—— HP Revenue Jumps for First Time in 2 Years; US GDP Grew Faster Than Forecast in 2nd Quarter; US Pending Home Sales Index Drops to 23-Year Low; Gap Posts Surprise Sales Beat in Second Quarter; Huawei Sales Grow for Six Straight Quarters; S&P 500 Gains Even As Nvidia Drops 5%; Bill Ackman to Revive Pershing Square IPO

1. HP Revenue Jumps for First Time in 2 Years

HP Inc.’s stock rose after the company announced its first increase in sales in two years, driven by a spike in corporate computer purchases.

The company reported a 2.4% increase in fiscal third-quarter sales, reaching $13.5 billion, surpassing the average analyst estimate of $13.4 billion.

This growth was primarily fueled by a surge in business PC sales, according to Chief Executive Officer Enrique Lores in an interview. He attributed the boost to an aging fleet of computers and the upcoming termination of support for Microsoft Corp.’s Windows 10, which spurred companies to update their hardware. Meanwhile, sales of PCs aimed at consumers fell by 1%—a smaller decline than analysts had anticipated.

However, HP lowered its full-year earnings forecast due to ongoing struggles in its printing division. The company now expects earnings, excluding certain items, to be between $3.35 and $3.45 per share for the fiscal year ending in October, down from the previously projected high of $3.60.

______

2. US GDP Grew Faster Than Forecast in 2nd Quarter

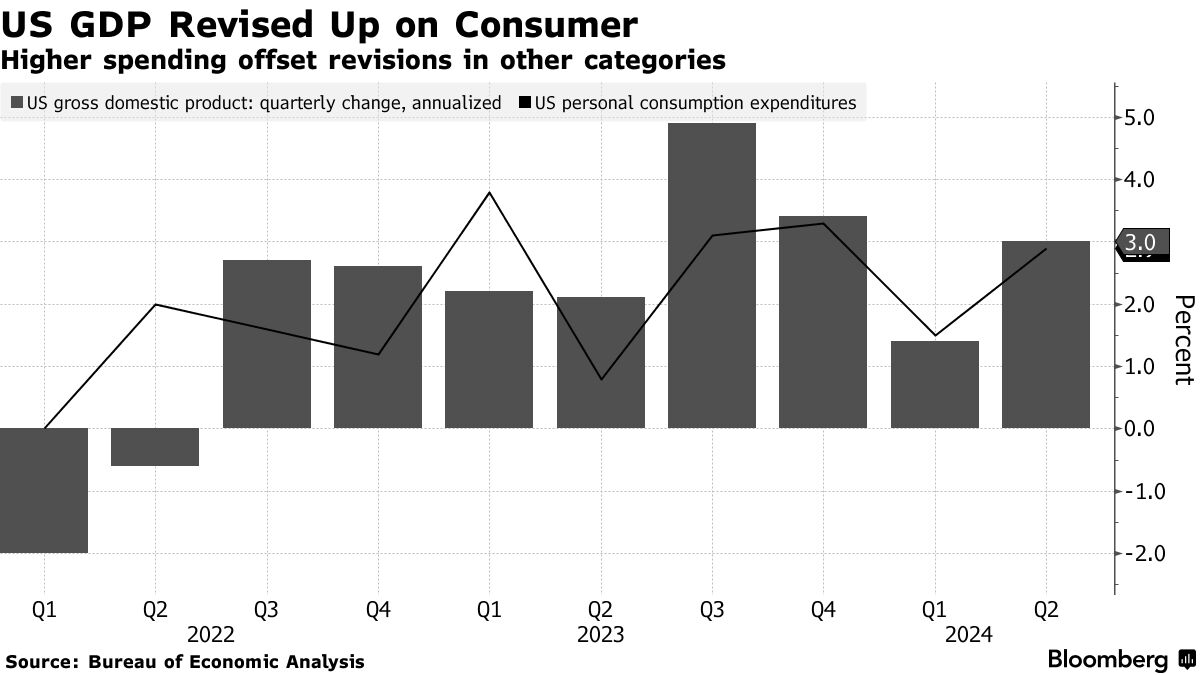

The US economy expanded at a slightly faster rate in the second quarter than previously reported, with an increase in consumer spending offsetting declines in other sectors.

The Bureau of Economic Analysis revised the annualized growth rate for the April-June period to 3% from an earlier estimate of 2.8%. This uptick was largely due to personal spending, which rose 2.9%, up from the initial estimate of 2.3%.

On the same day, a government report indicated that initial claims for unemployment benefits held steady at 231,000. Following the economic updates, Treasury yields increased, and S&P 500 index futures stayed elevated, while the dollar saw a strengthening.

Additionally, gross domestic income, another critical measure of economic activity, grew by 1.3% in its initial estimate for the quarter, consistent with the growth seen in the first quarter. Gross domestic income tracks the income produced and expenses incurred in the production of goods and services. The average growth rate between GDP and GDI for the period stood at 2.1%.

______

3. US Pending Home Sales Index Drops to 23-Year Low

Super Micro Computer Inc. has announced a delay in filing its annual financial disclosures, leading to the stock’s largest single-day drop in nearly six years.

The San Jose, California-based server manufacturer needs extra time to evaluate the design and effectiveness of its internal financial controls, according to a filing made Wednesday morning. The company has not updated its results for the previous fiscal year and quarter.

This delay follows a critical report from short-seller Hindenburg Research, which highlighted “significant accounting red flags, evidence of undisclosed related party transactions, sanctions and export control violations, and customer-related issues.”

As a result, Super Micro’s stock plummeted by as much as 26%, marking its steepest intraday decline since October 9, 2018.

______

4. Gap Posts Surprise Sales Beat in Second Quarter

Gap Inc. surpassed sales forecasts in the second quarter, indicating that the strategic changes implemented by new CEO Richard Dickson are taking effect.

For the quarter ending August 3, net sales increased by 5% from the previous year to $3.7 billion. Comparable sales, defined by Gap as sales from stores open at least one year, rose 3% across its brand portfolio, which includes Old Navy and Athleta.

Following these robust results, Gap raised its forecasts for gross margin and operating income for the year.

The company inadvertently released its earnings details early on its investor relations website. Although scheduled to report at 4:15 p.m. New York time, the materials appeared online shortly before 9:15 a.m., with official results following about two hours later.

Shares of the retailer were up 3.1% at 12:12 p.m., following a temporary trading halt. By Wednesday’s close, the stock had already risen 7.3% for the year.

Gap’s leadership saw a significant change a year ago with the appointment of Dickson as CEO, who had previously revitalized Mattel Inc. and its Barbie brand. Under his direction, the retailer has emphasized celebrity marketing and reshuffled its executive team.

______

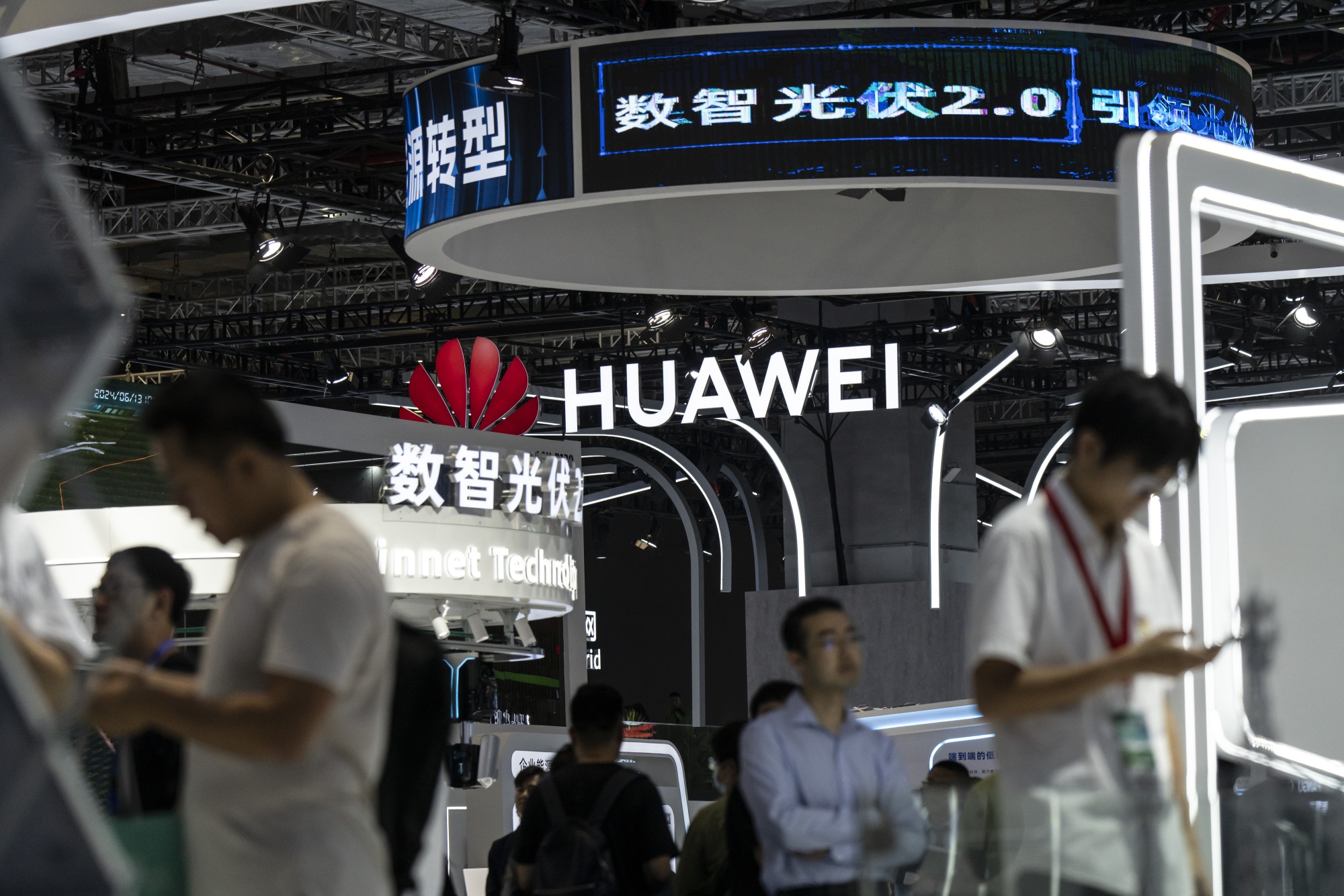

5. Huawei Sales Grow for Six Straight Quarters

Huawei Technologies Co. reported its sixth consecutive quarter of revenue growth, benefiting from an increase in smartphone market share in China at the expense of Apple Inc.

For the June quarter, Huawei announced a revenue of 239 billion yuan ($33.6 billion), marking a 33.7% increase from the previous year. This figure was derived from the company’s financials for the first six months.

However, Huawei’s implied net profit fell 18.6% to 35.5 billion yuan compared to the previous year, when the company benefited from one-time gains linked to asset sales. In 2020 and 2021, Huawei sold its mobile brand Honor Device Co. and parts of its server business, with proceeds being paid in installments.

In the latest quarter, Huawei’s smartphone shipments in China surged by 50%, outperforming competitors like Vivo and Xiaomi Corp., and surpassing Apple, which fell to sixth place among handset makers in China according to IDC.

Apple’s sales in China declined by 6.5%, falling short of Wall Street expectations, despite a growth in overall market shipments.

______

6. S&P 500 Gains Even As Nvidia Drops 5%

Stock markets rose broadly while bond prices fell, reflecting optimism that the U.S. economy remains robust despite high interest rates set by the Federal Reserve. Despite the downturn, Nvidia Corp.’s shares fell 5% as its future financial outlook did not meet expectations following a significant rally.

The overall strength of the equity market, however, continued to rise, bolstered by data showing enduring consumer strength. This comes at a crucial time just before the release of the Fed’s preferred measure of inflation, the core personal consumption expenditures price index, which is anticipated to demonstrate progress towards the central bank’s 2% inflation target.

Economic indicators reinforced this optimism: the U.S. gross domestic product increased at a 3% annualized rate in the second quarter, revised up from an initial estimate of 2.8%. Consumer spending, a key driver of economic growth, also rose more than expected, advancing 2.9% compared to the earlier estimate of 2.3%.

Additionally, a government report indicated that initial unemployment claims remained stable at 231,000, suggesting ongoing labor market strength.

______

7. Bill Ackman to Revive Pershing Square IPO

Bill Ackman is actively working to rejuvenate the initial public offering (IPO) of Pershing Square USA by proposing attractive incentives to early investors, addressing a major obstacle that initially hindered the float. Following weak demand, Ackman had pulled the IPO of this new U.S. investment fund last month.

Initially, the IPO aimed for a $25 billion listing on the New York Stock Exchange for this closed-end fund, which would have ranked among the largest IPOs ever. However, due to insufficient interest, Ackman reduced the fundraising target drastically to just $2 billion, leading to the withdrawal of the listing.

In efforts to revive investor interest, Ackman is considering a revised structure that includes extra benefits with the stock of Pershing Square USA. Among the discussed options, one would allow early investors the chance to acquire additional shares in the future at a predetermined price through warrants.

Moreover, a significant draw for investors could be the opportunity to purchase shares in the eventual IPO of Ackman’s hedge fund, Pershing Square Capital Management. This fund oversees investments for both the proposed U.S. vehicle and Ackman’s existing European fund.

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。