——Biden‘s Disastrous Debate Cast More Doubt; US Key Inflation Measure Rises by Least in 6 Months; Nike Market Cap Sheds $23bn; Junior Bankers Log 100-Hour Weeks Again; Tesla Share Price Braces for Big Volatility; Pershing Sqaure Plans IPO at $50 a Share; Qatar to Build $5.5bn Theme Park

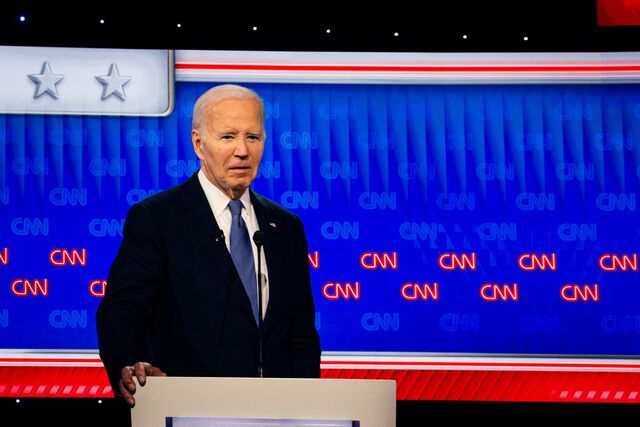

1. Biden‘s Disastrous Debate Cast More Doubt

President Joe Biden’s attempt to revive his struggling reelection campaign through a debate with Republican Donald Trump backfired.

During the debate, the 81-year-old president appeared fatigued and struggled to convey the stamina needed for another four-year term. Biden misspoke multiple times, providing incorrect facts and figures from the outset. His remarks were often soft-spoken and interrupted by coughing fits, with a tendency to ramble and repeat himself. He seemed disengaged as Trump launched attacks, frequently botched his scripted responses, and froze at the end of a particularly meandering answer.

In the aftermath, Democrats expressed alarm both publicly and privately, with frustration directed at a candidate and campaign that had previously downplayed concerns about the president’s age and mental sharpness.

This performance prompted questions about whether Biden should continue his campaign, though he reaffirmed to reporters that night his intention to remain in the race.

______

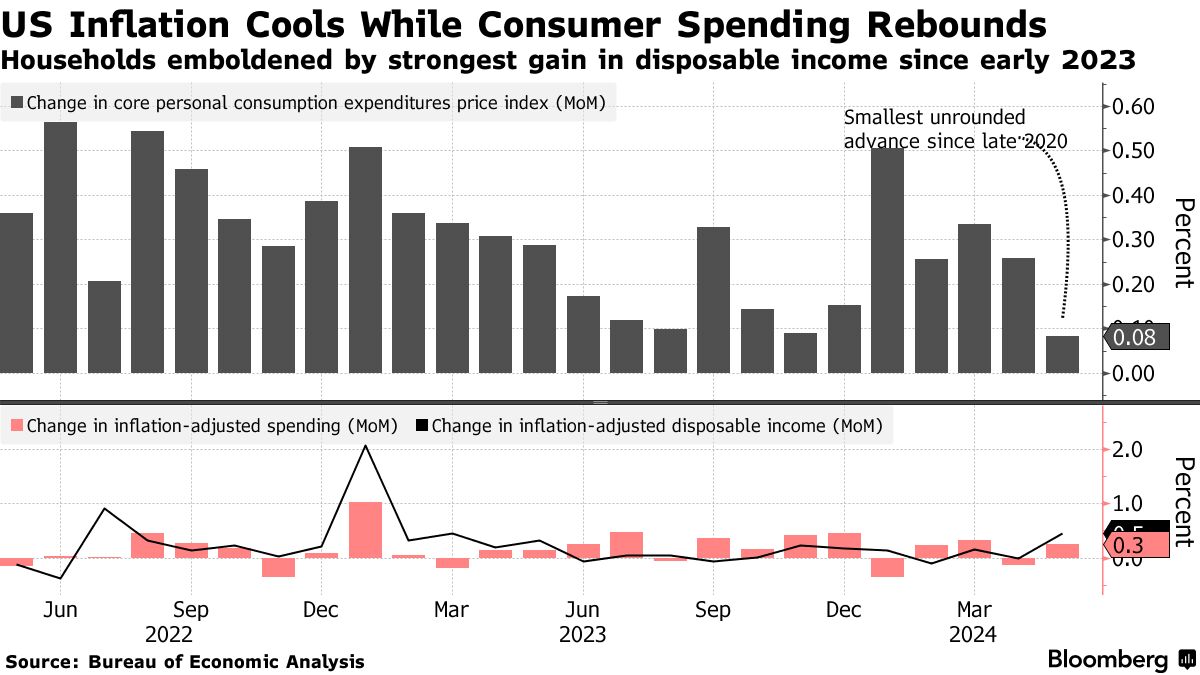

2. US Key Inflation Measure Rises by Least in 6 Months

The Federal Reserve’s preferred measure of underlying US inflation decelerated in May, strengthening the argument for potential lower interest rates later this year.

Simultaneously, household spending rebounded after a dip in April, and incomes exhibited solid growth, providing some optimism that price pressures can be managed without causing significant harm to consumers.

The core personal consumption expenditures (PCE) price index, which excludes volatile food and energy items, increased by 0.1% from the previous month, according to Bureau of Economic Analysis data released on Friday.

This marked the smallest advance in six months. On a two-decimal basis, the increase was just 0.08%, the smallest since late 2020.

______

3. Nike Market Cap Sheds $23bn

Nike Inc. shares plummeted after the sneaker company’s full-year outlook fell short of expectations, fueling investor concerns about declining demand and heightened competition from emerging brands like On and Hoka, as well as rival Adidas AG.

Nike, the world’s largest sportswear company, forecasts a revenue decline in the mid-single digits for the current fiscal year, which began this month. This is in stark contrast to analysts’ expectations of about 2% growth for the year, according to Bloomberg estimates.

The shares dropped as much as 18% on Friday morning, marking Nike’s biggest fall since 2001. By 9:35 a.m., the drop had erased approximately $23 billion in market value. The stock had already decreased by 17% over the past 12 months.

The disappointing outlook also negatively impacted other athletic retailers, including JD Sports Fashion Plc and Puma SE. Although Adidas saw early gains on Friday in Frankfurt, those gains were later wiped out.

Nike is currently struggling to produce new, hot-selling footwear to replace popular models such as the Air Force 1 and Dunk sneakers. This decline in performance intensifies the pressure on Chief Executive Officer John Donahoe. Donahoe has implemented layoffs and other cost-cutting measures after the company’s strategy to prioritize its own sales channels failed to deliver the anticipated levels of profit and growth.

Nike’s reduced reliance on retail partners in recent years has led those partners to promote rival brands. The increased competition from newer brands like On Holding AG and Deckers Outdoor Corp.’s Hoka has pushed Nike to refocus on sports, new products, and wholesale partners.

In contrast, Adidas has seen a resurgence under new Chief Executive Officer Bjorn Gulden, who has re-embraced retail partners and accelerated the introduction of new products like the retro Samba sneaker, which has become a hit. Gulden has also sharpened the company’s focus on athletic performance, fueling a new era of growth for Adidas.

______

4. Junior Bankers Log 100-Hour Weeks Again

To observe the mounting stress on Wall Street’s junior bankers, one can look at the role of staffers—a group of unheralded deputy managers responsible for assigning tasks to trainees. When investment bankers or clients need work done, staffers are the ones who delegate the drudgery to junior bankers. This task has become more challenging as banks aim to exit a slump in deals with a reduced workforce but big ambitions for landing new mandates.

Both trainees and staffers are feeling the increased pressure.

At JPMorgan Chase & Co., a junior banker admitted to inflating their weekly hours in internal tracking systems to avoid losing their remaining free time. Similarly, a junior banker at UBS Group AG reported doing the same. On the other hand, two trainees at Bank of America Corp. stated they were understating their hours to avoid exceeding the 100-hour limit, a practice referred to as “tripping the system.” Exceeding this limit can trigger a call from HR and cause trouble for managers.

When there are not enough junior bankers available to complete analyses and pitch decks, staffers are tasked with informing their superiors of the shortfall. A staffer at Citigroup Inc. recounted how nerve-wracking it was the first time she had to deliver such news to her bosses.

______

5. Tesla Share Price Braces for Big Volatility

A rare period of calm for Tesla Inc. shares is expected to end soon, as investors prepare for three significant events over the next six weeks that could bring back the stock’s characteristic volatility.

In less than a week, Tesla, led by Elon Musk, will report its second-quarter delivery results. This will be followed by earnings later in July and the unveiling of its self-driving vehicle, known as the robotaxi, in early August. Options trading data indicates that investors are anticipating a move of around 15% in either direction through mid-August, according to data compiled by Citigroup Inc.

However, strategists suggest that the shares could experience even greater volatility. “Tesla options are underestimating volatility across these three upcoming catalysts,” Citi’s equity trading strategist Vishal Vivek said in a note to clients. He noted that these events have historically triggered significant stock movements, including impacts on Tesla suppliers and other electric vehicle (EV) makers.

“Considering how important Tesla’s deliveries have been in the past, how much the stock moves on earnings, and the potential for a new product line announcement at the robotaxi day, the 15% move implied between now and the Aug. 16 expiry seems low,” Vivek added in an interview.

______

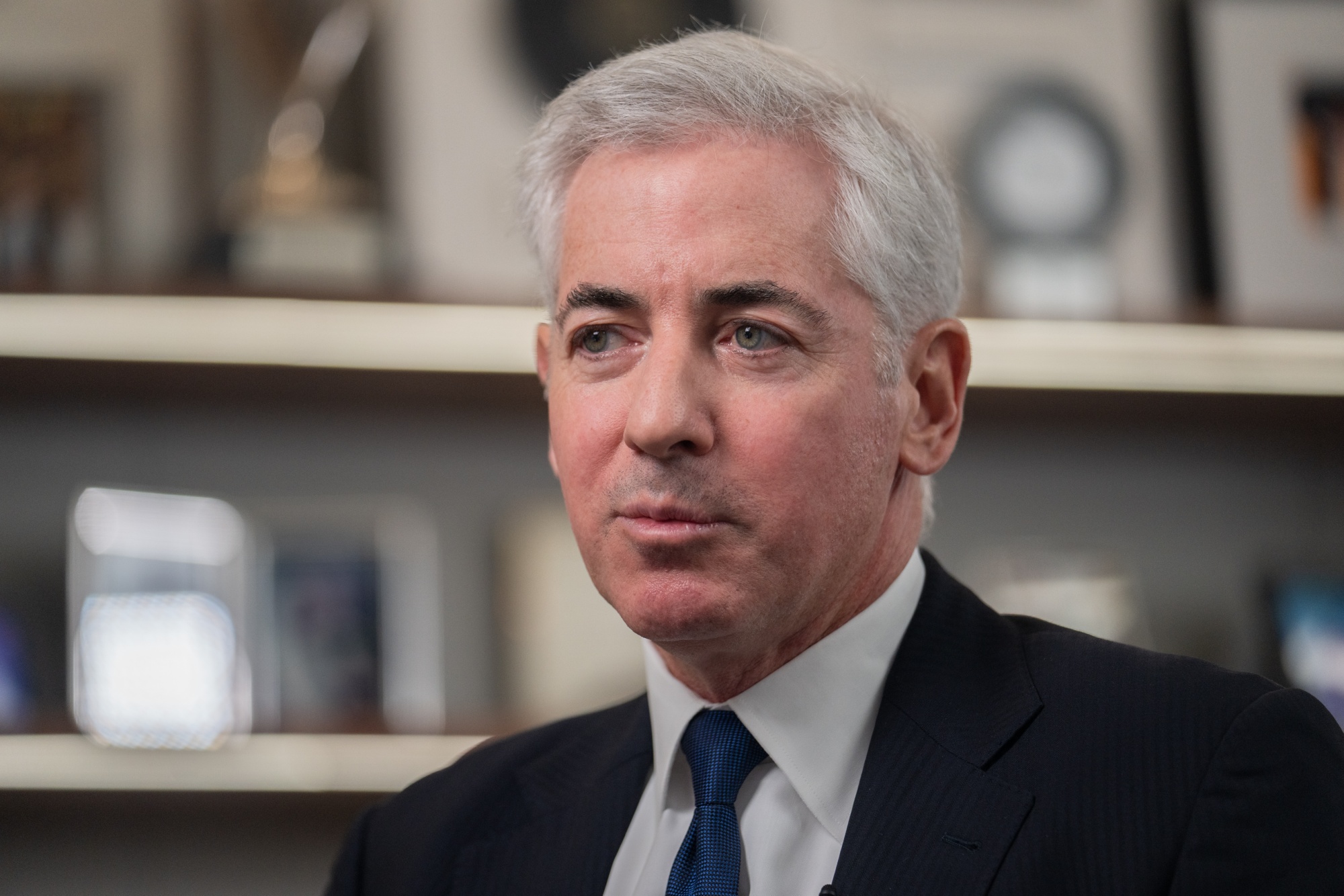

6. Pershing Sqaure Plans IPO at $50 a Share

Bill Ackman’s Pershing Square has set the initial public offering (IPO) price of its US closed-end vehicle at $50 per share, marking a significant move towards what could become the largest ever closed-end fund in the US.

The vehicle, named Pershing Square USA Ltd., did not disclose the number of shares to be sold or the timing of the offering in its filing with the US Securities and Exchange Commission on Friday.

According to Bloomberg News, citing sources with direct knowledge of the plans, Pershing Square USA aims to raise $25 billion from retail investors.

Pershing Square already operates a European vehicle with a market capitalization of $10 billion. This fund has “returned 50.3% over the past year, outpacing almost all of its US peers, yet trades at a 25% discount to its net asset value,” Bloomberg Intelligence analyst David Cohne noted earlier this month.

“With lower required costs than his typical hedge fund fees and social media popularity, the US-listed Pershing Square USA Ltd. could become the largest closed-end fund in the country and trade at a premium to its net asset value,” Cohne wrote.

______

7. Qatar to Build $5.5bn Theme Park

Qatar is embarking on a new 20 billion riyal ($5.5 billion) tourism development centered around a large amusement park set to surpass the size of Walt Disney Co.’s iconic Magic Kingdom.

The Simaisma project will be located approximately 40 minutes north of Doha, the capital of the gas-rich nation. It will span 8 million square meters (1,976 acres) along 7 kilometers of beachfront land. The development will also feature an 18-hole golf course surrounded by 300 villas, luxury resorts, a marina and beach club, as well as residential homes and shops.

Qatari Diar Real Estate Investment Company, a subsidiary of the state’s sovereign wealth fund, has been appointed by the government to oversee the project’s development.

“The anchor is the theme park and that phase will be coming first to attract more people to come and invest,” Qatari Diar Chief Executive Officer Ali Mohamed Al-Ali said in an interview. “It’s part of the government strategy to diversify the economy and invest in the tourism pillar.”

This development is part of Qatar’s ongoing efforts to transform itself into a premier vacation destination. Qatari officials have stated their goal for the tourism industry to contribute 12% to the country’s gross domestic product by 2030. The nation has seen a surge in tourism since hosting the FIFA World Cup in 2022, an event for which it spent more than $300 billion in preparation.

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。