—— Wegovy Sales Missed Forecasts Amid High Concessions; US Mortgage Rates Drop by Most in 2 Years; US Dining Demand Remains Strong Despite Inflation; $42bn Bond Sale Drags Down US Stocks; JPMorgan CEO Doubtful of 2% Inflation Target; Air Pollution in NYC Subway Reaches Dangerous Level

1. Wegovy Sales Missed Forecasts Amid High Concessions

Novo Nordisk A/S reported disappointing sales for its blockbuster weight-loss treatment Wegovy, marking a rare setback for the Danish drugmaker as it faces increasing competition in the rapidly expanding market.

Chief Financial Officer Karsten Knudsen explained in a conference call with journalists that revenue from Wegovy was negatively impacted by higher-than-expected price concessions to US pharmacy benefit managers in the latest quarter. He described this as a one-time factor, but the significant shortfall has raised investor concerns about growing pricing pressures, especially as Eli Lilly & Co. enters the market with a rival product.

Doug Langa, who leads the company’s North American operations, mentioned on a conference call with investors that Wegovy is becoming more widely available through Medicaid, the US health program for low-income individuals.

Novo’s shares were down 3.6% as of 2:25 p.m. in Copenhagen, having dropped as much as 7.7% earlier in the day. Despite this decline, the shares had gained 27% this year through Tuesday’s close.

______

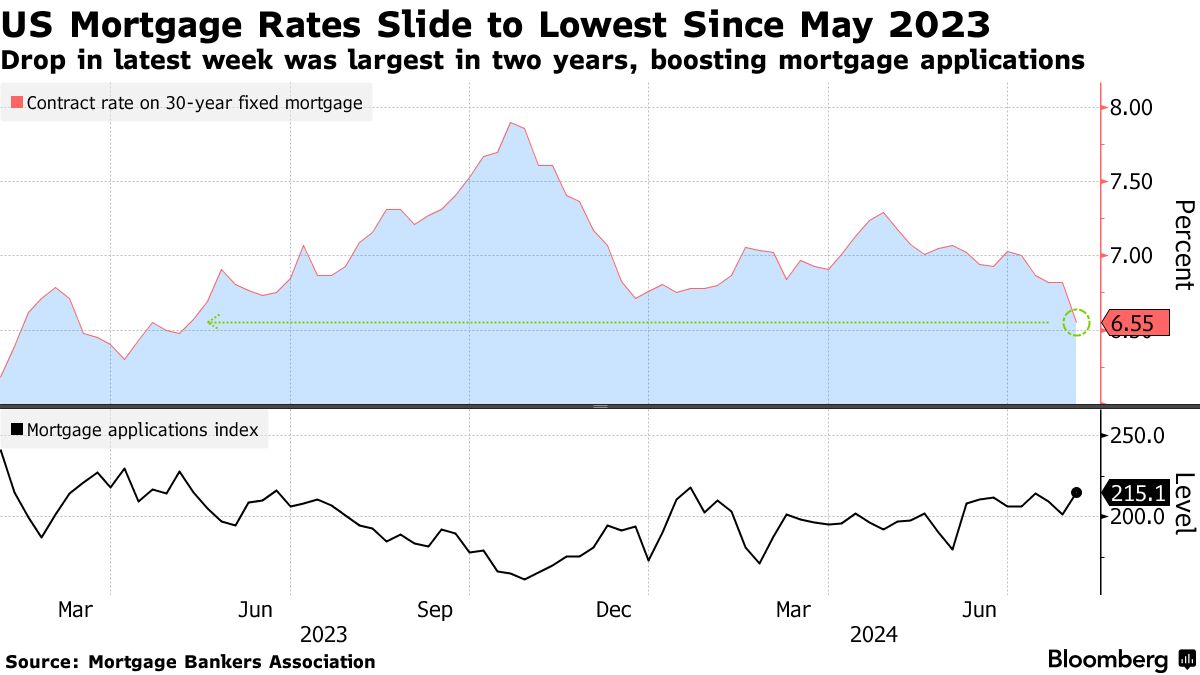

2. US Mortgage Rates Drop by Most in 2 Years

US 30-year mortgage rates experienced their largest drop in two years last week, falling to their lowest level since May 2023, which triggered a significant increase in refinancing applications.

According to data released Wednesday by the Mortgage Bankers Association, the contract rate on a 30-year fixed mortgage decreased by 27 basis points to 6.55% for the week ending August 2. Meanwhile, the rate on a five-year adjustable mortgage dropped by 31 basis points to 5.91%, marking the lowest rate for the year.

An index of refinancing surged nearly 16% last week, reaching a two-year high of 661.4. Mortgage applications for home purchases increased by 0.8%, the first rise in a month. The overall index of applications, which includes both refinancing and home purchase applications, climbed 6.9% last week, hitting its highest level since the beginning of the year.

Thomas Ryan, North America economist at Capital Economics, commented in a note that the decline in rates “should set the stage for a modest recovery in transactions in the rest of the year, providing that recession fears prove unfounded as we expect.” He added, “We think this marks a turning point for the housing market, which has been frozen for a while now.”

______

3. US Dining Demand Remains Strong Despite Inflation

Resy, the reservation platform owned by American Express Co., continues to experience strong consumer demand for restaurant dining, despite some cities and neighborhoods being more adversely affected by higher costs.

“You can see that some restaurants are hurting by high prices, inflation, their rent and so on,” said Pablo Rivero, Resy’s chief executive officer, in an interview on Bloomberg Television on Wednesday. “People are still going out, trying to find that human connection with people, and the dining table is a perfect space for that.”

American Express acquired Resy, founded by Eater’s Ben Leventhal, in 2019. The credit-card company is renowned for catering to higher-net-worth individuals who value exclusive hospitality experiences, and the acquisition has benefited Amex as travel and dining spending surged following the pandemic.

Following the Resy deal, American Express also acquired Tock, an event ticketing and table-management platform. Additionally, Amex has integrated Resy’s perks into its credit-card rewards, further enhancing its appeal to cardholders.

______

4. $42bn Bond Sale Drags Down US Stocks

Stocks struggled to maintain momentum after an initial rally driven by the Bank of Japan’s reassurances following historic market volatility. Meanwhile, Treasuries fell amid a weak $42 billion sale of 10-year bonds.

The S&P 500, which surged nearly 2% earlier in the session, ended up little changed. Bonds faced pressure as 17 high-grade issuers rushed to sell debt on the busiest day since February, including Meta Platforms Inc. offering $10.5 billion in bonds. Despite a pre-sale selloff in bonds, the 10-year Treasury auction resulted in this year’s lowest yield.

“Terrible 10-year auction,” remarked Peter Boockvar of The Boock Report. “One would have thought that the 10-year note auction today would do just fine with that backdrop but no, the auction was terrible.”

Mark Hackett at Nationwide commented that the recent events have been a “masterclass” in how emotions can drive market movements, particularly when sentiment and positioning are overwhelmingly positive.

______

5. New York Rental Market Stays Competitive

The search for a New York apartment has become more frustrating than ever for many renters in this fiercely competitive summer market.

A Brooklyn woman waits in a line that stretches around the block, hoping to secure an affordable studio. Another renter loses multiple bidding wars for a coveted two-bedroom apartment in Bushwick. A recent college graduate assembles a personal dossier to prove his trustworthiness.

These are not just isolated incidents but reflect a new normal in a city where leasing and rents are near all-time highs. Since the chaotic period following the pandemic lockdown, landlords have maintained a strong advantage. The aggressive tactics they adopted during that time have now become standard practice, and property owners have discovered ways to increase competition and elevate their demands.

“The terms changed,” said Jonathan Miller, president of appraiser Miller Samuel Inc., who has been producing monthly reports on the city’s rental market since 2009. “Landlords resumed control and could dictate terms that were more and more favorable for them.”

Agents representing property owners often underprice apartments to incite bidding wars, attracting crowds to open houses or back-to-back appointments. This strategy allows owners to choose from a large pool of applicants, selecting not only those willing to pay the highest rent but also those whose personal history and behavior indicate they will be reliable tenants.

______

6. JPMorgan CEO Doubtful of 2% Inflation Target

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon expressed skepticism about inflation returning to the Federal Reserve’s 2% target, citing risks such as deficit spending and the “remilitarization of the world.”

In an interview with CNBC from Kansas City on Wednesday, Dimon highlighted ongoing economic uncertainties related to geopolitics and quantitative tightening. While he anticipates that the central bank will likely cut rates soon, he downplayed the significance of such a move, stating, “I don’t think it matters as much as other people think.”

Dimon has consistently warned over the past year that inflation may prove to be more persistent than investors anticipate. In his annual letter to shareholders in April, he noted that JPMorgan is prepared for interest rates to range from 2% to 8% “or even more.” Last month, he acknowledged some progress in reducing inflation but emphasized the presence of ongoing inflationary pressures.

Fed Chair Jerome Powell mentioned last week that the central bank could cut rates as early as September, pointing to risks associated with a weakening labor market. These concerns were further underscored by the July jobs data released on Friday, which showed slower hiring and an unexpected rise in the unemployment rate.

______

7. Air Pollution in NYC Subway Reaches Dangerous Level

The New York City subway system, while often faster and cheaper for many commuters, poses significant health risks due to air quality concerns.

A new study has found that levels of fine-particle air pollution, known as PM2.5, are “exceptionally high” on subway platforms and inside train cars. This pollution is particularly concerning for low-income, Black, and Hispanic New Yorkers, who are disproportionately affected by the highest exposure levels.

Published Tuesday in the journal PLOS One, the research adds to existing studies on subway pollution globally. While underground rail systems help reduce fossil fuel emissions and traffic congestion, they also introduce their own health hazards.

The study includes data on the home-to-work commute patterns of 3.1 million workers across Manhattan, Brooklyn, Queens, and the Bronx. It reveals that commuters with longer subway journeys have higher exposure to PM2.5, a fine particulate pollution that can penetrate deeply into the lungs and enter the bloodstream, posing serious health risks.

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。