—— Goldman Sees China Stocks Go Up 20%; Key US Treasury Yields Surge Past 4%; Major US Landlord Hires Ex-Goldman CFO; Hurrican Milton Approaches Florida at 160mph; Starboard Takes $1bn stake in Struggling Pfizer; Jefferies Analyst Thinks Apple AI Hype is Overblown; Saudi PIF to Buy 40% Stake of Selfridges

1. Goldman Sees China Stocks Go Up 20%

Goldman Sachs Group Inc. has upgraded its outlook on Chinese stocks to “overweight,” joining other optimists who highlight the potential benefits of Beijing’s stimulus measures. According to a note dated October 5 by strategists including Tim Moe, indices tracking China’s equities could increase by another 15%-20% if authorities follow through on policy actions.

Despite the recent gains, valuations remain below historical averages, earnings prospects are improving, and global investors are still underexposed to Chinese stocks, they noted.

The recent stimulus steps have boosted market confidence that policymakers are taking more decisive actions to mitigate risks to economic growth, the strategists added.

______

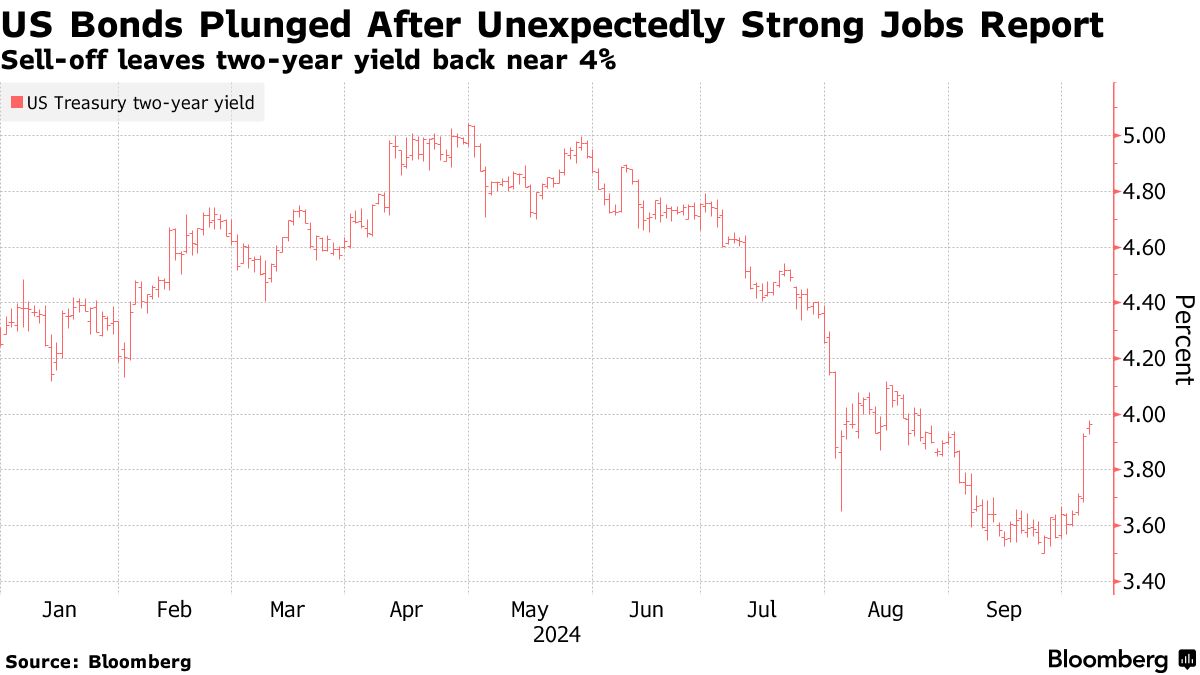

2. Key US Treasury Yields Surge Past 4%

For the first time in nearly 50 years, dockworkers have walked out of every major port along the US East and Gulf coasts, staging a strike that could significantly impact the world’s largest economy and create political challenges just weeks before the presidential election.

The 36 affected ports, which together handle up to half of all US trade volume, have ceased container operations and auto shipments. While energy supplies and bulk cargo won’t be directly affected, some exceptions are being made for military goods and cruise ships.

The overall impact of the strike, spanning from Houston to Miami and New York-New Jersey, will largely depend on its duration. According to JPMorgan Chase & Co., the shutdown, which began at 12:01 AM EST on Tuesday, is expected to result in economic losses ranging from $3.8 billion to $4.5 billion per day.

Shipping congestion caused by a week-long strike would take approximately a month to resolve, according to Grace Zwemmer from Oxford Economics.

______

3. Major US Landlord Hires Ex-Goldman CFO

Stephen Scherr, the former Chief Financial Officer of Goldman Sachs Group Inc., is making a return to Wall Street by taking on a leadership role at Pretium, one of the largest investors in the U.S. housing market. Scherr starts this week as co-president of the $55 billion investment firm, which is a major landlord of single-family homes in the U.S. Founded by his former Goldman colleague Don Mullen, Pretium has expanded rapidly. Scherr will share his position with Jon Pruzan, former CFO of Morgan Stanley, who was recruited by Mullen last year.

Mullen, 66, emphasized the need for strong leadership as the firm grows, saying, “I need to have people around me who can run the place if something happens to me. There’s a lot to do now.” Scherr, 60, spent the majority of his career at Goldman, serving as finance chief for his last three years until stepping down in 2021. He later led Hertz Global Holdings Inc. before stepping down from that role in March, following challenges related to the company’s investments in electric vehicles.

At Pretium, Scherr returns to the familiar field of finance, this time focusing on residential real estate, a market that has been reshaped by large investors. Mullen previously made a smart move by acquiring homes at discounted prices in California and Arizona after the U.S. foreclosure crisis.

______

4. Hurrican Milton Approaches Florida at 160mph

Hurricane Milton has intensified into a catastrophic Category 5 storm as it approaches Florida’s west coast, prompting residents to evacuate inland in a region still recovering from the damage caused by Hurricane Helene. The U.S. National Hurricane Center reported that Milton’s winds have surged to 160 miles per hour (257 kilometers per hour), up from 90 mph earlier on Monday morning. This makes Milton one of the most powerful storms in the Atlantic this year, alongside Hurricane Beryl, which impacted Texas, Mexico, and the Caribbean in July.

With winds this strong, Milton poses a severe threat, capable of destroying homes, uprooting trees, and causing widespread power outages that could last for weeks or even months. While hurricanes often struggle to maintain their peak intensity for long, Milton may weaken as it nears Florida.

Historically, only four Category 5 hurricanes have made landfall in the U.S., including Hurricane Michael, which hit Florida’s Panhandle in 2018.

______

5. Starboard Takes $1bn stake in Struggling Pfizer

Activist investor Starboard Value has acquired a stake worth approximately $1 billion in Pfizer Inc. and is looking to drive a turnaround at the struggling pharmaceutical company, according to a source familiar with the situation. Starboard has reached out to former Pfizer executives Ian Read and Frank D’Amelio for assistance, and both have shown interest in getting involved, though their specific roles remain unclear.

Read served as Pfizer’s CEO from 2010 to 2018 and was responsible for selecting current CEO Albert Bourla as his successor, while D’Amelio was the company’s CFO from 2007 to 2021.

Details about Starboard’s exact plans for Pfizer have not yet been disclosed. However, the investor has noted dissatisfaction among shareholders and analysts over Pfizer’s prolonged challenges following the pandemic, the source added.

______

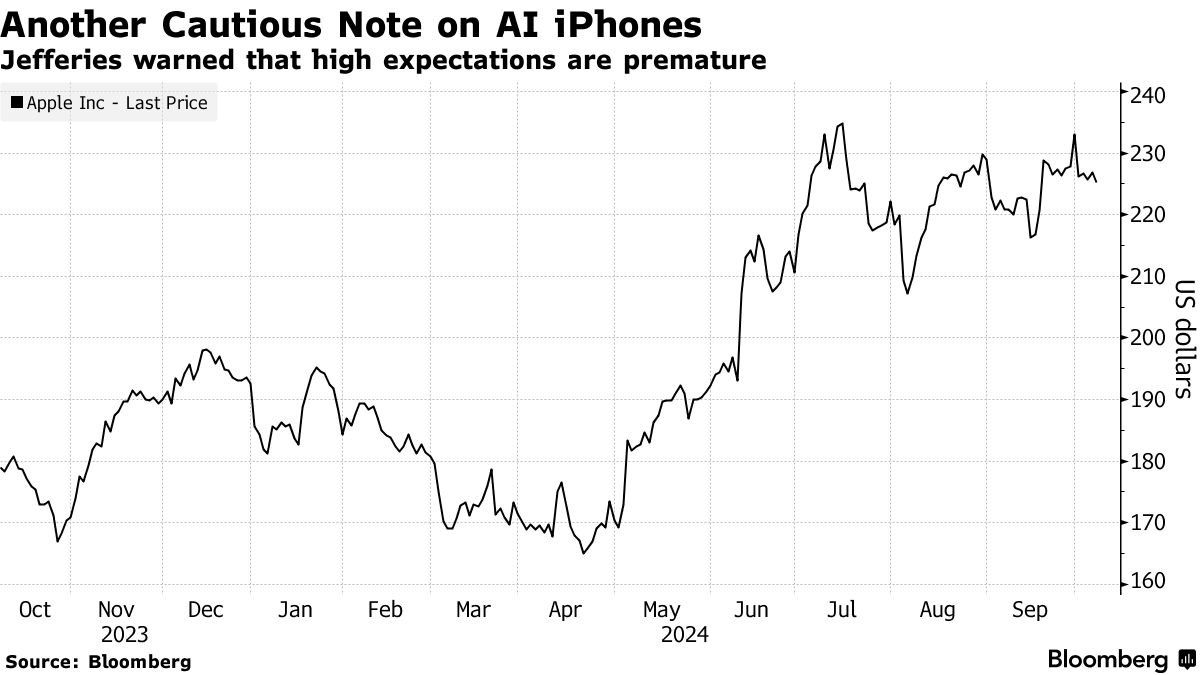

6. Jefferies Analyst Thinks Apple AI Hype is Overblown

Apple Inc. shares dropped over 1% after Jefferies analyst Edison Lee warned that investor expectations for the company’s latest iPhones, which feature artificial intelligence tools for the first time, are overly optimistic. Lee, who initiated coverage of Apple with a hold rating—downgrading it from a previous buy—stated that expectations for iPhone 16/17 growth are premature, citing the lack of significant new features and limited AI integration. He added that the anticipated 5%-10% unit growth is unlikely to be achieved.

Apple shares have surged around 36% since their April low, fueled by optimism that the AI features will encourage upgrades and revive revenue growth. However, early signs of demand have been mixed.

While Lee acknowledged Apple’s long-term potential in AI, particularly due to its unique hardware-software integration and ability to offer low-cost, personalized AI services, he believes the current valuation is “rich” and that AI won’t significantly impact performance in the near term.

______

7. Saudi PIF to Buy 40% Stake of Selfridges

Saudi Arabia’s Public Investment Fund (PIF) is poised to become a minority partner in the luxury department store chain Selfridges after acquiring the stake of the now-bankrupt Signa Group. The PIF will hold a 40% stake in both Selfridges’ properties and its operational businesses, while Thai retail conglomerate Central Group, the current co-owner, will maintain a 60% stake. Both shareholders plan to inject new investments to strengthen Selfridges’ financial standing.

The PIF has signed a binding agreement for the complete buyout of Signa’s interest in Selfridges, although the terms of the deal were not disclosed. This partnership follows the collapse of Central Group’s joint-venture partner Signa, which fell into insolvency due to a sharp rise in interest rates that exacerbated its debt issues.

Turqi Al-Nowaiser, deputy governor and head of international investments at PIF, expressed enthusiasm for the collaboration, stating, “We are pleased to be partnering with Central Group in Selfridges Group, one of Europe’s most iconic luxury department stores. This transaction allows Selfridges Group to further strengthen its position as a premier retail destination.”

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。