1. Two Snack Giants Eye Merger

2. Nvidia CEO Offloads $500 Million in Stock

3. AI Chip Company Raises $640 Million

4. Google Search Ruled a Monopoly

5. Global Stocks Plunge Badly

6. Nvidia AI Chip Faces Production Challenges

7. Buffett Sells Nearly Half of Apple Stock

1. Two Snack Giants Eye Merger

Shares of Kellanova, parent company of the iconic Pringles brand, surged 20% today despite a broader market downturn, after reports that snack giant Mars is considering a buyout.

Kellanova has a market value of around $30 billion and could help Mars expand beyond its traditional focus on chocolate. Its product portfolio includes household snack names such as Pringles, Cheez-It, and Pop-Tarts.

In recent years, Mars has faced declining sales and slowing revenue growth, with global consumers’ purchasing power under pressure.

During the pandemic, many snack companies raised prices, which has now led to a drop in demand.

______

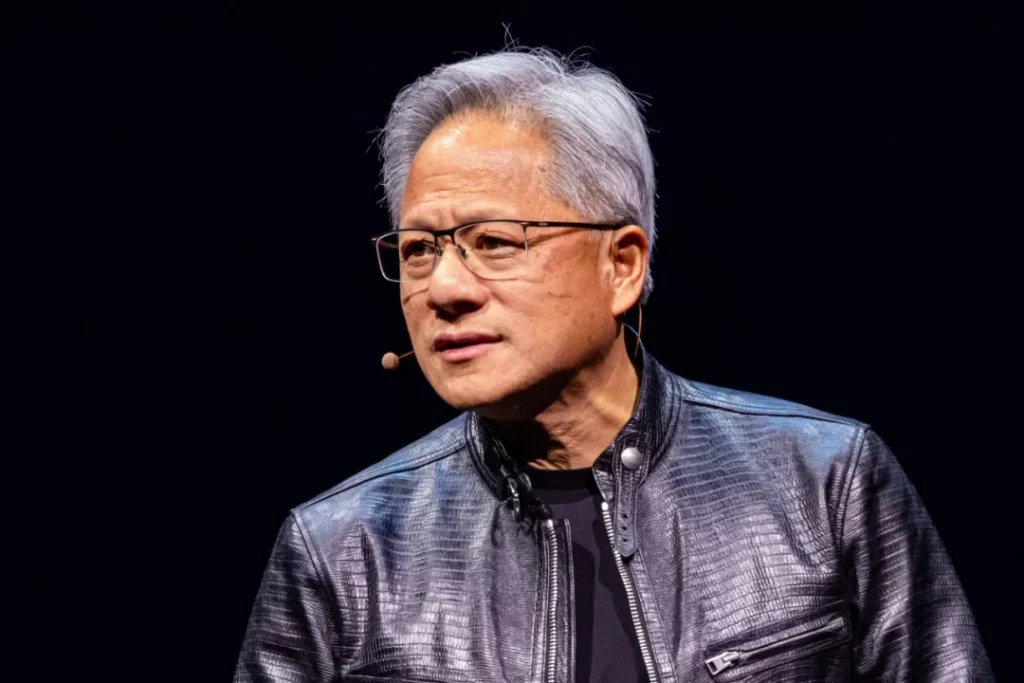

2. Nvidia CEO Offloads $500 Million in Stock

Since Nvidia shares hit record highs, founder and CEO Jensen Huang has sold nearly $500 million worth of stock. In July alone, he sold $323 million, just before tech stocks began to retreat.

According to Bloomberg, in July, Nvidia accounted for four of the top eight events contributing to the largest market cap losses. Huang’s net worth briefly surpassed $100 billion last month but has since dropped to $88.8 billion.

Regulatory filings show that several other top Nvidia executives have also sold stock worth hundreds of millions.

______

3. AI chip company raises $640 million

AI semiconductor and software design startup Groq, valued at $2.8 billion, has raised $640 million in its latest Series D funding round.

The new round was led by a number of BlackRock funds, with participation from investment arms of Cisco Systems and Samsung Electronics..

Groq plans to use the funding to develop 108,000 language processing units, hire more people, and possibly make acquisitions.

Former Intel executive Stuart Pann to serve as the company’s COO

______

4. Google Search Ruled a Monopoly

A U.S. federal judge ruled today that Google violated antitrust laws by paying mobile device manufacturers to make its search engine the default option.

Judge Amit Mehta in Washington stated that Google spent $26 billion to suppress competitors and secure its position as the world’s most-used search engine.

Google’s search engine generates approximately $300 billion in ad revenue annually.

______

5. Global Stocks Plunge Badly

Stocks in the U.S. and around the globe all closed sharply lower today due to a number of bearish factors, with Japan’s stock indexes posting their worst plunge in 37 years.

Today, the S&P 500 and the Nasdaq fell 3% and 3.4% respectively, marking their worst day since September 2022

Ninety-five percent of the companies in the S&P were not spared, with the companies that have risen the most this year falling the hardest today, including NVIDIA, which at one point tumbled 15 percent before the opening bell before narrowing to a 6 percent drop after the close.

Factors in the stock plunge included the Israel-Iran conflict, Warren Buffett’s sharp reduction in his Apple stake, and market concerns about the state of the U.S. economy.

Wall Street’s panic index, the VIX, spiked to a four-year high of 65 at one point today, soporific down to 38 in the afternoon

______

6. Nvidia AI Chip Faces Production Challenges

Nvidia’s next-generation AI chip for data centers, the Blackwell, is likely to face shipment delays due to production issues. Major clients including Microsoft, Google, Meta, Amazon, and startups like OpenAI are all counting on the chip to further their AI capabilities.

Analysts estimate that tech companies may spend up to $1 trillion per year on data center infrastructure over the next five years.

In a recent letter to investors, Elliott Management stated that Nvidia and other major tech firms are entering bubble territory, arguing that AI capabilities are currently overhyped.

Although Nvidia has already pre-sold the new chips, delays in delivery could impact the entire industry’s momentum.

______

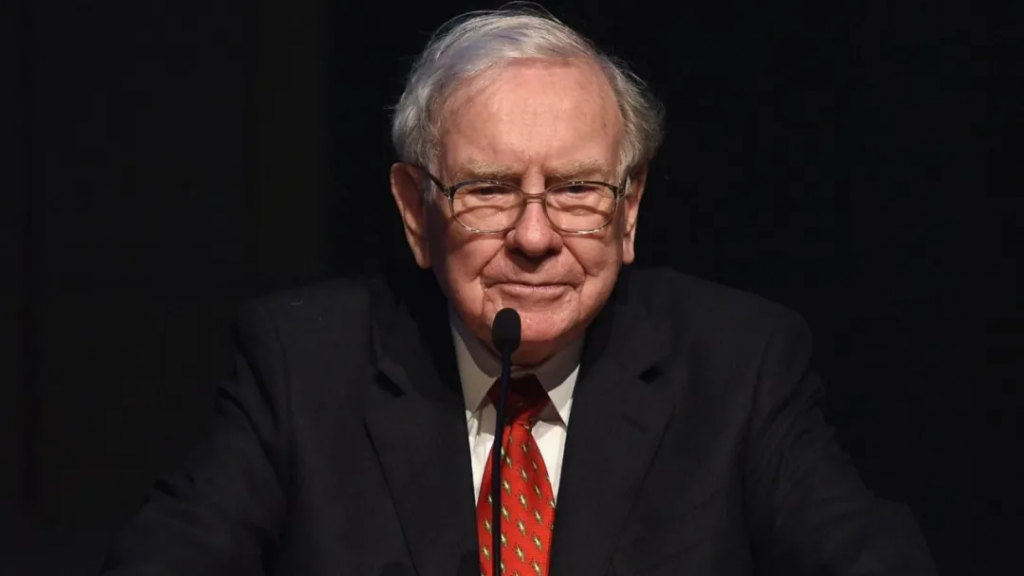

7. Buffett Sells Nearly Half of Apple Stock

The latest quarterly filing shows that Warren Buffett’s Berkshire Hathaway cut nearly 50% of its Apple holdings in Q2, reducing the stake to $75.5 billion.

Jim Shanahan, an analyst at Edward Jones who follows Berkshire closely, said the move is a strong sell signal, as such a large reduction is highly unusual.

In addition to Apple, Berkshire also offloaded significant portions of its U.S. bank holdings. Since mid-July, the value of its equity portfolio has declined by 8.8%.

Berkshire’s cash reserves have reached a record high of $276.9 billion.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.