1. New York MTA May Need $13 Billion Loan

2. U.S. Consumer Confidence Unexpectedly Drops

3. U.S. Home Price Growth Slows Down

4. U.S. Commercial Real Estate Shows Signs of Life

5. Elliott to Buy Miami Office Tower for $450 Million

6. Financial Firms Competing for Midtown Office Buildings

7. S&P 500 May Break Through 6,000 Points

1. New York MTA May Need $13 Billion Loan

The Metropolitan Transportation Authority (MTA) in New York warned that it may need to borrow $13 billion over the next five years to meet its capital investment needs, though borrowing comes with significant risks.

This Wednesday, the MTA will submit a budget proposal to the state government for 2025-2029, totaling $68.4 billion. Nearly half of the proposed projects lack funding support.

MTA CEO Janno Lieber stated that the agency can no longer fill budget gaps through new loans. Excessive borrowing would severely compress the operating budget, affecting staff recruitment and service quality.

Of the proposed budget, $65.4 billion will be allocated to upgrade subways, buses, and train tracks.

______

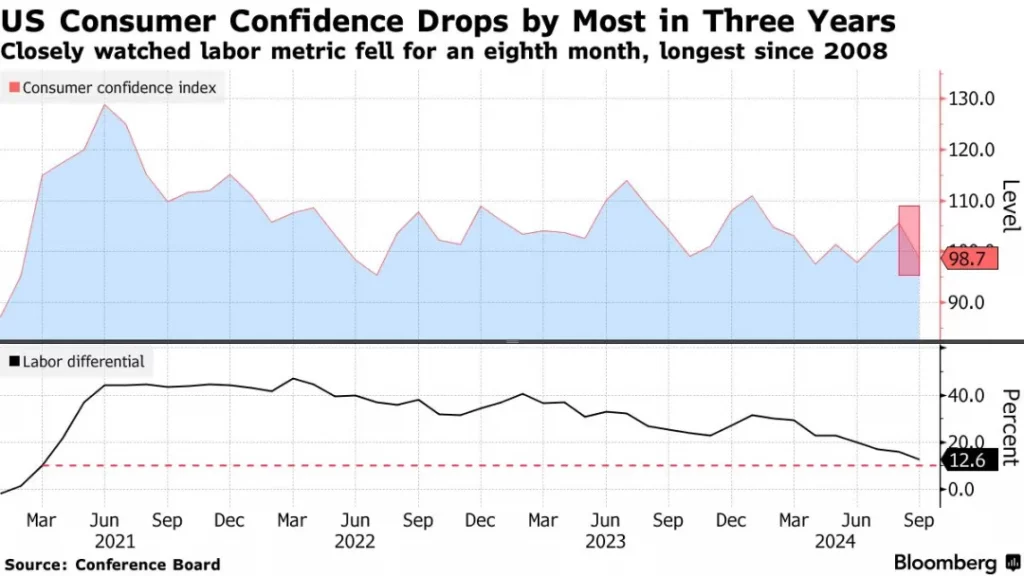

2. U.S. Consumer Confidence Unexpectedly Drops

The Conference Board’s latest data shows that the U.S. Consumer Confidence Index dropped by 6.9 points to 98.7 in September, marking the largest decline in over three years.

The index of confidence in the future six months also fell to 81.7, while the current conditions confidence index dropped to 124.3.

The recent cooling of the job market and persistent living costs have caused consumer confidence to remain well below pre-pandemic levels.

The percentage of consumers who think the job market is strong dropped to a low of 30.9% since 2021.

______

3. U.S. Home Price Growth Slows Down

In July, the S&P CoreLogic Case-Shiller Home Price Index showed a 5% year-over-year increase, down from June’s 5.5%, indicating that home price growth has slowed.

However, rising home prices still come with a significant cost, as eight markets saw a month-over-month decline. Excluding inflation, home price growth is still above the long-term average.

Realtor.com’s chief economist forecasts that home price growth may plateau and then accelerate again in the coming months, as mortgage rates continue to fall.

After seasonal adjustments, July’s home prices rose by 0.2% month-over-month, marking the 14th consecutive record high.

______

4. U.S. Commercial Real Estate Shows Signs of Life

Both buyers and sellers in the U.S. commercial real estate market are increasingly optimistic that the market is approaching the bottom.

Commercial real estate prices have dropped 22% from 2022, but signs of recovery are becoming more apparent. In recent months, many sellers have been forced to sell properties at low prices. Earlier this year, an office building in New York was resold at only 33% of its 2018 purchase price.

With the Federal Reserve’s recent rate cut, many property owners and creditors are eager to sell properties quickly to limit losses and recover funds for new investments.

David Avraham, founder of Maverick Real Estate Partners, stated that the market will be more active by 2025.

From January to July, commercial real estate transactions fell 5% quarter-over-quarter to $203.8 billion.

______

5. Elliott to Buy Miami Office Tower for $450 Million

Sources revealed that private equity firm Elliott Investment Management is close to acquiring a $450 million office tower in Miami’s Brickell district, with Nuveen Real Estate as the seller.

The Brickell area has attracted a large number of financial and tech companies, and Citadel is building a 54-story tower next to Elliott’s new building.

Office rents in Miami are even approaching those of Manhattan’s top buildings, and there is a severe shortage of available space for rent.

Earlier this year, Jones Lang LaSalle started marketing the tower, with an initial asking price of over $500 million.

______

6. Financial Firms Competing for Midtown Office Buildings

Since hitting a low in October last year, SL Green Realty REIT, which specializes in office buildings, has seen its stock price rise over 145%.

SL Green claims to be New York’s largest landlord and is also the biggest driver of the revival of office buildings along Manhattan’s Park Avenue.

Analysts note that SL Green has heavily invested in office buildings along Park Avenue and Century City in Los Angeles, two areas that have recently been targeted by financial and other firms.

In New York, demand for office buildings near Grand Central Station has surged as many financial employees are being required to return to the office. SL Green’s iconic building, One Vanderbilt, has helped make Midtown a hot office market.

The vacancy rate for office buildings along Park Avenue is below 10%, compared to 24% for all of Manhattan.

______

7. S&P 500 May Break Through 6,000 Points

David Kostin, Chief U.S. Equity Strategist at Goldman Sachs, stated in an interview today that he expects the S&P 500 Index to break through the 6,000-point mark in the next year, about 5% higher than its current level.

However, he warned investors that they will need to weather volatility in the weeks leading up to the U.S. presidential election. Historically, U.S. stocks tend to decline during this period, with volatility increasing.

Currently, strategists tracked by Bloomberg have set an average target of 5,523 for the S&P 500 Index.

Scott Rubner, a trader at Goldman Sachs, believes the S&P 500 could even break 6,000 by the end of this year.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.