide.

______

5. Meta Becomes Hottest Tech Stock

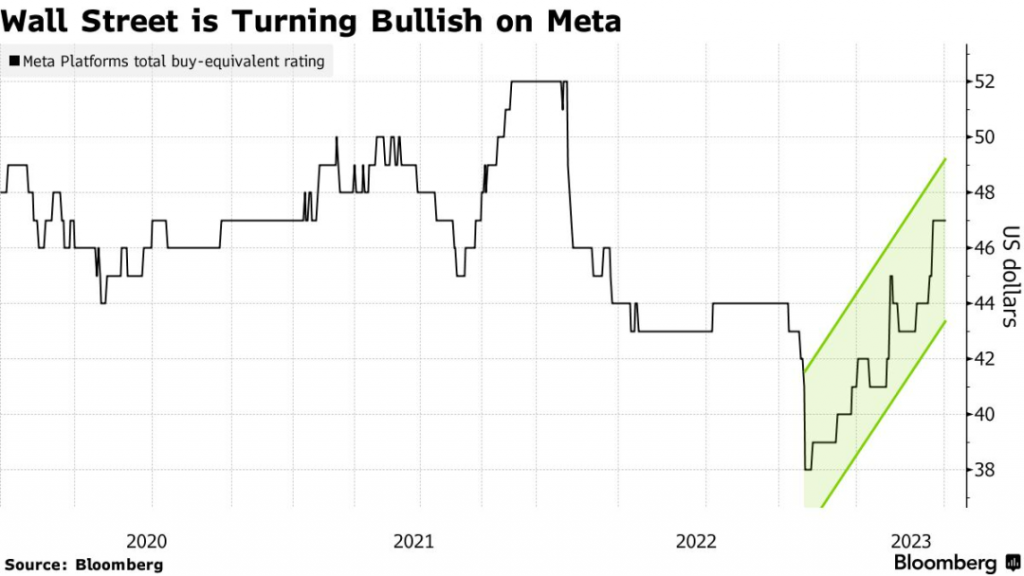

Bloomberg data shows that more than 20 brokerage firms raised their price targets for Meta after the company announced a second round of layoffs. Wall Street analysts also raised Meta’s EPS forecast by 15%.

Morgan Stanley’s Brian Nowak upgraded Meta stock to “buy” after five months on the sidelines.

Analysts bullish on Meta argue that despite a decline in advertising revenue, the company’s cost-cutting measures have helped stabilize its operations.

Mike Akins, founding partner of ETF Action, said Meta has “adjusted” to Apple’s privacy restrictions, and its recent stock surge may be a rebound from prior over-selling.

Meta stock has rebounded 140% from its 7-year low in November 2022.

______

6. PIMCO Backs Mortgage-Backed Bonds

PIMCO, which manages $1.7 trillion in assets, warned in a new report that the recent banking crisis and Fed rate hikes may trigger a sharp tightening in U.S. credit conditions—possibly accelerating a broader economic crisis.

Tiffany Wilding, PIMCO’s North American economist, wrote that in today’s environment, bonds provide greater diversification and asset protection—and may still have room to appreciate.

The 10-year U.S. Treasury yield has fallen from a March high of 4.09% to 3.28%.

PIMCO favors asset-backed bonds over high-risk corporate credit.

______

7. GM Overtakes Ford in EV Sales

According to a statement from Ford Motor, it sold 10,866 electric vehicles in the U.S. in Q1, up 41% year-over-year—but still behind General Motors’ 20,670 units.

Sales of Ford’s electric Mustang Mach-E fell 19.7% to 5,407 units. Due to battery fire-related recalls, Ford also lost at least five weeks of F-150 Lightning truck production.

Ford CEO Jim Farley had aimed to become the No. 2 EV maker behind Tesla and plans to invest $50 billion in electric vehicle development by 2026. However, the company now expects a $3 billion loss on EV sales this year.

Tesla controls two-thirds of the U.S. EV market and remains the undisputed leader.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.