—— Target Shares Tank 20%; Ukraine Fires UK Missiles at Russia; US Capital Markets Could Pick Up in 2025; Galderma Shareholders to Sell $1.4bn of Shares; Tesla Chair Sells $35mn of Shares Post-Election; Ford to Cut 4,000 People in Europe; NY Thanksgiving Travelers Could Reach New High

1. Target Shares Tank 20%

Target Corp. experienced a significant drop in share value on Wednesday, following the company’s revision of its full-year earnings forecast downward. This adjustment was prompted by stagnant sales and an overaccumulation of inventory, which negatively impacted profitability.

Company executives highlighted that U.S. consumers have reduced their spending on non-essential items like clothing and home products, contributing to a less favorable third-quarter performance compared to the more positive results reported by Walmart Inc. earlier in the week.

Target’s profit was further impacted by an excess of stockpiled goods, a strategy initially adopted in anticipation of a potential U.S. port strike last month. The costs associated with maintaining this larger inventory ended up being higher than expected, further eroding the company’s earnings.

The market response raises concerns about Target losing market share to Walmart, and whether similar challenges could affect other retailers. Analyst Adam Crisafulli from Vital Knowledge noted, “Weak results at Target underscores how a big part of Walmart’s strength is market share gains,” suggesting that consumer behavior remains cautious and selective, which may not spell good news for other retailers such as Kohl’s, Dollar General, and Dollar Tree.

The stock’s 18% plunge in New York was its most substantial single-day fall since May 2022, with shares trading without dividend rights on Wednesday.

Source: Bloomberg – Target Shares Tumble After Retailer Cuts Profit Outlook

______

2. Ukraine Fires UK Missiles at Russia

Ukrainian forces have used British cruise missiles to strike military targets within Russia, marking the first use of such Western-supplied long-range weaponry in the ongoing conflict that has surpassed 1,000 days.

The deployment of the Storm Shadow missiles by the UK was a response to Russia’s introduction of North Korean troops into the conflict, a move seen by the British government as an escalation. This information comes from a Western official who spoke on the condition of anonymity due to the sensitive nature of the details.

This action by Ukraine follows closely after their first utilization of US-made Army Tactical Missile Systems (ATACMS) to target a military site in Russia’s western Bryansk region.

This move came after the U.S. administration, led by President Joe Biden, gave the green light for Kyiv to use these systems on a limited basis to strike targets inside Russia.

Source: Bloomberg – Ukraine Fires UK Cruise Missiles at Russia for First Time

______

3. US Capital Markets Could Pick Up in 2025

Goldman Sachs Group Inc. CEO David Solomon anticipates that the capital markets will see further improvement under the policies expected from Donald Trump’s administration. During a CNBC interview on Wednesday, Solomon expressed optimism, noting that he observes signs of increased activity within his business and from conversations with clients, who seem ready to engage more actively following a period of waiting for favorable valuations and strategic timing.

Following Trump’s election victory, shares of major U.S. banks, including Goldman Sachs, surged, fueled by expectations of benefiting from Trump’s regulatory and tax policies. Goldman Sachs itself saw its shares jump over 13% to a record high the day after Trump’s win.

Similarly, JPMorgan Chase & Co. CEO Jamie Dimon suggested that the banking sector would thrive under the anticipated deregulatory environment, even remarking that bankers would be “dancing in the street” due to the lighter regulatory touch expected under Trump.

Source: Bloomberg – Goldman CEO Sees Capital-Markets Activity Accelerating Into 2025

______

4. Galderma Shareholders to Sell $1.4bn of Shares

A consortium of shareholders in Galderma Group AG, including EQT AB, the Abu Dhabi Investment Authority, and Auba Investment Pte, are selling a 6% stake in the skincare company. The stake, comprising 14.3 million shares, is valued at approximately 1.2 billion Swiss francs ($1.4 billion), as per the terms viewed by Bloomberg News.

The sale is being conducted through an accelerated book-building process and has already attracted sufficient orders to cover all the shares offered, indicating strong investor interest.

Major financial institutions like Morgan Stanley, Goldman Sachs Group Inc., UBS Group AG, Citigroup Inc., and Jefferies Financial Group Inc. are overseeing the transaction.

______

5. Tesla Chair Sells $35mn of Shares Post-Election

Robyn Denholm, Chair of Tesla Inc., profited significantly from selling shares this month, netting over $35 million following the surge in stock value after the U.S. election. Denholm exercised 112,390 stock options scheduled to expire next year on November 15, as detailed in a regulatory filing. These transactions were prearranged in July via a trading plan designed for U.S. company insiders, allowing them to sell shares strategically.

Tesla’s stock performance has been notably strong post-election, with the company’s market value increasing by more than $300 billion—a 38% rise since election day. Investors seem optimistic about Tesla’s prospects under the incoming administration, particularly given CEO Elon Musk’s support for President-elect Donald Trump.

After accounting for the exercise cost, Denholm’s total gain from the sale amounted to approximately $32.5 million.

______

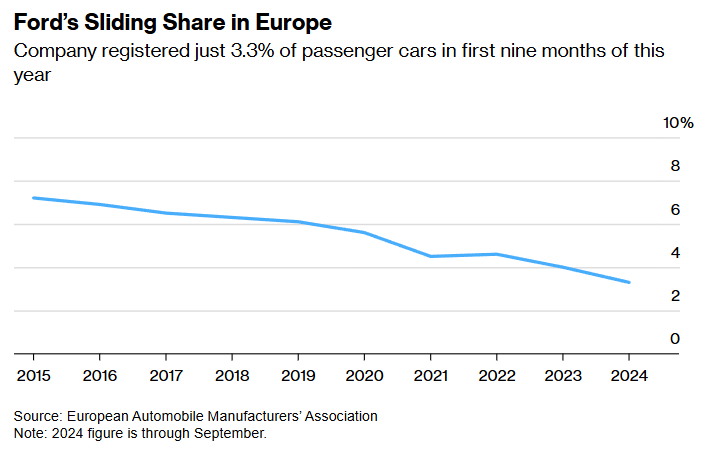

6. Ford to Cut 4,000 People in Europe

Ford Motor Co. is planning to cut an additional 4,000 jobs in Europe, deepening its cutbacks in a region where the automotive industry’s shift to electric vehicles (EVs) has been faltering. This move represents a 14% reduction in Ford Europe’s workforce, with the job cuts mainly affecting operations in Germany and the UK by the end of 2027, subject to discussions with unions and local governments.

Additionally, Ford has decided to scale back production of the Explorer and Capri EV models at its facility in Cologne, Germany. This decision is part of a broader strategy Ford announced in early 2021 aimed at nearly full electrification of its European product line by 2030. However, this transition has encountered significant challenges, as evidenced by the company’s announcement last year to eliminate 3,800 jobs.

The automotive industry across Europe, including major players like Volkswagen AG and Stellantis NV, has been experiencing a slowdown in vehicle sales and reduced governmental incentives for EV purchases, leading to profit warnings from several companies.

______

7. NY Thanksgiving Travelers Could Reach New High

New York City is gearing up for a record-breaking influx of travelers this Thanksgiving, leading to anticipated congestion at the region’s airports and on its roads. The Port Authority of New York and New Jersey forecasts that 8.7 million people will pass through its facilities, including airports, bridges, and tunnels, from November 25 to December 2, setting a new record for the Thanksgiving travel period.

The Port Authority expects approximately 3.2 million passengers will transit through Newark Liberty International, LaGuardia, New York Stewart International, and John F. Kennedy International airports during the eight-day span, marking a 2% increase from last year. Additionally, 5.5 million vehicles are projected to utilize the bridges and tunnels, maintaining the same level of traffic as in 2023.

To ease traffic flows and reduce potential disruptions, all non-emergency roadwork at vehicular crossings will be suspended from the Wednesday before Thanksgiving until the following Monday.

______

This content is sourced from Financial Times, Bloomberg, and The Real Deal, among other financial news outlets.