1. Blackstone Lists Defaulted Loan at Half Price;

2. China’s GDP Grows 5.2%;

3. Verizon Writes Down $5.8 Billion in Goodwill;

4. US Retail Sales Beat Expectations;

5. Surge of Capital in VC Secondary Markets;

6. Burger King to Acquire Largest Franchisee;

7. Schwab’s Net Income Nearly Halved.

1. Blackstone Lists Defaulted Loan at Half Price

Over a year ago, Blackstone defaulted on a $308 million commercial mortgage backed by a Manhattan office building.

Sources say Midland Loan Services and broker Jones Lang LaSalle are now jointly marketing the CMBS-packaged loan for $150 million — more than a 50% discount.

Back in September, CBRE was hired to sell the loan but pulled the listing shortly after.

The 26-story office tower between 55th and 56th streets was appraised at $175 million last April — 71% lower than the original 2014 valuation of $605 million.

The loan was transferred to special servicing in March 2022 when Blackstone chose to stop repayment due to poor asset performance.

______

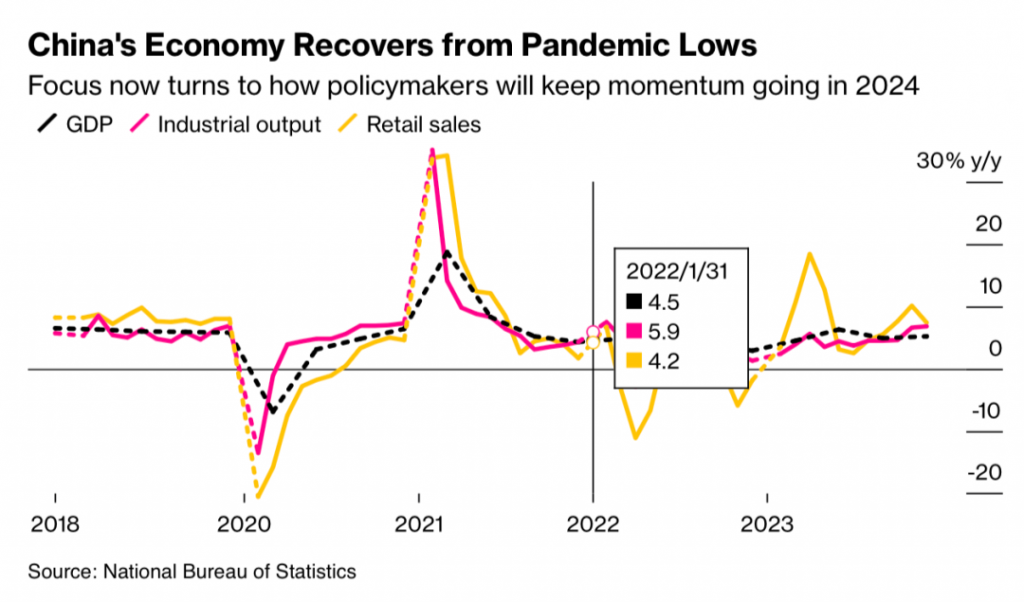

2. China’s GDP Grows 5.2%

China’s National Bureau of Statistics reported that GDP grew by 5.2% in 2023, meeting the government’s ~5% target.

However, persistent pressures from the real estate crisis and falling prices continue to weigh on the economy.

In Q4, the price index dropped 1.5%, marking the third consecutive quarterly decline.

December housing prices saw the steepest fall since 2015, and spending on development and renovation dropped 7.8% YoY. New home construction fell 20.9% compared to 2022.

Economists say the government may need to strengthen stimulus to ensure more sustainable recovery in 2024.

______

3. Verizon Writes Down $5.8 Billion in Goodwill

Verizon Communications disclosed in a regulatory filing that it would take a $5.8 billion non-cash goodwill impairment charge on its enterprise segment due to increased industry competition and economic headwinds.

As of year-end 2023, the segment was valued at $1.7 billion. Demand for legacy fixed-line communications continues to decline while mobile services rise.

In Q3, the unit reported $7.5 billion in revenue, down 4% YoY, missing expectations. The division has posted YoY declines in six of the last eight quarters.

Verizon shares fell 1.8% premarket.

______

4. US Retail Sales Beat Expectations

The U.S. Department of Commerce reported that December retail sales rose 0.6% MoM — the biggest gain in three months and above the 0.4% forecast.

Excluding autos, sales were up 0.4%, also beating expectations of 0.2%.

Sales rose in 9 of 13 categories, with apparel and general merchandise leading. Auto sales rose 1.1%, tying May’s 2023 high.

Meanwhile, gasoline sales fell for the third straight month due to lower oil prices — but consumer spending remains robust entering 2024.

______

5. Surge of Capital in VC Secondary Markets

With IPO and M&A activity largely stalled, early investors in private startups have been selling shares at discounts.

Lexington Partners just launched a new $23 billion fund focused on venture secondary deals — buying early-stage startup stakes from LPs looking to exit. Around $5 billion will go to direct investments.

Lexington’s executives say many LPs are eager to offload underperforming VC holdings, presenting a ripe opportunity.

Other firms like StepStone, Pinegrove, and Brookfield have also launched similar funds.

______

6. Burger King to Acquire Largest Franchisee

Burger King parent Restaurant Brands International announced a $1 billion deal to acquire Carrols Restaurant Group, its largest U.S. franchisee.

The acquisition is expected to close in Q2. Restaurant Brands also plans to invest $500 million to renovate 600 of Carrols’ Burger King locations.

Burger King has struggled to compete with rivals like McDonald’s.

The brand aims to modernize stores, boost advertising, and enhance customer experience — targeting expansion from 300 to 400 locations.

______

7. Schwab’s Net Income Nearly Halved

Charles Schwab’s latest earnings show that Q4 net new assets fell 48% to $66.3 billion, while net income was nearly cut in half.

Bank deposits fell 21% to $290 billion, and active retail accounts missed analyst forecasts (34.8 million expected).

Customers have been shifting funds to higher-yield products, and Fed rate hikes have hurt Schwab’s investment portfolio.

CEO Walt Bettinger said Schwab is facing its most difficult period since the dot-com crash of 2000.

Shares fell as much as 7% premarket but later recovered somewhat.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.