—— Apollo Offers to Invest Billions in Intel; Corporates Refinance Following Fed Rate Cut; Goldman Headquarter Turned Apartment Starts Leasing; Thailand State Fund Raises $4.5bn to Support Stocks; Apple Drops 2% in Last 5 Minutes of Trading; Boeing Offers 30% Wage Hike to Union Workers; Novo Weight Loss Drugs Brought in Nearly $50b Revenue

1. Apollo Offers to Invest Billions in Intel

Apollo Global Management Inc. has proposed a multibillion-dollar investment in Intel Corp., according to individuals familiar with the situation, signaling confidence in the chipmaker’s turnaround strategy and offering an alternative to a potential takeover by its larger competitor, Qualcomm Inc.

In recent days, the alternative asset manager has expressed willingness to invest up to $5 billion in Intel in a manner resembling equity, one source revealed, requesting anonymity due to the confidential nature of the information.

This development follows a friendly takeover proposal from Qualcomm, headquartered in San Diego, as Intel navigates one of the toughest periods in its 56-year history. Qualcomm’s approach has sparked speculation about a potential massive M&A deal, potentially drawing in other bidders. For now, Broadcom Inc. remains on the sidelines.

Intel’s stock climbed as much as 4.2% in early Monday trading, and by 9:43 a.m. in New York, shares were up 2.7%, giving the company a market value of approximately $96 billion.

______

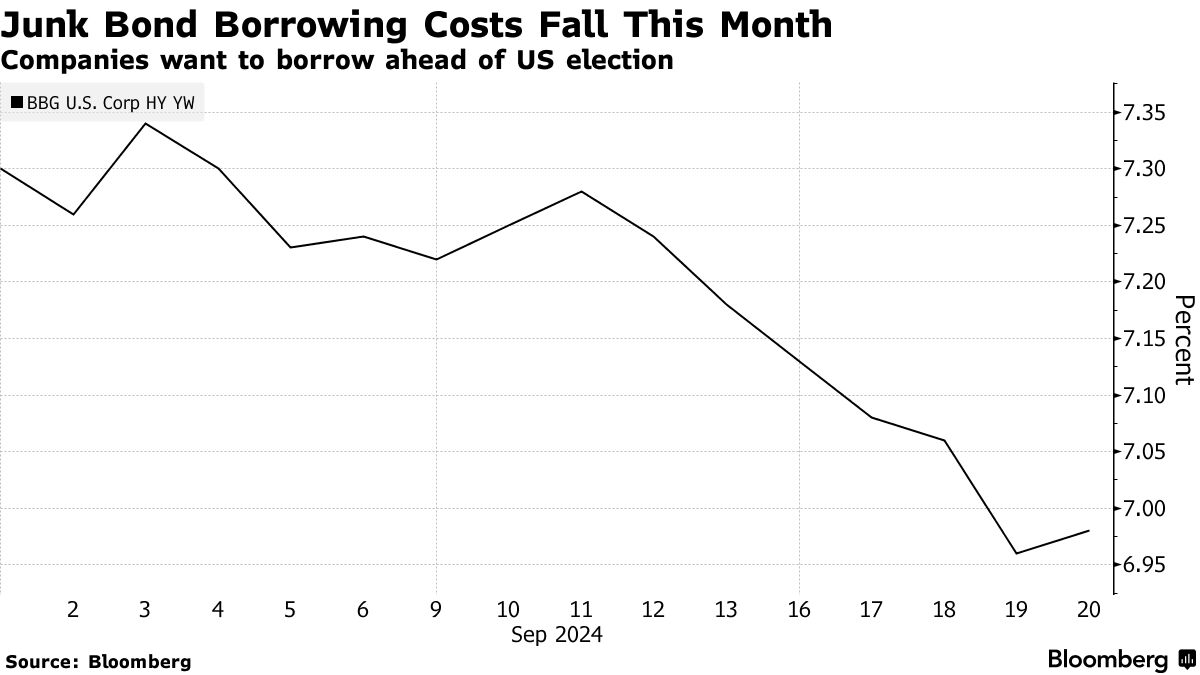

2. Corporates Refinance Following Fed Rate Cut

Corporate borrowers are flooding debt markets on Monday, following the Federal Reserve’s recent decision to lower its benchmark interest rate, which has reduced borrowing costs.

T-Mobile and nine other high-grade issuers are seeking to raise funds as the market rebounds after last week’s sales fell short of issuance projections. Syndicate desks anticipate deal volumes could range between $20 billion and $25 billion this week. Additionally, 10 companies are borrowing in the junk-bond market, marking the busiest day of the year based on the number of issuers. In the US, 14 leveraged loan deals have also launched.

The Fed’s decision last week to cut interest rates by half a percentage point further tightened credit spreads, providing borrowers with another window to refinance and secure fresh capital before earnings blackouts or potential volatility related to the US elections and upcoming economic data.

“With uncertainty surrounding the Fed’s decision now resolved and liquidity still available for investors, it seems issuers are eager to finalize their deals,” said David Schiffman, lead portfolio manager at Aquila Investment Management. “Companies are looking to avoid being locked out of the market as liquidity becomes more challenging leading up to the election.”

______

3. Goldman Headquarter Turned Apartment Starts Leasing

Just a minute’s walk from the New York Stock Exchange, down a cobblestone street once lined with the grand headquarters of finance titans, a corner office now holds a new significance.

As of Monday, New Yorkers can lease apartments in the former Goldman Sachs Group Inc. headquarters at 55 Broad St., where the company was based from the late 1960s through the early 1980s. Back then, Drexel Burnham Lambert had offices across the street, and nearby were the headquarters of Bank of America Corp. and J.P. Morgan & Co.

Today, the landscape has transformed. The financial industry’s dominance in the area has faded, a shift accelerated by the pandemic. A New York Sports Club that was once packed with bankers has become an indoor playground for young families, while a Serafina restaurant now occupies what was once a men’s suit store. For $4,000 a month, anyone can now live in the same space where Gus Levy helped solidify Goldman Sachs’ legacy as a trading giant.

Last year, Metro Loft and Silverstein Properties capitalized on the 60-year-old building, which had struggled to attract commercial tenants seeking newer office spaces. Larry Silverstein noted that the building’s wedding-cake design made it perfect for conversion, as no structural changes were needed to ensure apartments received adequate natural light.

“The financial district has turned into a 24/7 neighborhood,” said Nathan Berman, CEO of Metro Loft Development, one of the project’s developers. “It used to be a fallback option, but now it’s a destination and a very stable community.”

______

4. Thailand State Fund Raises $4.5bn to Support Stocks

Thailand’s state-controlled Vayupak Fund has raised 150 billion baht ($4.5 billion) from both retail and institutional investors as part of the government’s initiative to bolster the domestic capital market.

The fund will issue 15 billion new units at a par value of 10 baht each to subscribers, according to a statement released on Monday. Demand surpassed the number of available units, with the fund manager noting that principal protection and guaranteed returns were key factors in attracting investors.

This successful offering boosts Vayupak’s total assets under management to approximately 500 billion baht. The fund plans to invest the newly raised capital in companies listed on the SET 100 Index or other local stocks with strong ESG (Environmental, Social, and Governance) ratings.

In the first seven months of 2024, Thai stocks were among the world’s worst performers, dropping by as much as 10%, as international investors withdrew over $3 billion due to political instability and corporate scandals. However, the SET Index has since bounced back by about 14% from its 2024 low in early August, now approaching its highest level in nearly a year.

The idea for the fundraising was first proposed by Finance Minister Pichai Chunhavajira in June, when Thai stocks were near their lowest point.

______

5. Apple Drops 2% in Last 5 Minutes of Trading

Friday was expected to be a positive day for Apple Inc. shares, as the iPhone maker was poised to benefit from the quarterly adjustment of major stock indexes. For most of the trading session, that seemed to be the case — until roughly 10 minutes before the closing bell.

By the end of the day, Apple had fallen more than 2% from its intraday high, closing in negative territory in a surprising reversal that left market observers speculating about the cause.

Market-on-close orders — instructions to buy or sell stocks at the day’s closing price — showed an unusually large imbalance, with a net selloff of 30 million shares. This figure represents more than half of Apple’s average full-day trading volume over the past three months, all sold in the final moments of the Wall Street week.

The massive selling pressure came as a surprise, as funds tracking major equity benchmarks were anticipated to be major buyers of Apple stock on Friday. This expectation followed Warren Buffett’s decision to sell a significant portion of his stake in Apple during the second quarter, which resulted in the company’s weighting being substantially increased in various indices.

______

6. Boeing Offers 30% Wage Hike to Union Workers

Boeing Co. has proposed a 30% wage increase to its largest union in an effort to resolve a deadlock that has halted aircraft production in the Pacific Northwest.

The revised contract includes the reinstatement of an annual bonus, a key issue that had been removed from an earlier offer, which union members of the International Association of Machinists and Aerospace Workers (IAM) overwhelmingly rejected on September 12, leading to Boeing’s first major strike since 2008. Additionally, Boeing has doubled the bonus to $6,000 for workers if the new agreement is approved.

Boeing stated that the offer is contingent upon ratification by the end of the day on September 27.

Since September 13, approximately 33,000 Boeing workers have been on strike, bringing the company’s main jetliner factories near Seattle to a standstill. Workers had previously rejected Boeing’s offer of a 25% wage increase after union leaders initially sought a 40% raise.

Following the announcement, Boeing’s shares surged, gaining 3% by 2:25 p.m. in New York.

______

7. Novo Weight Loss Drugs Brought in Nearly $50b Revenue

The sales of Novo Nordisk A/S’s drugs, Ozempic and Wegovy, have been so significant that their combined revenue is expected to soon exceed the company’s entire research and development spending over the past three decades, challenging a common justification for their high prices.

These medications for diabetes and obesity have generated nearly $50 billion in sales by the second quarter of this year and are projected to reach $65 billion by year’s end, according to a Bloomberg News analysis of regulatory filings and analyst forecasts. Adjusted for inflation, this would surpass the $68 billion Novo Nordisk has invested in R&D since the mid-1990s, when the company began focusing on this class of drugs.

Novo Nordisk’s CEO, Lars Fruergaard Jorgensen, is scheduled to face scrutiny over the pricing of these drugs during a hearing led by Vermont Senator Bernie Sanders on Tuesday.

The Danish pharmaceutical giant is under growing pressure to lower the cost of these medications, as surging demand for their use in weight loss and uneven insurance coverage leave many patients paying out of pocket.

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。