1. WeWork Files for Bankruptcy

2. New $4.1 Billion Private Credit Fund Launched

3. AI Accounting Startup Raises $60 Million

4. Trump Faces Court Over Inflated Assets

5. U.S. Household Debt Surges by $200 Billion

6. Point72 Founder Bids for Casino License

7. Carlyle Announces Layoffs Amid Fundraising Slump

1. WeWork Files for Bankruptcy

WeWork, once valued at $47 billion in 2019, officially filed for Chapter 11 bankruptcy protection in New Jersey this Monday.

Under Chapter 11 of the U.S. Bankruptcy Code, WeWork can continue operating while negotiating debt repayment with creditors.

Recently, WeWork reached a $3 billion debt restructuring deal with SoftBank and existing creditors but forfeited most of its equity stake.

CEO David Tolley said the company is seeking to terminate over 60 leases and renegotiate with landlords under court supervision.

As of June 30, WeWork operated 777 locations across 39 countries. Although occupancy rates are close to 2019 levels, the company has remained unprofitable.

Court filings show WeWork has $19 billion in liabilities and $15 billion in assets.

______

2. New $4.1 Billion Private Credit Fund Launched

Kennedy Lewis Investment Management recently launched a $4.1 billion private credit fund, surpassing its $3 billion target. The fund focuses on loans that traditional banks typically avoid, and half of its capital has already been deployed.

Private credit has become one of Wall Street’s hottest trends this year. As banks tighten lending, pensions, sovereign wealth funds, insurers, and other institutions are stepping in.

Co-founder David Chene says investors are flush with capital and eager to deploy it in this space. He believes private credit is a long-term trend. The firm avoids leveraged buyouts and focuses on healthcare, energy, and real estate development loans.

Current private credit yields exceed risk-free rates by 500 to 700 basis points, offering attractive returns.

______

3. AI Accounting Startup Raises $60 Million

Black Ore Technologies, a company developing AI tools for the financial services industry, announced today it has raised $60 million.

The round was co-led by Andreessen Horowitz and Oak HC/FT, with participation from General Catalyst, Peter Thiel’s Founders Fund, Khosla Ventures, SV Angel, and various fintech executives.

Black Ore’s platform simplifies accounting and financial tasks. Its Tax Autopilot tool uses AI to learn federal and state tax codes and rapidly prepare tax filings.

The company currently has only 20 employees and plans to use the new funds to expand its user base and hire more staff.

______

4. Trump Faces Court Over Inflated Assets

According to Bloomberg’s Billionaires Index, former President Donald Trump’s net worth has risen to $3.1 billion, up from $2.6 billion in 2021.

Thanks to corporate relocations and migration to Florida, revenue from his Mar-a-Lago and Doral resorts has surged 50% compared to 2019.

He also sold his Washington hotel and paid off debt, boosting his cash reserves and lowering his liabilities to their lowest in over a decade.

However, New York Attorney General Letitia James has sued Trump, alleging he greatly inflated asset values.

For example, the state values Mar-a-Lago at $27.6 million, while Trump claimed it’s worth $612 million. In court Monday, Trump argued his valuations were conservative, citing his brand’s premium.

Since leaving office, Trump’s wealth has grown by $500 million.

______

5. U.S. Household Debt Surges by $200 Billion

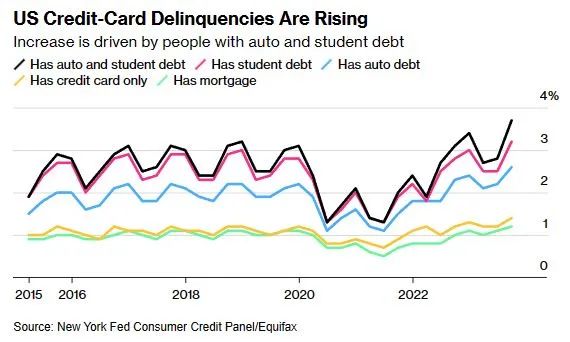

According to a report released today by the New York Fed, U.S. household debt grew by $228 billion last quarter. Credit card debt alone rose by $48 billion to $1.08 trillion — marking eight consecutive quarters of increases.

Many Americans are falling behind on student and auto loans, yet credit cards continue to fuel consumer spending and economic growth.

The Fed noted that most delinquency rates now exceed pre-pandemic levels. Lawmakers must closely monitor how consumers manage their debt loads.

Delinquencies rose most sharply among Americans born between 1980 and 1994.

______

6. Point72 Founder Bids for Casino License

Steve Cohen — owner of the New York Mets and founder of hedge fund Point72 — is partnering with Hard Rock International to bid for a casino license next to Citi Field in Queens.

Roughly a dozen firms are competing for three large-scale downstate casino licenses in New York.

If successful, Cohen plans to develop a casino called Metropolitan Park with Hard Rock and SHoP Architects. The project would also include a 20-acre public park, a new subway station, and a Queens food market.

The total cost is estimated at $8 billion, and the project would create 15,000 permanent jobs.

______

7. Carlyle Announces Layoffs Amid Fundraising Slump

Carlyle Group CEO Harvey Schwartz announced that the firm will lay off staff to reduce costs after disappointing fundraising performance.

In September, Carlyle shut down its U.S. consumer, media, and retail divisions, laying off some investment professionals. Insiders say the U.S. leveraged buyout team was also affected.

Last quarter, Carlyle cut annualized costs by $40 million, 85% of which came from staff reductions. Schwartz says the savings will be redirected to higher-potential areas.

Carlyle manages $400 billion and hired former Goldman Sachs exec Schwartz as CEO in February.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.